Has Western Digital’s 173% 2024 Surge Fully Reflected Its AI Storage Potential?

- Wondering if Western Digital is still a smart buy after its huge run, or if the easy money has already been made? This article will walk you through what the market might really be pricing in.

- The stock has climbed 3.4% over the last week and 3.2% over the past month, adding to a massive 173.0% gain year to date and 215.7% over the past year, with a staggering 528.3% jump over three years and 339.2% over five.

- Those moves have come as Western Digital continues to be seen as a key player in the storage and memory market, particularly as demand for high performance drives rises with AI and cloud infrastructure build outs. Investors have also been watching industry supply discipline and pricing power, which can quickly change sentiment toward cyclical names like WDC.

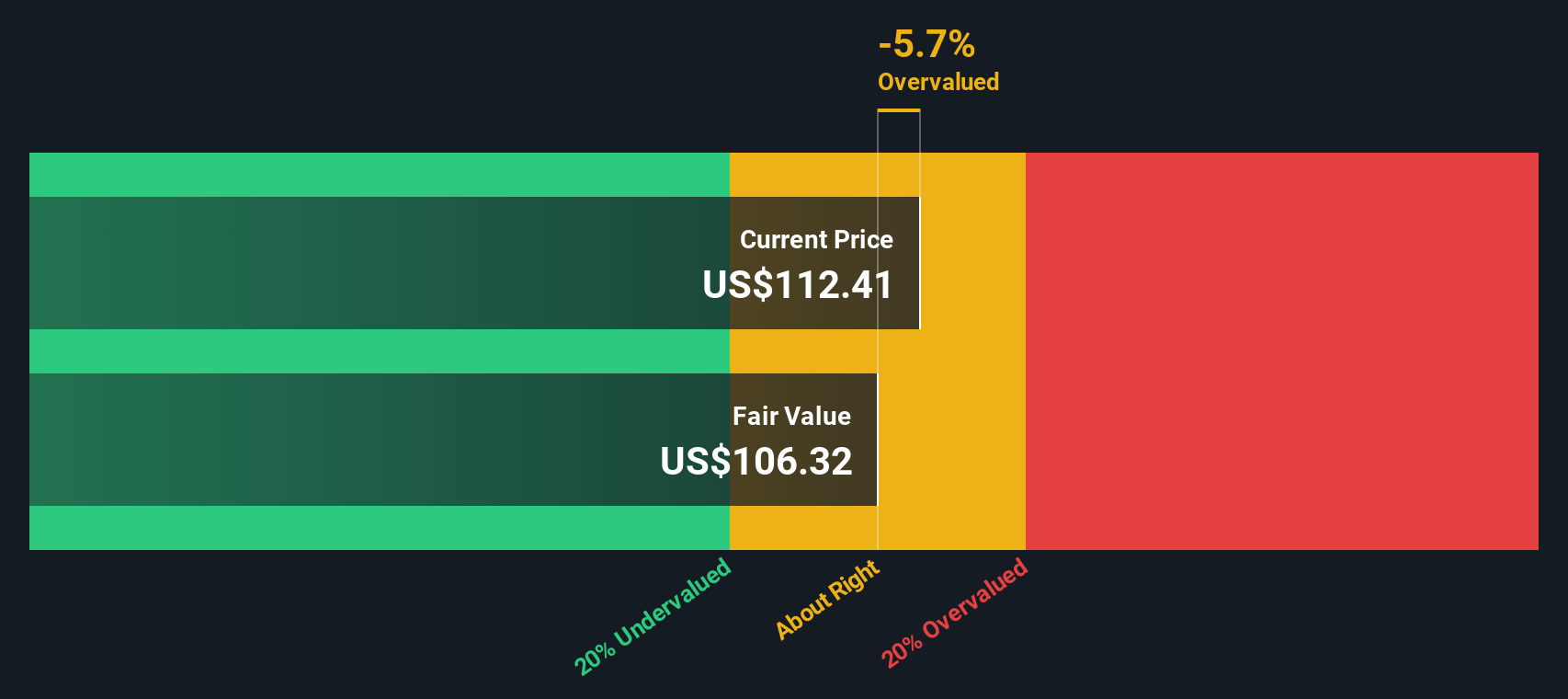

- Right now Western Digital scores a 4/6 on our undervaluation checks, giving it a valuation score of 4 that suggests some upside but not a screaming bargain. Next we will unpack how different valuation approaches view the stock, before finishing with an even better way to think about its true value.

