Assessing Waste Connections (WCN) Valuation After Recent Share Price Stabilisation

Waste Connections (WCN) has quietly become a long term compounder, so with the stock up about 4% over the past month but still down roughly 8% over the past year, investors are reassessing the setup.

See our latest analysis for Waste Connections.

The latest 1 month share price return of 4.2% has only slightly offset a weaker 1 year total shareholder return of negative 8.4%. This suggests momentum is just starting to stabilise rather than fully turning higher at the current price of $173.11.

If you are weighing up Waste Connections alongside other ideas, this could be a good moment to explore fast growing stocks with high insider ownership as a source of fresh, fast growing candidates.

With shares trading at a discount to both analyst targets and intrinsic value estimates despite solid growth in revenue and earnings, is Waste Connections quietly undervalued here, or is the market already pricing in its future growth?

Most Popular Narrative: 15.5% Undervalued

With Waste Connections last closing at $173.11 against a narrative fair value of $204.96, the valuation case leans toward meaningful upside if the projections land.

The analysts have a consensus price target of $210.947 for Waste Connections based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $227.0, and the most bearish reporting a price target of just $150.0.

Want to see what kind of revenue climb, margin rebuild, and earnings power are baked into that upside path, and how long it is meant to last? The narrative pulls together a detailed roadmap of compounding, capital allocation, and a future earnings multiple that would usually raise eyebrows in a slow growing industry. Curious which assumptions have to hold for that to make sense, and how tight or generous they really are? Open the full story and test those numbers against your own expectations.

Result: Fair Value of $204.96 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if acquisition synergies disappoint or commodity linked recycling revenues stay weak, the path to higher margins and earnings could appear much less certain.

Find out about the key risks to this Waste Connections narrative.

Another Angle on Valuation

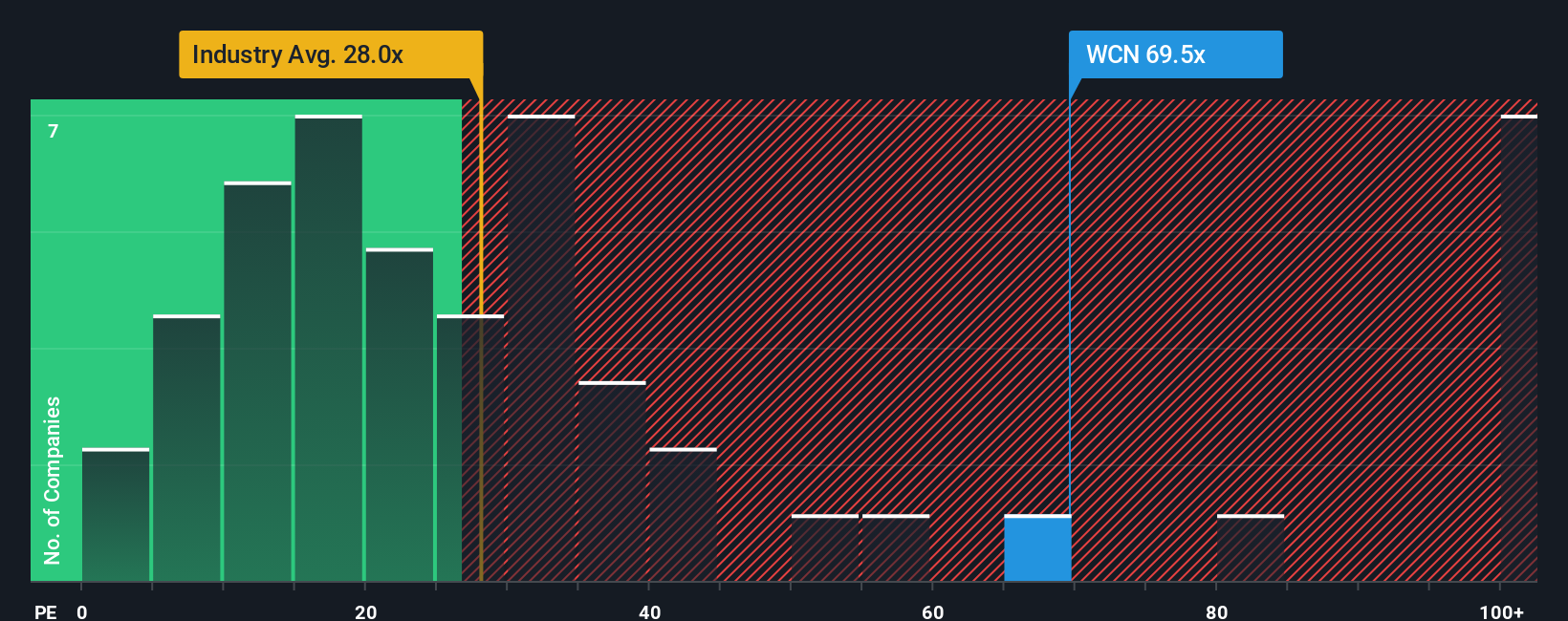

On headline numbers, Waste Connections does not look cheap. It trades on a price to earnings ratio of 71.2 times, far richer than both the Commercial Services industry at 23.1 times and peers at 37.6 times, and well above a fair ratio of 35.4 times that the market could drift toward over time.

That kind of premium leaves less room for execution hiccups and raises the risk that even solid fundamental progress might still coincide with a lower share price if sentiment or growth expectations cool from here. Is this a quality premium that can be sustained, or a valuation stretch waiting to be tested?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Waste Connections Narrative

If you would rather dig into the numbers yourself or challenge these assumptions directly, you can build a fresh, personalised view in just a few minutes by using Do it your way.

A great starting point for your Waste Connections research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you lock in any decision on Waste Connections, tap into a wider opportunity set with targeted stock screens that can surface your next potential outperformer.

- Capture income potential by zeroing in on dependable payers through these 15 dividend stocks with yields > 3% and build a portfolio that works harder while you wait.

- Ride structural growth by sharpening your focus on these 26 AI penny stocks, where companies are pushing the boundaries of automation, data, and intelligent software.

- Position ahead of the crowd by scanning these 81 cryptocurrency and blockchain stocks for businesses that are shaping digital asset infrastructure, payments, and next generation blockchain applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com