Did Fresh Accounting Probes into Revenue and Liabilities Just Shift Ardent Health's (ARDT) Investment Narrative?

- In the past few days, several law firms, including Holzer & Holzer, Hagens Berman, and The Schall Law Firm, announced investigations into Ardent Health after its third-quarter 2025 results revealed a US$43 million revenue reduction from a change in accounting estimate and a US$54 million increase in professional liability reserves.

- These probes center on whether Ardent accurately disclosed internal control issues around revenue recognition and liability reserves, raising fresh questions about the reliability of its reported financials.

- We’ll now examine how these accounting adjustments and related investigations may affect Ardent Health’s investment narrative built around margin improvement and operational efficiency.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Ardent Health Investment Narrative Recap

To own Ardent Health, you have to believe its hospital and outpatient network can translate steady procedure demand and efficiency gains into reliable earnings, despite reimbursement and regulatory headwinds. The recent US$97 million accounting adjustments and related legal investigations directly challenge the short term narrative around cleaner margins and internal controls, making confidence in the quality of reported profits, rather than demand growth, the key near term catalyst and risk.

The November 12 earnings release, which paired higher year on year Q3 revenue with a swing to a net loss and lowered 2025 EPS guidance, is central to interpreting these developments. That update, now reframed by the accounting revisions, puts more weight on whether Ardent can sustain its focus on higher margin outpatient growth and payer mix improvement while addressing control weaknesses that have raised concerns about the reliability of its numbers.

But for investors, the bigger question is how these control issues intersect with rising payer denials and reimbursement pressure that...

Read the full narrative on Ardent Health (it's free!)

Ardent Health's narrative projects $7.3 billion revenue and $339.9 million earnings by 2028. This requires 5.7% yearly revenue growth and about an $85 million earnings increase from $254.9 million today.

Uncover how Ardent Health's forecasts yield a $13.96 fair value, a 59% upside to its current price.

Exploring Other Perspectives

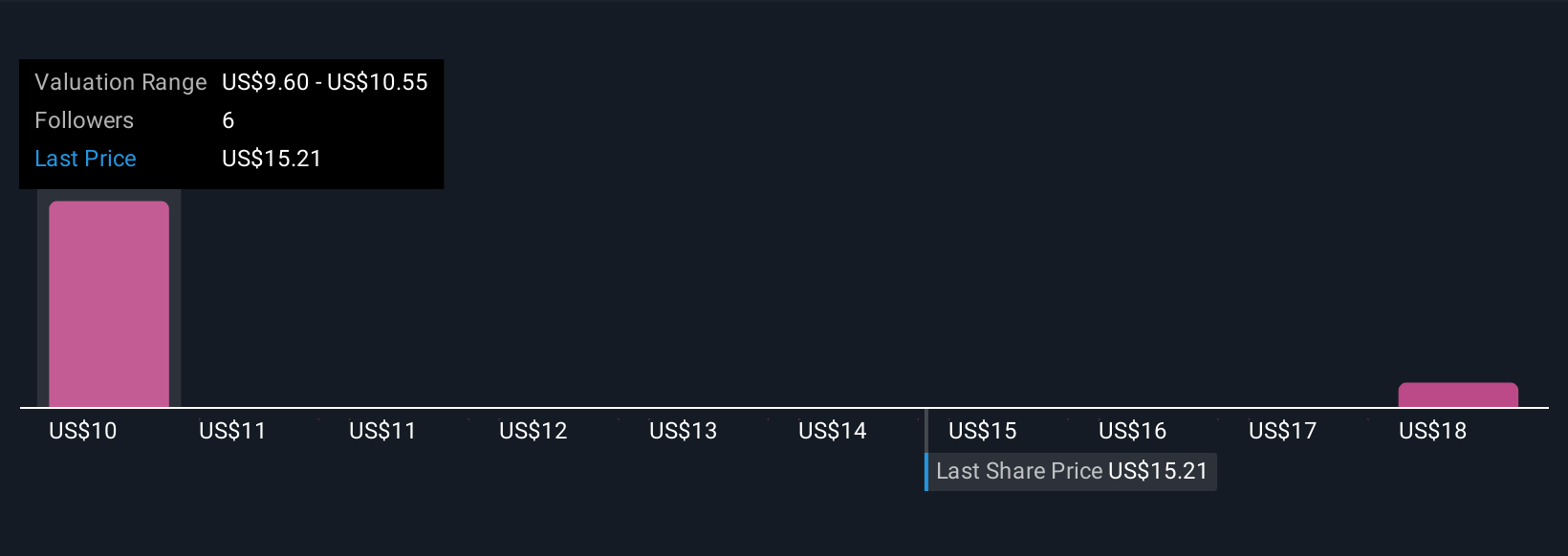

One member of the Simply Wall St Community currently estimates Ardent’s fair value at US$7.02 per share, underscoring how individual views can differ from market pricing. Against this backdrop, the emerging questions around Ardent’s revenue recognition controls take on added importance for anyone weighing its future earnings resilience and should encourage you to compare several independent viewpoints before deciding how comfortable you are with the stock’s risk profile.

Explore another fair value estimate on Ardent Health - why the stock might be worth as much as $7.02!

Build Your Own Ardent Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ardent Health research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Ardent Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ardent Health's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com