Parsons (PSN) Is Down 21.3% After Losing FAA ATC Deal To Peraton Has The Bull Case Changed?

- Recently, Parsons Corporation announced several contract wins, including roles on Missouri’s US$441 million I-70 Rocheport–Columbia design-build project, Sound Transit’s 2025 US$1 billion-ceiling design-services MATOC, and DTRA’s US$3.50 billion CTRIC IV IDIQ, while also adding former Blue Origin CEO Robert H. Smith to its board.

- However, investor attention has centered on Parsons losing the anticipated US$12.50 billion FAA air traffic control modernization contract to rival Peraton, removing a major potential growth opportunity that many had viewed as a key long-term workload driver.

- We’ll now examine how missing the FAA air traffic control modernization contract could reshape Parsons’ previously optimistic infrastructure and defense growth narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Parsons Investment Narrative Recap

To own Parsons today, you need to believe in its role as a contractor at the intersection of U.S. infrastructure and defense, supported by a large, long-dated backlog. Losing the anticipated US$12.50 billion FAA air traffic control modernization contract removes a highly visible medium term workload catalyst and highlights competition risk, but does not change the fact that near term results are still driven by a broader portfolio of federal and infrastructure programs.

Against that backdrop, Parsons’ position on DTRA’s US$3.50 billion CTRIC IV IDIQ stands out as the most relevant counterpoint to the FAA loss, keeping it in the mix for significant national security work. While not a direct replacement for the FAA opportunity, CTRIC IV reinforces the depth of Parsons’ defense pipeline and illustrates how multiple contract vehicles can support growth, even when one marquee opportunity does not land as hoped.

Yet, despite these contract wins, investors still need to consider how intense competition for mega federal programs could...

Read the full narrative on Parsons (it's free!)

Parsons’ narrative projects $7.4 billion revenue and $350.2 million earnings by 2028.

Uncover how Parsons' forecasts yield a $91.56 fair value, a 37% upside to its current price.

Exploring Other Perspectives

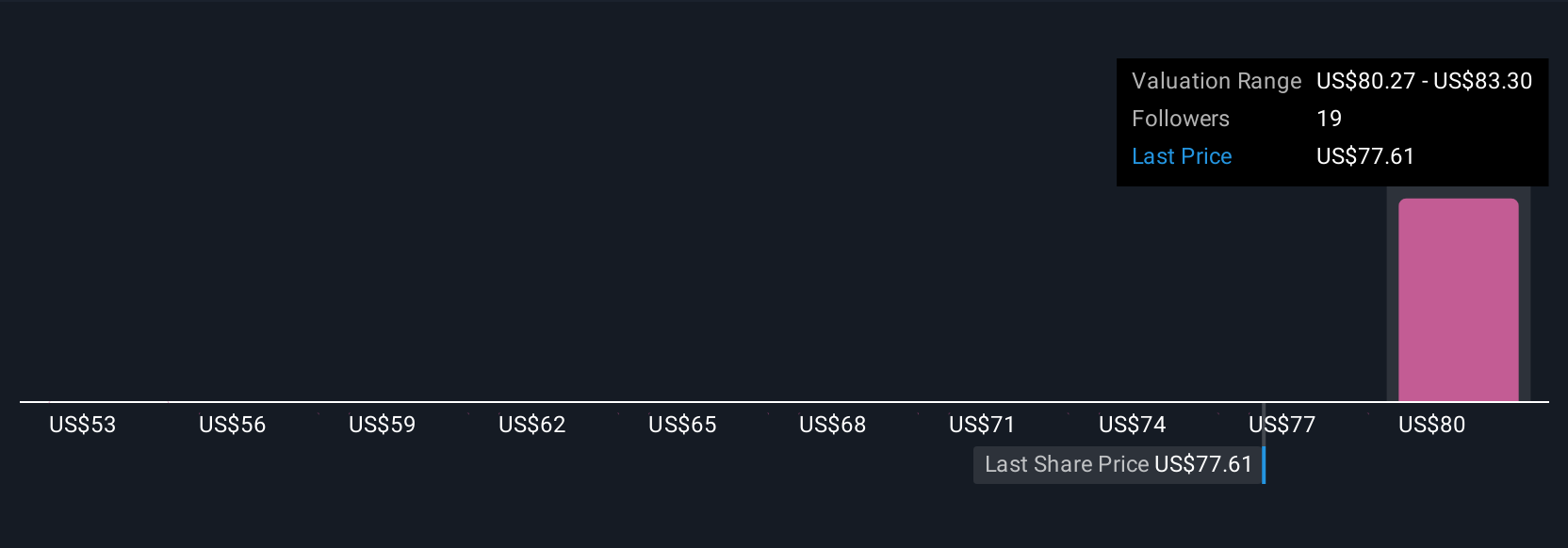

Three fair value estimates from the Simply Wall St Community cluster between US$81.71 and US$91.56, above the recent share price. You should weigh those views against the FAA contract loss and what it implies for future federal win rates and earnings resilience, then compare several different perspectives before forming your own view.

Explore 3 other fair value estimates on Parsons - why the stock might be worth just $81.71!

Build Your Own Parsons Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Parsons research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Parsons research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Parsons' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com