Do Cloudflare’s Recent Outages Reframe The Reliability Premium In Its AI Story For NET?

- In recent weeks, Cloudflare has suffered multiple global outages tied to its Web Application Firewall changes and third-party network issues, briefly knocking major sites like LinkedIn, Zoom, Shopify, banks, and government portals in Norway and Sweden offline before fixes were rolled out.

- These back-to-back disruptions have thrust Cloudflare’s reliability under the spotlight, testing confidence in an infrastructure provider that quietly underpins a large share of everyday internet activity.

- Next, we’ll examine how these recurring outages and heightened reliability concerns intersect with Cloudflare’s AI-driven growth narrative and long-term earnings outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Cloudflare Investment Narrative Recap

To own Cloudflare, you need to believe that its vast global network will remain a go to backbone for secure, high performance internet and AI traffic, and that management can convert that position into durable revenue growth and eventual profitability. The recent outages and 20.5% share price pullback directly stress test the company’s core value proposition of reliability, but so far they do not appear to have changed the key near term catalyst of AI driven usage growth or the biggest current risk around margin pressure and execution on new products in a meaningful way.

The most relevant recent announcement here is Cloudflare’s Q3 2025 update, which highlighted strong billings, record net new ARR, rising RPO and increased AI related traffic, alongside reiterated long term targets toward a US$5,000,000,000 revenue run rate by 2028. That context matters, because it shows the business is still adding large, multi year commitments even as reliability concerns flare up, keeping the focus on whether Cloudflare can balance rapid AI and Zero Trust expansion with the operational rigor its role now demands.

Yet for all the AI momentum, investors should be aware that repeated outages and growing dependence on a few core infrastructure providers could...

Read the full narrative on Cloudflare (it's free!)

Cloudflare's narrative projects $3.8 billion revenue and $176.4 million earnings by 2028. This requires 26.5% yearly revenue growth and a $293.5 million earnings increase from -$117.1 million today.

Uncover how Cloudflare's forecasts yield a $242.46 fair value, a 21% upside to its current price.

Exploring Other Perspectives

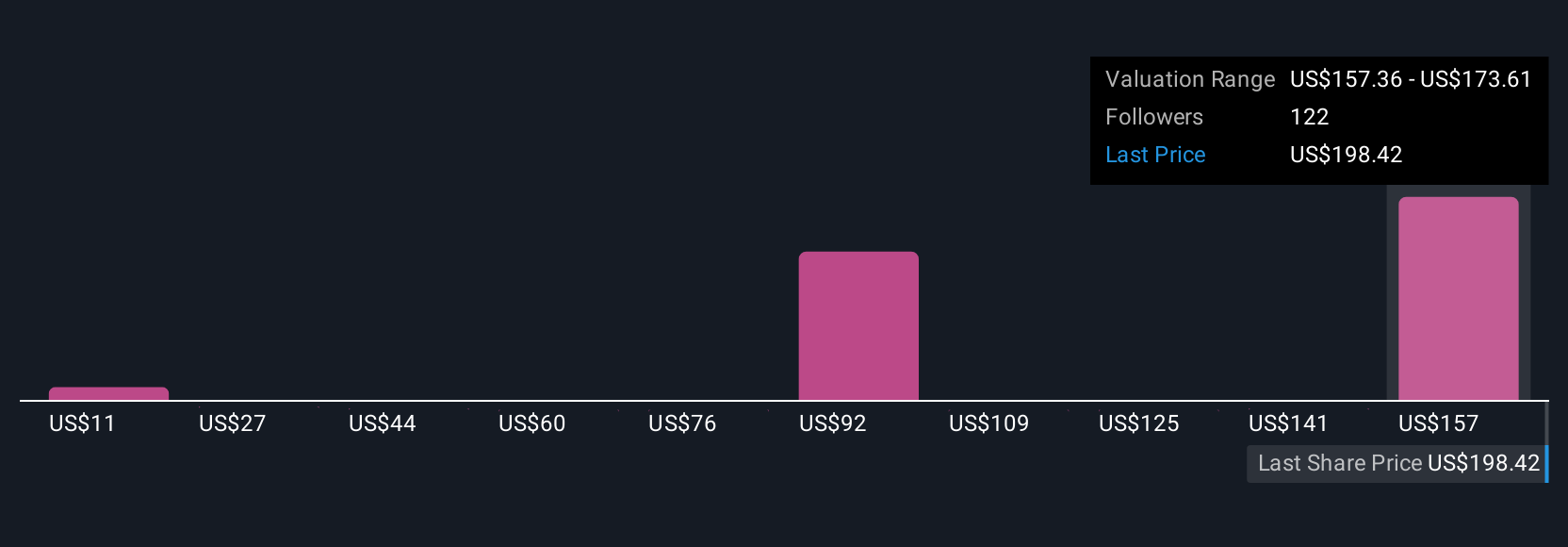

Twenty eight fair value estimates from the Simply Wall St Community span roughly US$12 to US$242 per share, underscoring how far apart individual views can be. When you set that dispersion against Cloudflare’s recent outages and the central question of whether its reliability can keep up with its AI driven scale up, it becomes clear why checking multiple viewpoints on the company’s prospects and risks matters.

Explore 28 other fair value estimates on Cloudflare - why the stock might be worth as much as 21% more than the current price!

Build Your Own Cloudflare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cloudflare research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Cloudflare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cloudflare's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com