Approach 1: Western Digital Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting its future cash flows and then discounting them back to today in dollar terms. For Western Digital, the 2 Stage Free Cash Flow to Equity model starts with last twelve months free cash flow of about $1.8 billion and then builds in growth as the storage cycle improves.

Analysts and internal estimates see free cash flow rising to roughly $4.3 billion by 2030, with detailed projections stepping up through the late 2020s as demand for high performance and AI related storage grows. Simply Wall St uses analyst forecasts where available and then extrapolates additional years to complete the 10 year cash flow curve before discounting those expected cash flows back to today.

On this basis, the model arrives at an intrinsic value of about $231 per share. That implies Western Digital trades at roughly a 26.9% discount to its estimated fair value, which indicates the market is still cautious on how durable the upcycle will be.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Western Digital is undervalued by 26.9%. Track this in your watchlist or portfolio, or discover 907 more undervalued stocks based on cash flows.

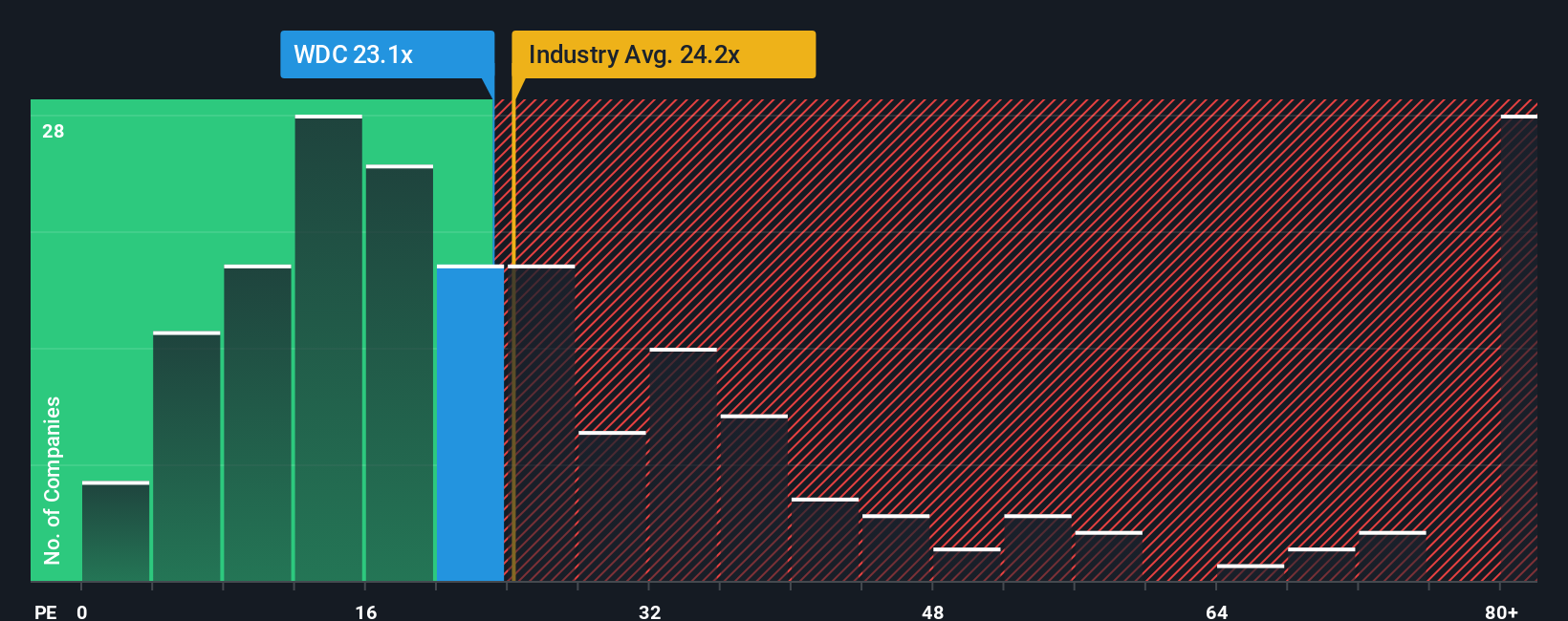

Approach 2: Western Digital Price vs Earnings

For profitable companies like Western Digital, the price to earnings ratio is a useful way to gauge how much investors are willing to pay for each dollar of current earnings. In general, faster growing and less risky businesses deserve a higher PE, while slower growth or greater uncertainty should translate into a lower, more conservative multiple.

