Veeco Instruments (VECO): Assessing Valuation After Strategic Push Into Advanced DRAM and High-Bandwidth Memory

Veeco Instruments (VECO) just landed a strategic foothold in next generation memory, with a tier 1 customer evaluating its laser spike annealing system for advanced DRAM and high bandwidth memory research.

See our latest analysis for Veeco Instruments.

That backdrop helps explain why the stock has quietly built momentum, with a 29.23 percent 3 month share price return and a robust 68.15 percent 3 year total shareholder return, which signals that investors are gradually pricing in higher growth.

If Veeco’s move into advanced memory has you thinking about where else innovation could surprise to the upside, it is worth exploring high growth tech and AI stocks as potential next candidates.

With shares already near analyst targets and fundamentals trending higher, the key question now is whether Veeco’s DRAM push is still underappreciated by the market or if today’s price already bakes in tomorrow’s growth.

Most Popular Narrative Narrative: 2.1% Undervalued

Veeco Instruments last closed at $32.05, a touch below the most widely followed narrative fair value of $32.75, framing a tight valuation debate.

The analysts have a consensus price target of $27.0 for Veeco Instruments based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $30.0, and the most bearish reporting a price target of just $21.0.

Want to see why a modestly higher fair value still leans on ambitious profit margins and richer future earnings multiples than the industry usually commands? The narrative lays out specific growth, margin trends, and share count assumptions that quietly push today’s valuation into premium territory. Curious which levers do the real heavy lifting in that model and how sensitive the outcome is if they shift? Dive in to see the exact moving parts behind this tight underpricing call.

Result: Fair Value of $32.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained AI driven demand or a faster adoption of Veeco’s next generation tools could increase revenue, margins and valuation beyond today’s cautious assumptions.

Find out about the key risks to this Veeco Instruments narrative.

Another Lens on Value

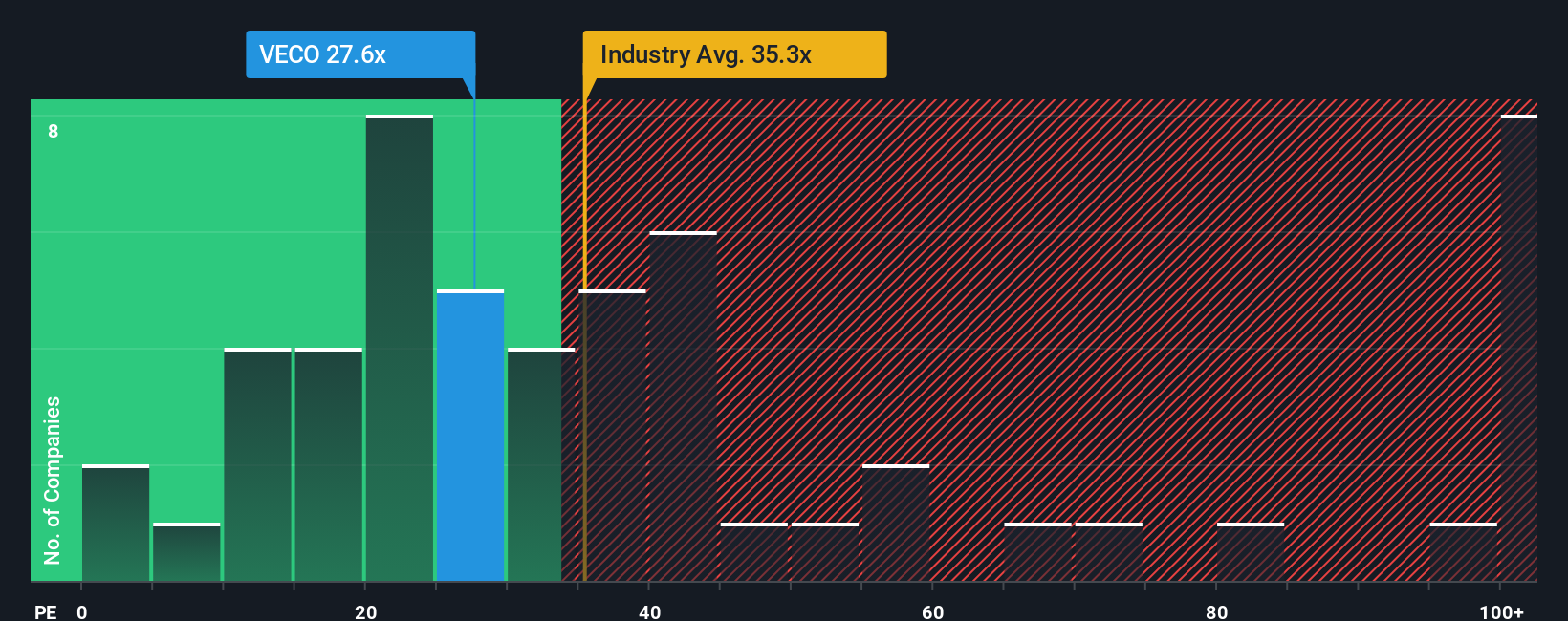

While the narrative suggests Veeco is only 2.1 percent undervalued, its price to earnings ratio near 39 times looks stretched against a fair ratio of 22.5 times and even the US semiconductor average of 38 times. That rich gap points to valuation risk, not hidden upside, if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Veeco Instruments Narrative

If the current story does not quite match your view, or you want to dig into the numbers yourself, you can build a personalized narrative in just a few minutes. Do it your way.

A great starting point for your Veeco Instruments research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in an edge by scanning fresh opportunities beyond Veeco, or you will risk missing the next phase of market leadership.

- Capitalize on growth potential by targeting emerging innovators using these 26 AI penny stocks that tap into powerful secular technology shifts.

- Strengthen your portfolio’s core with cash flow backed opportunities from these 908 undervalued stocks based on cash flows that still trade below intrinsic value.

- Boost your income stream by reviewing steady cash generators through these 15 dividend stocks with yields > 3% that can help balance more aggressive growth bets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com