Can Dominion Energy’s (D) Offshore Wind Bet Quietly Rewire Its Long‑Term Earnings Stability?

- Dominion Energy recently reported better-than-expected Q3 2025 adjusted earnings and revenue, narrowed its full‑year operating guidance, and continued advancing its large capital program, including the Coastal Virginia Offshore Wind project, while receiving regulatory approvals for new infrastructure and rate changes benefiting high‑load customers like data centers.

- This combination of cleaner energy build‑out, AI‑driven data center demand, and new rate structures is reshaping Dominion’s long‑term earnings profile and revenue stability, even as analysts remain cautious about risks such as project cost inflation and regulatory uncertainty.

- We’ll now examine how Dominion’s progress on the Coastal Virginia Offshore Wind project could influence its existing investment narrative and long‑term outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Dominion Energy Investment Narrative Recap

To own Dominion Energy, you really need to believe in regulated, utility-style growth backed by rising electricity demand and a massive clean energy buildout. The latest Q3 beat and narrowed guidance mostly confirm a steady, rather than explosive, near term outlook, while the key short term catalyst remains execution on its capital plan and the biggest current risk is still cost and regulatory outcomes around Coastal Virginia Offshore Wind (CVOW), which this update does not meaningfully change.

The most relevant update here is the progress report that CVOW is about two thirds complete and targeted to enter service by the end of 2026. That milestone sits right at the heart of Dominion’s investment case, because the project is expected to expand the regulated rate base that underpins long term earnings, but also concentrates risk if costs continue to rise or regulators push back on full recovery.

Yet investors should also keep in mind the possibility that future tariff or regulatory shifts could materially affect CVOW’s economics and overall project returns...

Read the full narrative on Dominion Energy (it's free!)

Dominion Energy's narrative projects $17.8 billion revenue and $3.6 billion earnings by 2028. This requires 5.3% yearly revenue growth and about a $1.1 billion earnings increase from $2.5 billion today.

Uncover how Dominion Energy's forecasts yield a $64.00 fair value, a 9% upside to its current price.

Exploring Other Perspectives

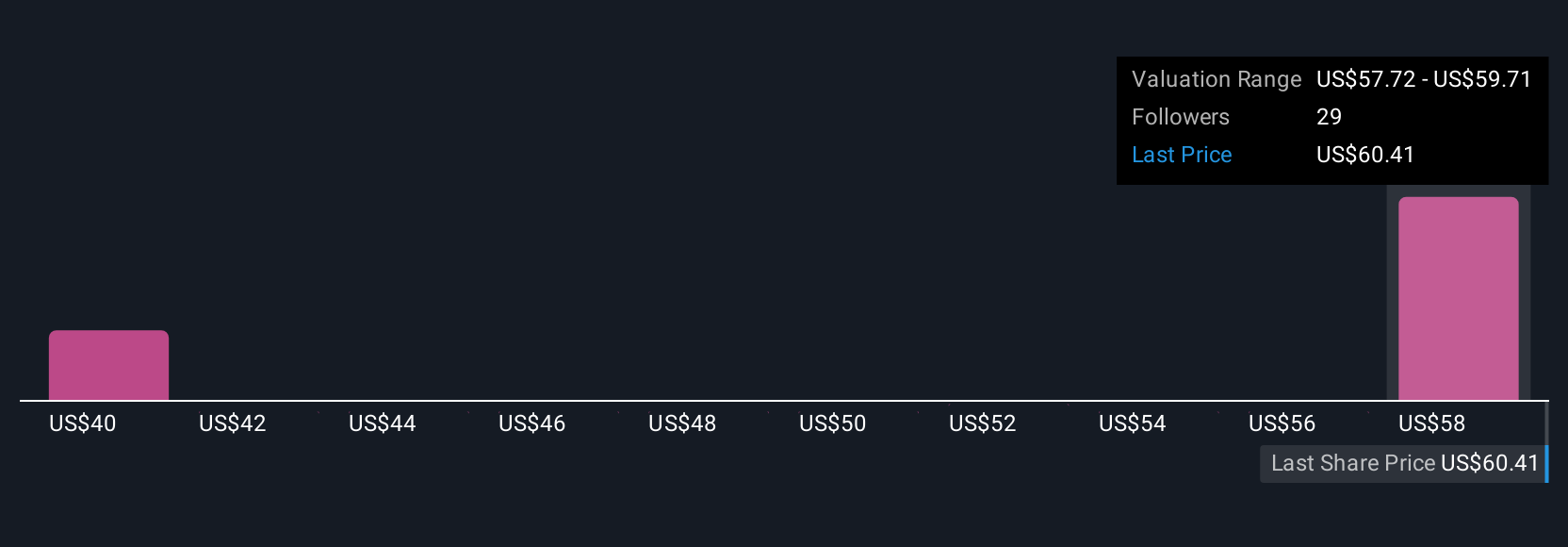

Three Simply Wall St Community fair value estimates for Dominion span roughly US$36.73 to US$64 per share, underscoring how far apart individual views can be. When you set that against the company’s multi decade CVOW buildout and the regulatory and cost risks tied to such a large offshore project, it becomes even more important to compare several perspectives before forming your own view.

Explore 3 other fair value estimates on Dominion Energy - why the stock might be worth 37% less than the current price!

Build Your Own Dominion Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dominion Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Dominion Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dominion Energy's overall financial health at a glance.

No Opportunity In Dominion Energy?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com