How Investors Are Reacting To OceanaGold (TSX:OGC) Extending EG Vein And Expanding Wharekirauponga Drilling

- In November 2025, OceanaGold Corporation reported new drilling results from ten holes at its Wharekirauponga project in New Zealand, extending the mineralized EG vein by 135 m to the south and confirming additional high-grade gold zones.

- The company also secured permits that could double the number of drill rigs and expand exploration sites, potentially accelerating resource definition and conversion at Wharekirauponga in 2026 and beyond.

- We’ll now examine how the expanded high-grade EG vein zone at Wharekirauponga could influence OceanaGold’s existing investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

OceanaGold Investment Narrative Recap

To own OceanaGold, you need to believe the company can translate its growing production base and exploration success into sustained cash generation while managing cost and operational pressures at assets like Haile, Didipio and Macraes. The latest Wharekirauponga drill results strengthen the long term growth story but do not materially change the nearer term focus on delivering against 2025 and 2026 production guidance and keeping unit costs and capex under control.

The recent Wharekirauponga update ties directly into OceanaGold’s broader exploration and growth program, which includes guidance for higher group production through 2026 and ongoing investment in projects such as Waihi and Haile. High grade intercepts and more drilling capacity at Wharekirauponga support the idea that exploration can extend mine lives and underpin future earnings, even as investors weigh short term risks from ore hardness, weather related disruptions and capital spending needs across the portfolio.

But while Wharekirauponga adds longer term appeal, investors should still be aware of the near term cost and disruption risks from severe weather at Didipio...

Read the full narrative on OceanaGold (it's free!)

OceanaGold's narrative projects $2.2 billion revenue and $764.2 million earnings by 2028.

Uncover how OceanaGold's forecasts yield a CA$40.31 fair value, a 13% upside to its current price.

Exploring Other Perspectives

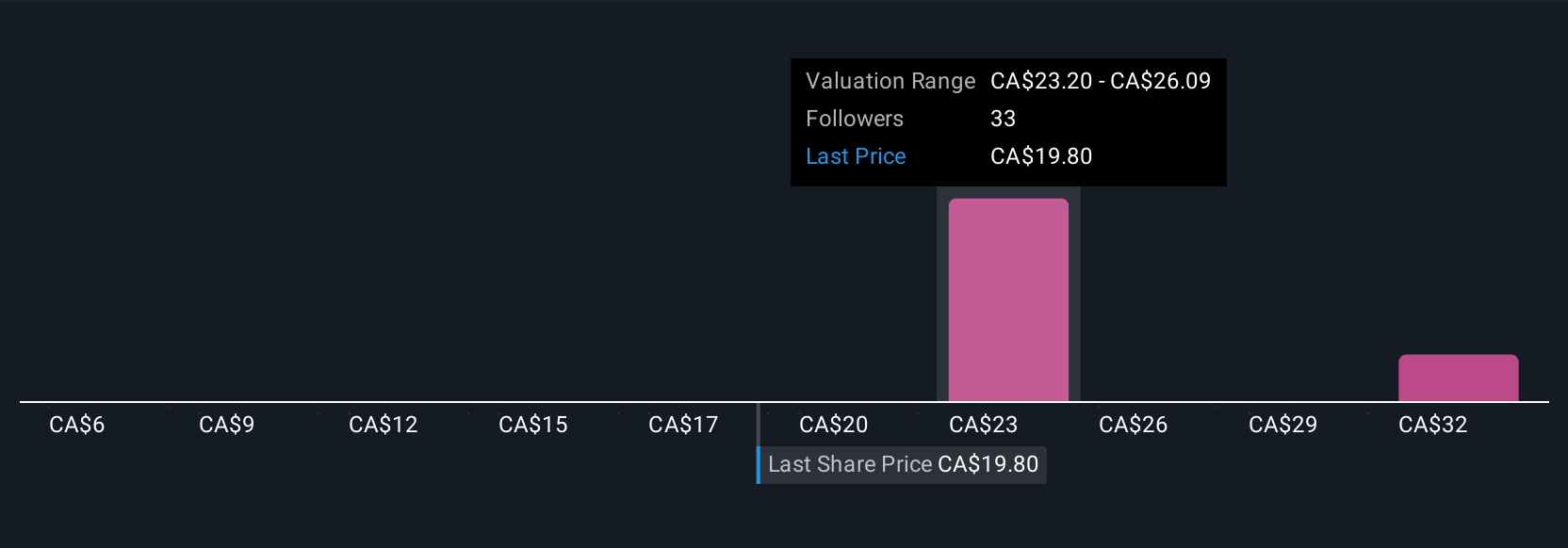

Seven fair value estimates from the Simply Wall St Community span a wide range, from CA$5.87 to CA$145.07 per share, showing how far opinions can differ. When you weigh those views against OceanaGold’s plan to lift production through 2026 and its expanding New Zealand exploration footprint, it becomes even more important to compare multiple perspectives before deciding how this growth potential fits into your expectations for the business.

Explore 7 other fair value estimates on OceanaGold - why the stock might be worth over 4x more than the current price!

Build Your Own OceanaGold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OceanaGold research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free OceanaGold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OceanaGold's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com