What RH (RH)'s New Immersive Detroit Gallery Means For Shareholders

- RH recently opened RH Detroit, The Gallery in Birmingham, a four-level, 60,000-square-foot immersive space blending luxury home furnishings with hospitality-inspired experiences.

- This latest gallery strengthens RH’s push into experiential retail, aiming to offer design and lifestyle experiences that online competitors cannot easily match.

- We’ll now examine how this new immersive Detroit gallery could influence RH’s investment narrative and its expansion-led growth thesis.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

RH Investment Narrative Recap

To own RH, you need to believe its high‑end, experiential galleries can translate into sustained demand and better economics despite housing and macro uncertainty. The opening of RH Detroit supports the expansion-focused catalyst, but does not materially change the near term risk around tariffs, inflation and a still‑fragile housing market that could pressure margins and big ticket demand.

The Detroit Gallery launch fits directly into RH’s broader plan to roll out immersive Design Galleries in major markets, a key pillar for its expansion thesis. This complements other recent openings, such as the RH Outlet in Sacramento, which broaden the physical footprint and could support the company’s efforts to grow revenue and better leverage its substantial past investments in stores and inventory.

However, against that expansion story, investors should also be aware that RH’s sizeable debt from past buybacks could amplify the impact if...

Read the full narrative on RH (it's free!)

RH’s narrative projects $4.3 billion revenue and $442.6 million earnings by 2028.

Uncover how RH's forecasts yield a $262.25 fair value, a 63% upside to its current price.

Exploring Other Perspectives

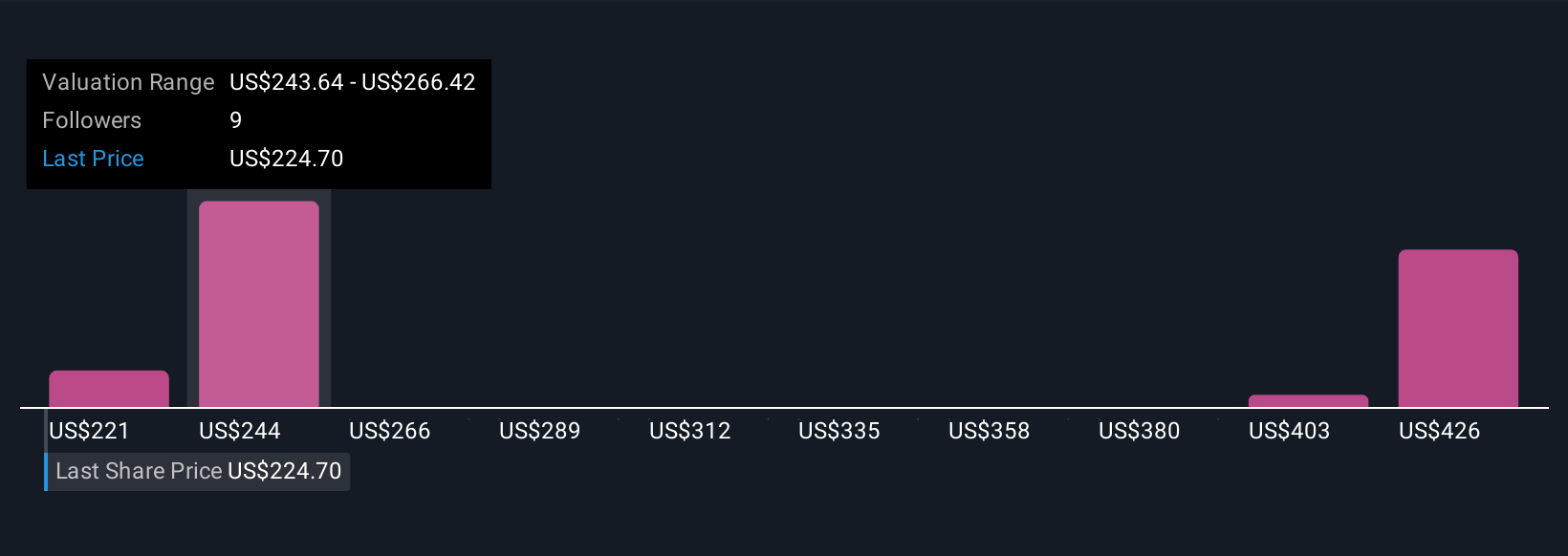

Six fair value estimates from the Simply Wall St Community span roughly US$179 to US$420 per share, showing how far apart individual views can be. When you set those against RH’s expansion heavy gallery strategy and exposure to a weak housing market, it becomes even more important to compare several of these perspectives before deciding how RH might fit in your portfolio.

Explore 6 other fair value estimates on RH - why the stock might be worth just $179.00!

Build Your Own RH Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RH research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free RH research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RH's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com