Western Digital currently trades at about 22.2x earnings, which is roughly in line with the broader Tech sector average of around 22.8x and a touch above its direct peer group at about 20.7x. Simply Wall St also calculates a Fair Ratio of 33.4x, which reflects what investors might reasonably pay for Western Digital given its specific combination of earnings growth prospects, profitability, industry positioning, size and risk profile.

This Fair Ratio is more informative than a simple comparison to peers or the sector, because it adjusts for Western Digital’s particular fundamentals rather than assuming all storage or semiconductor names should trade at the same multiple. With the shares on 22.2x compared with a Fair Ratio of 33.4x, the stock screens as undervalued on a PE basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1452 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Western Digital Narrative

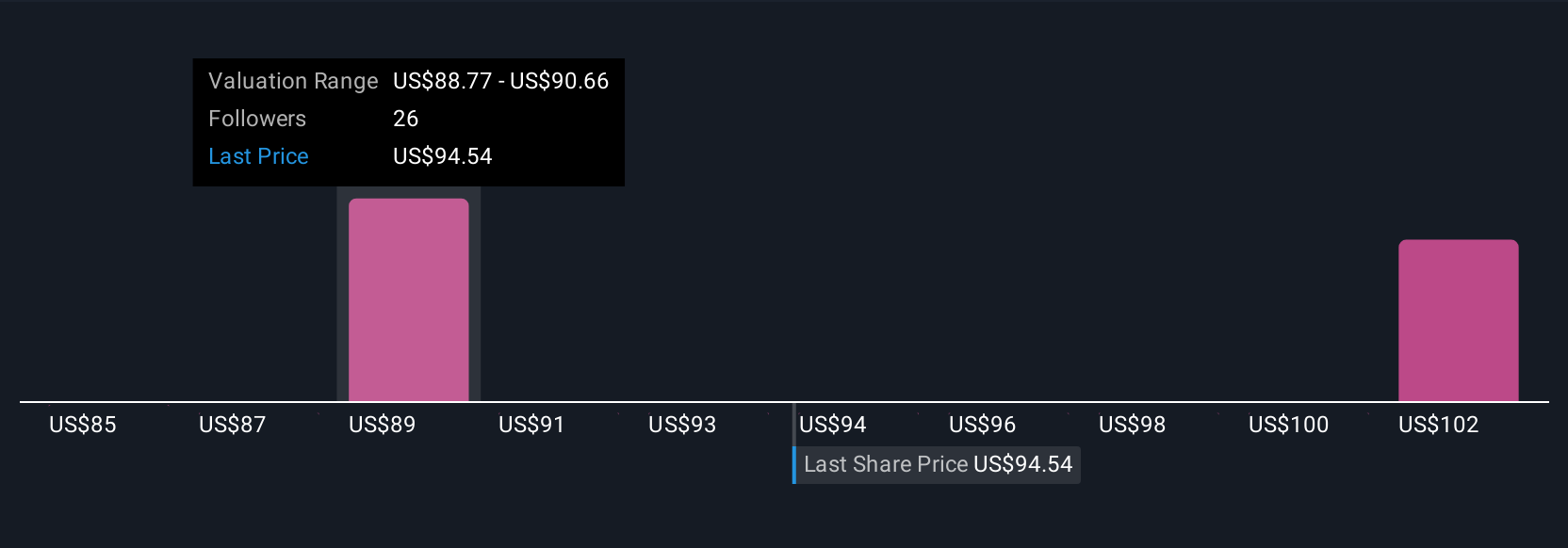

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to spell out your story for Western Digital, link it to a concrete forecast for revenue, earnings and margins, and then see the fair value that drops out of that story, all inside the Narratives tool on Simply Wall St’s Community page that millions of investors already use.

A Narrative is your view of how Western Digital’s business will actually play out, turned into numbers and a fair value that updates dynamically as new earnings, news or guidance come in, making it easier to compare that evolving fair value to today’s share price.

For example, one investor might build a Narrative where AI storage demand stays tight and margins stay high, and assume Western Digital is worth something closer to $181 per share. A more cautious investor might assume growth slows, margins normalise and the stock is worth around $62. Narratives lets you see and track both perspectives side by side.

Do you think there's more to the story for Western Digital? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com