Guardant Health (GH) Valuation Check After Strong Q3 Update, Bullish Analyst Targets and Capital Raises

The spotlight on Guardant Health (GH) really brightened after its third quarter update, which paired strong revenue growth with upbeat analyst commentary and fresh capital raises that underline management’s confidence in funding the next leg of expansion.

See our latest analysis for Guardant Health.

Those upbeat third quarter numbers and capital raises have landed against a backdrop of powerful momentum, with Guardant Health’s 90 day share price return of nearly 70 percent and a 1 year total shareholder return of around 177 percent, even though the stock has recently pulled back about 6 percent over the past week.

If Guardant’s run has you rethinking your healthcare exposure, this could be a good moment to explore other innovative names using our curated list of healthcare stocks.

With the stock up more than 170 percent over the past year and trading just above consensus targets, yet still at a steep discount to some intrinsic value estimates, is Guardant Health a genuine buying opportunity or is the market already pricing in its future growth?

Most Popular Narrative Narrative: 3.1% Overvalued

With Guardant Health last closing at $102.02 against a most popular narrative fair value of $99, the story hinges on aggressive growth translating into premium earnings multiples.

In order for you to agree with the analyst's consensus, you would need to believe that by 2028, revenues will be $1.5 billion, earnings will be $82.1 million, and it would be trading on a PE ratio of 116.4x, assuming you use a discount rate of 6.8 percent.

Want to understand why a loss making diagnostics company is being modeled with future margins and valuation multiples usually reserved for elite compounders? See how fast revenue must accelerate, how sharply profitability is expected to swing, and how long that premium multiple is assumed to last before the math adds up.

Result: Fair Value of $99 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks around payer coverage for Shield and ongoing cash burn mean that delays or setbacks could quickly undermine today’s premium growth narrative.

Find out about the key risks to this Guardant Health narrative.

Another Lens On Value

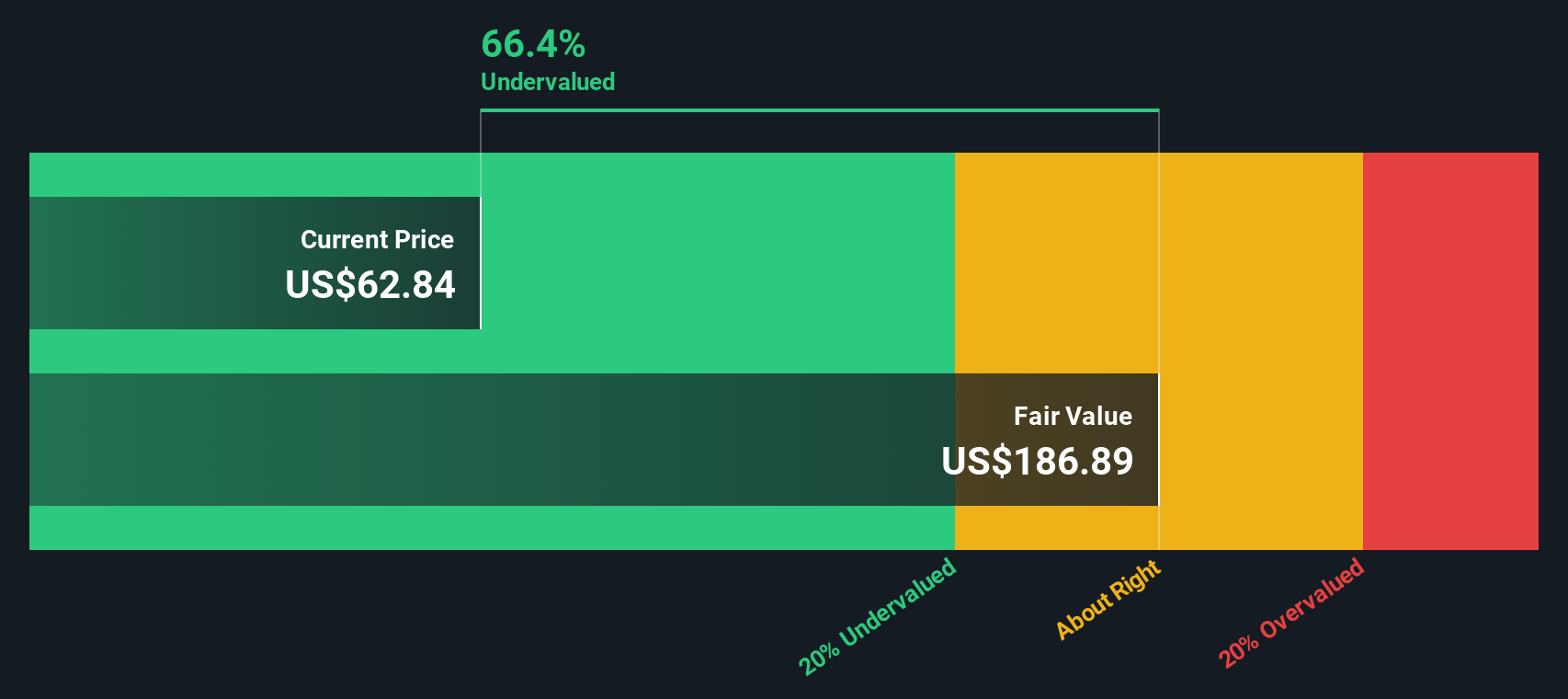

While the popular narrative leans toward modest overvaluation, our DCF model suggests something different. It indicates that Guardant Health’s shares are trading at roughly a 58 percent discount to an intrinsic value of about $242. If that gap narrows, who will be left on the sidelines?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Guardant Health for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Guardant Health Narrative

If you would rather dig into the numbers yourself and challenge these assumptions, you can quickly craft a personalized view in just a few minutes: Do it your way.

A great starting point for your Guardant Health research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before Guardant’s story moves on without you, consider your next move by scanning other high potential opportunities tailored to your strategy with the Simply Wall St Screener.

- Explore fast moving growth potential by reviewing these 26 AI penny stocks shaping the future of intelligent technology and automation.

- Review potential income streams by targeting these 15 dividend stocks with yields > 3% that may add regular cash returns to your portfolio.

- Position yourself in emerging market themes by assessing these 81 cryptocurrency and blockchain stocks related to payments, infrastructure, and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com