Will South Bow's Q3 Miss and Steady 2025 Guidance Change South Bow's (TSX:SOBO) Narrative

- South Bow Corporation recently reported mixed fiscal Q3 2025 results, with earnings per share beating expectations while revenue fell year over year and missed forecasts, prompting cautious commentary from several Wall Street analysts.

- Despite revenue pressure and ongoing concerns about the financial implications of the MP 171 incident, management kept its 2025 guidance intact, signaling confidence in the company’s underlying outlook.

- Next, we’ll examine how management’s decision to maintain 2025 guidance despite the revenue decline could shape South Bow’s investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is South Bow's Investment Narrative?

To be comfortable owning South Bow, you really have to buy into a relatively stable, income-focused story built around long-term pipeline contracts, resilient EBITDA and a generous dividend, rather than rapid growth. The latest Q3 update complicates that picture: EPS surprised on the upside, but a double-digit revenue drop and reiterated Sell ratings from Wells Fargo, J.P. Morgan and an Underweight from Morgan Stanley all highlight that valuation and the MP 171 incident remain front-of-mind near-term risks. Management’s decision to hold 2025 guidance, including normalized EBITDA and a slightly better tax rate, suggests the core cash generation thesis is intact for now, so the main short-term catalysts still sit around throughput trends, regulatory clarity and progress on Canadian pipeline and carbon capture projects. Even so, the MP 171 financial overhang now looks like a bigger swing factor than before.

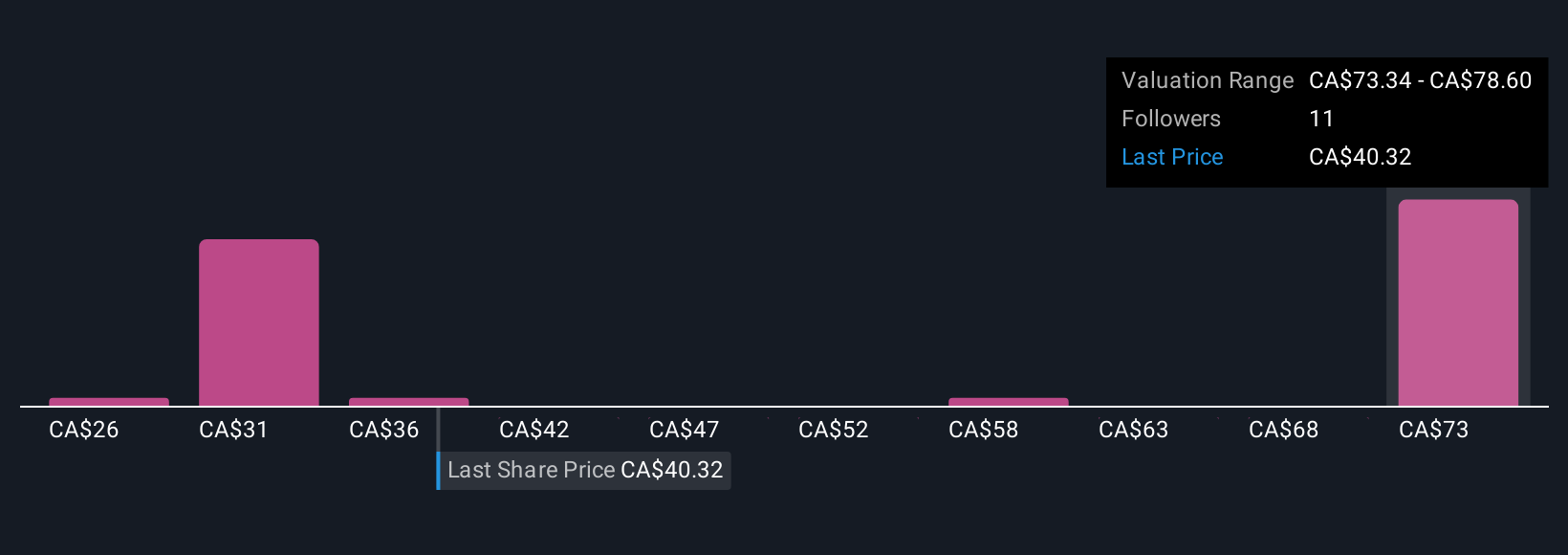

However, one risk in particular could matter more than the recent earnings surprise. Despite retreating, South Bow's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 6 other fair value estimates on South Bow - why the stock might be worth 32% less than the current price!

Build Your Own South Bow Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your South Bow research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free South Bow research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate South Bow's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com