What MSCI (MSCI)'s New Public–Private Equity Index Means For Shareholders

- MSCI has launched the MSCI All Country Public + Private Equity Index, a daily benchmark that blends the MSCI ACWI IMI with a new private equity index built from LP-sourced data on nearly 10,000 funds, targeting a 15% allocation to modelled private equity and rebalancing quarterly.

- This hybrid index gives investors a single framework to view public and private equity exposures together, potentially reshaping how institutions benchmark diversified, total-portfolio equity allocations.

- Next, we’ll examine how this public–private equity benchmark, with its 15% private allocation, could influence MSCI’s recurring revenue growth narrative.

The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

MSCI Investment Narrative Recap

To own MSCI, you need to believe in steady, recurring revenue from index and data products, with private markets becoming a larger part of that toolkit over time. The new public plus private equity index strengthens MSCI’s private assets proposition, but its near term impact on the key catalyst of subscription and ABF growth looks incremental. The biggest current risk around dependence on private markets data sources does not appear materially changed by this launch.

The launch of the MSCI All Country Public + Private Equity Index sits squarely within MSCI’s broader push into private capital tools, including earlier 2025 private markets index and data releases. Together, these offerings aim to deepen MSCI’s role in how institutions benchmark total portfolios, which ties back to the catalyst of expanding high margin subscription and analytics revenue across a more diversified client base.

Yet while the product story is compelling, investors should be aware that MSCI’s reliance on external private markets data and data sharing agreements...

Read the full narrative on MSCI (it's free!)

MSCI's narrative projects $3.8 billion revenue and $1.6 billion earnings by 2028. This requires 8.5% yearly revenue growth and an earnings increase of about $0.4 billion from $1.2 billion today.

Uncover how MSCI's forecasts yield a $657.56 fair value, a 22% upside to its current price.

Exploring Other Perspectives

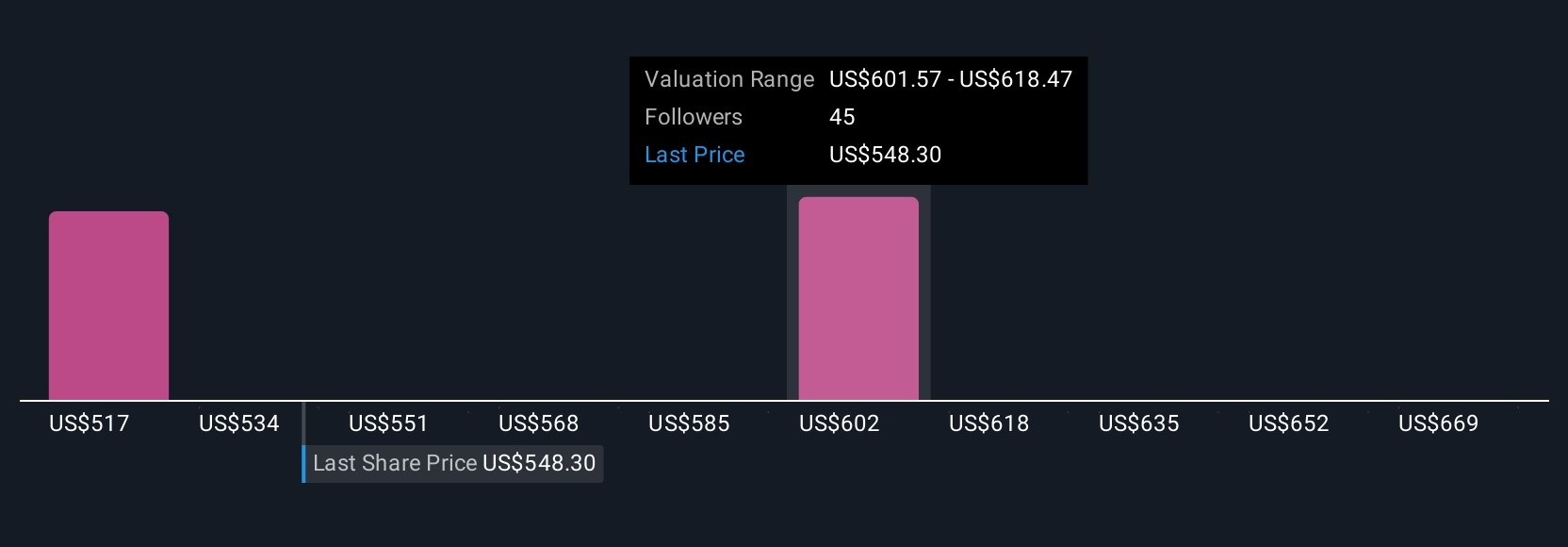

Seven Simply Wall St Community valuations for MSCI span roughly US$520.90 to US$686.08 per share, underlining how far opinions can diverge. Against that backdrop, the push into public plus private equity benchmarks raises fresh questions about how much growth MSCI can really extract from private assets over time, so you may want to compare several of these perspectives before deciding what you think.

Explore 7 other fair value estimates on MSCI - why the stock might be worth as much as 27% more than the current price!

Build Your Own MSCI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MSCI research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MSCI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MSCI's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com