Is Target’s (TGT) Kris K Soap Bet a Clue to Its Holiday Brand Strategy?

- Target and Dr. Squatch have launched “Not Santa: Sandalwood Summit,” a limited-edition men’s soap featuring Kris K. from Target, now available in all stores and online with full access to Target’s same-day and shipping options.

- This playful product tie-in with a viral holiday character highlights how Target is using exclusive collaborations and sensory branding to deepen seasonal customer engagement.

- We’ll now explore how this AI-enabled, holiday-focused product and fulfillment push could reshape Target’s existing investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Target Investment Narrative Recap

To own Target today, you need to believe its mix of owned brands, exclusive collaborations and expanding digital and fulfillment capabilities can offset soft sales, margin pressure and high debt. The Dr. Squatch “Not Santa” launch is fun and brand accretive, but it does not materially change the key near term catalyst of execution on AI enabled merchandising and supply chain upgrades, or the biggest risk around earnings pressure in a still cautious consumer backdrop.

The most relevant recent announcement here is Target’s AI powered Cyber Monday push, including its app in ChatGPT and Gift Finder. Paired with “Not Santa,” it shows Target trying to link viral, seasonal products with more personalized, tech driven discovery and fulfillment, which ties directly into the core catalyst of improving digital engagement and monetization to support margins and offset weaker in store trends.

Yet investors should also be aware that high debt and recent earnings declines could still limit how much room Target has if...

Read the full narrative on Target (it's free!)

Target’s narrative projects $110.5 billion revenue and $3.7 billion earnings by 2028.

Uncover how Target's forecasts yield a $96.52 fair value, a 5% upside to its current price.

Exploring Other Perspectives

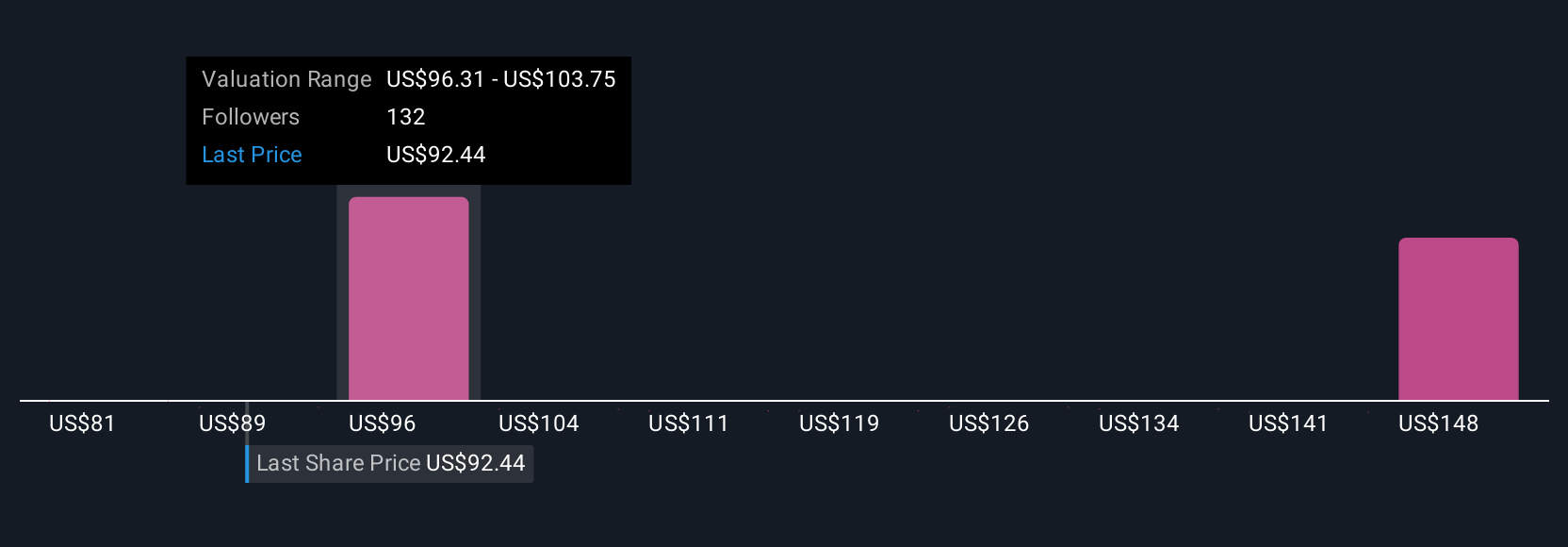

Nineteen Simply Wall St Community fair value estimates for Target span roughly US$80 to US$135 per share, reflecting very different expectations about upside. You can set those views against the core catalyst of Target’s tech and fulfillment investments needing to support margins and earnings, then decide which assumptions about the company’s performance feel most realistic to you.

Explore 19 other fair value estimates on Target - why the stock might be worth 13% less than the current price!

Build Your Own Target Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Target research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Target research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Target's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com