Dillard’s (DDS) Net Margin Compression Challenges Bullish Long‑Term Compounding Narrative in Q3 2026

Dillard's (DDS) just turned in its Q3 2026 scorecard with revenue of about $1.5 billion and basic EPS of $4.66 as investors weigh the latest read on the department store's profitability. The company has seen quarterly revenue move from roughly $1.51 billion and EPS of $4.59 in Q2 2025 to about $1.54 billion and EPS of $10.39 in Q1 2026 before landing at $1.54 billion and EPS of $4.66 in Q2 2026. This gives a clear sense of how earnings and sales have been oscillating around the same topline range while margins do more of the heavy lifting.

See our full analysis for Dillard's.With the headline numbers on the table, the next step is to set these results against the dominant narratives around Dillard's to see which stories the latest margins support and which ones the data starts to challenge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Margin Slips To 8.7%

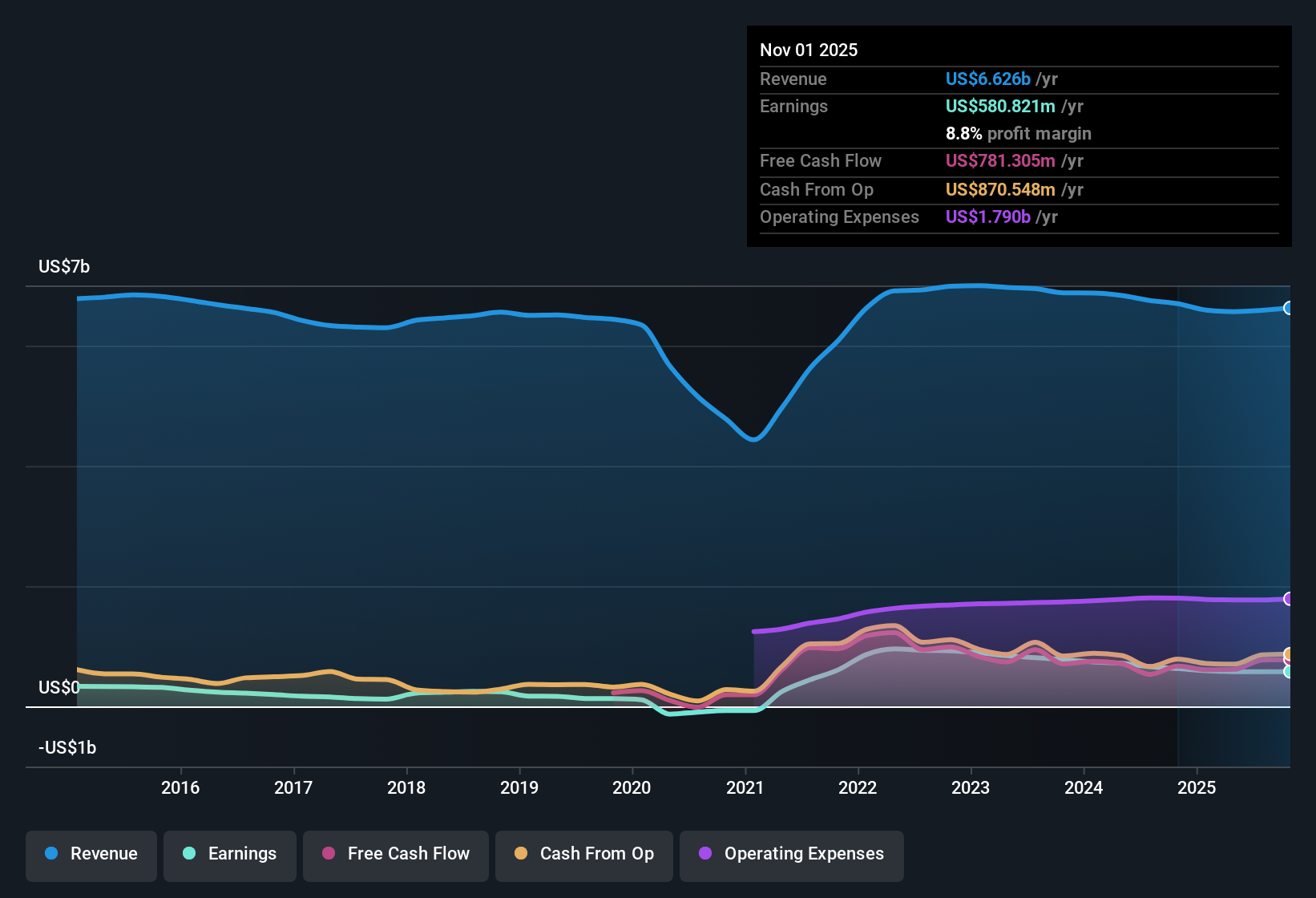

- Over the last twelve months Dillard's generated about $6.6 billion in revenue and $575.6 million in net income, which works out to an 8.7% net margin versus 9.8% a year earlier.

- What stands out for the bullish view is that a 12.7% annual earnings growth rate over five years is now meeting softer profitability, as shown by net income easing from $660.4 million on $6.8 billion of revenue to $575.6 million on $6.6 billion. Bulls therefore have to explain why that margin drift does not undermine the idea of a steadily compounding business.

- Supporters can still point to consistent profitability and the fact that same store sales in the latest reported quarter ticked up 1% after a prior stretch of negative comps, suggesting the business is holding its ground rather than sharply weakening.

- At the same time, the move from a 9.8% to 8.7% trailing margin gives bears concrete evidence that profitability is under gentle pressure even before any forecast decline in earnings plays out.

Same Store Sales Stabilize At 1%

- Comparable sales improved from a 5% drop in Q2 2025 and a 2% drop in Q1 2025 to a 1% gain in the latest reported quarter, even though quarterly revenue stayed in roughly the same $1.5 billion range.

- Bears argue that department stores face ongoing structural headwinds, and the pattern here shows why they focus on the top line, with trailing twelve month revenue nudging down from about $6.8 billion to $6.6 billion even as comps finally turned slightly positive. This hints that any traffic or ticket recovery is modest rather than a strong reversal.

- The fact that net income over the last twelve months declined from roughly $660.4 million to $575.6 million while revenue only dipped by about $0.2 billion backs the concern that cost pressure, not just sales softness, is weighing on performance.

- When you place that against forecast revenue growth of just 1.2% per year compared with 10.6% expected for the broader US market, it strengthens the cautious narrative that Dillard's is growing more slowly than many other opportunities.

P/E Discount And 3.72% Yield

- At a share price of $698.18, Dillard's trades on a 18.9x P/E that is below the 19.8x global multiline retail average and the 21.6x peer average, while also offering a 3.72% dividend yield and sitting about 5.7% below its DCF fair value of $740.03.

- From a bullish angle these numbers frame Dillard's as a relatively cheap, income generating stock. The same data set also highlights why some investors stay cautious, because forecasts call for earnings to shrink by about 0.6% per year even as the business remains solidly profitable.

- The valuation gap and dividend together give income and value focused investors a tangible payoff today, which can look appealing against an 8.7% net margin that is still healthy in absolute terms.

- However, the projected earnings decline and slower 1.2% revenue growth outlook compared with the wider market mean that paying even a below peer P/E multiple still involves accepting a business with more muted growth prospects.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Dillard's's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Dillard's faces easing net margins, modest same store sales gains, and slower forecast growth than the broader market. Together, these factors signal a less dynamic long term outlook.

If that tempered growth trajectory gives you pause, use our stable growth stocks screener (2089 results) today to focus on companies delivering steadier revenue and earnings momentum through different market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com