Assessing Alcoa’s Valuation After Its Recent Share Price Rally

Alcoa (AA) has quietly put together a strong run, with the stock up about 17% over the past month and roughly 37% in the past 3 months, even as earnings growth remains uneven.

See our latest analysis for Alcoa.

That recent 17.3% 1 month share price return and 36.6% 3 month share price return come after a choppy year for Alcoa, where the 1 year total shareholder return is a more modest 4.3%. This suggests momentum is only now starting to build as investors reassess future demand and earnings risk.

If Alcoa’s upswing has you thinking more broadly about cyclical opportunities, it could be worth exploring fast growing stocks with high insider ownership to see which other companies have both momentum and aligned insiders.

With earnings still patchy and the stock already trading slightly above consensus targets, the key question now is whether Alcoa remains mispriced after its recent surge or whether the market is simply front running future growth.

Most Popular Narrative: 6% Overvalued

With Alcoa last closing at 43.77 dollars against a narrative fair value of 41.29 dollars, the current rally sits ahead of those long term assumptions.

Revenue growth has increased significantly, moving from roughly 1.63 percent to about 3.28 percent annually in the long term model.

The net profit margin has fallen materially from around 7.73 percent to approximately 4.46 percent, indicating lower expected profitability per dollar of sales.

Want to know how slower margins can still support a richer future earnings multiple and higher growth path, even with a higher discount rate? The key lies in how long term revenue momentum, shifting capital allocation and a notably upgraded profit multiple all interact in this narrative. Curious which assumptions really carry the fair value math, and which are quietly doing the heavy lifting in the background? Dive in to see the numbers behind this pricing story.

Result: Fair Value of $41.29 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, strong decarbonization-driven aluminum demand and successful scaling of EcoLum and ELYSIS could support higher volumes, firmer pricing and structurally better margins.

Find out about the key risks to this Alcoa narrative.

Another Lens On Value

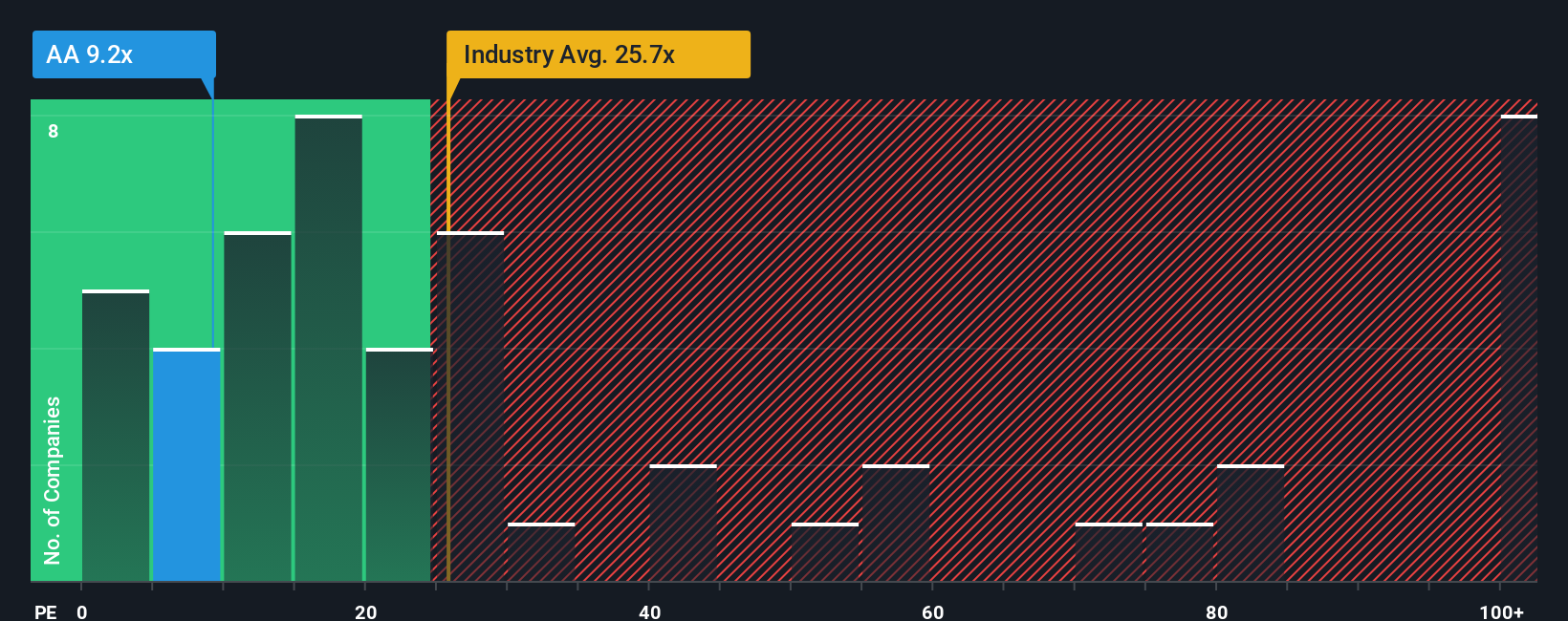

While the popular narrative pegs Alcoa at roughly 6 percent over fair value, its 10 times earnings multiple looks low compared with a 14.9 times fair ratio and about 22 times for both peers and the wider industry. Is the market underestimating the risk, or the opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alcoa Narrative

If you see Alcoa’s story differently or prefer to dig into the numbers yourself, you can build a custom view in just minutes with Do it your way.

A great starting point for your Alcoa research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Use Simply Wall Street’s powerful Screener now to uncover targeted opportunities beyond Alcoa so you do not miss the next wave of market winners.

- Explore underpriced potential by targeting companies trading below their estimated cash flow value with these 907 undervalued stocks based on cash flows, before the wider market reacts.

- Focus on the structural shift toward intelligent automation by filtering for category leaders in next generation innovation through these 26 AI penny stocks.

- Support your income strategy by focusing on dependable payers using these 15 dividend stocks with yields > 3%, with an emphasis on yields above 3 percent backed by solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com