CyberArk Software (CYBR): Assessing Valuation After Multi‑Year Share Price Surge

Recent performance and why CyberArk is back on investors radars

CyberArk Software (CYBR) has been quietly rewarding patient shareholders, with the stock up around 48% over the past year and more than tripling over the past 3 years.

See our latest analysis for CyberArk Software.

The stock has cooled slightly in recent weeks, with a negative 1 month share price return. However, the strong year to date share price return alongside a powerful multi year total shareholder return suggests momentum is still firmly with CyberArk as investors lean into its identity security growth story.

If CyberArk’s run has you thinking more broadly about security and software winners, this is a good moment to explore high growth tech and AI stocks for other high conviction ideas.

With shares near record highs, rapid revenue growth but ongoing losses, and the stock trading just shy of Wall Street targets, investors face a key question: is there still a buying opportunity here, or has the market already priced in CyberArk’s future growth?

Most Popular Narrative Narrative: 1.4% Undervalued

With CyberArk’s narrative fair value sitting just above the last close of $478.70, the story hinges on how far growth and margins can stretch.

The evolving machine identity market, coupled with CyberArk’s focus on AI-driven identity security through its machine identity capabilities and Secrets Management, is expected to drive significant revenue growth as organizations seek integrated solutions to manage increasingly complex identity security needs. CyberArk's unified identity security platform, which includes privileged access management and workforce security, is expected to drive higher average deal sizes, revenue growth, and improved net margins as customers increasingly consolidate their identity security solutions with trusted vendors.

Want to see what kind of revenue surge and margin lift need to materialize to support this premium? The narrative leans on aggressive compounding and a punchy future profit multiple. Curious how those moving parts combine into that near term fair value? Explore the full breakdown to see the assumptions powering this call.

Result: Fair Value of $485.47 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps integrating Venafi and Zilla Security, or intensifying competition in identity security, could quickly undermine the optimistic growth and valuation narrative.

Find out about the key risks to this CyberArk Software narrative.

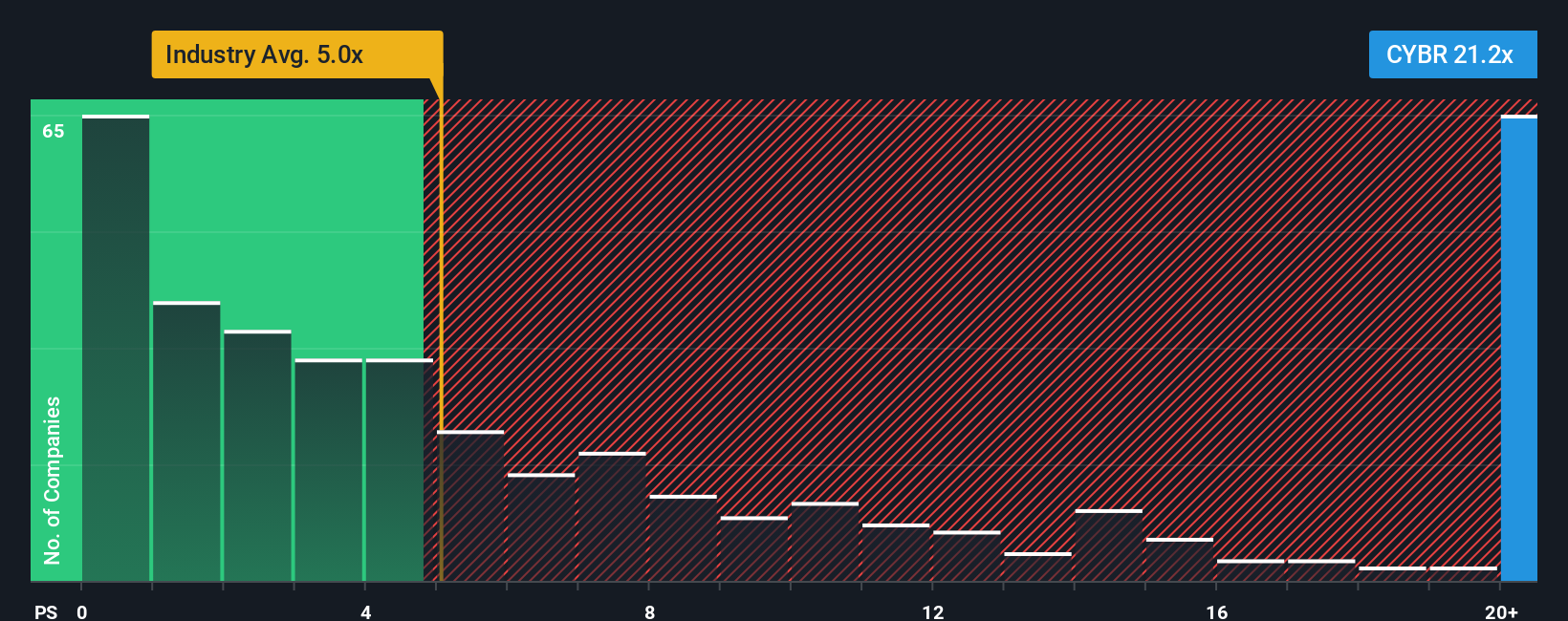

Another View: Rich Multiples Flag Valuation Risk

While the narrative fair value suggests CyberArk is roughly fairly priced, the price to sales ratio tells a tougher story. At 18.5 times sales versus 4.9 times for the US software sector and a 9.2 times fair ratio, the stock looks stretched, leaving little room for execution slip ups.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CyberArk Software Narrative

If you are skeptical of this view or simply prefer to dig into the numbers yourself, you can build a custom take in minutes: Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding CyberArk Software.

Ready for more investment ideas?

Now is the moment to broaden your opportunity set with targeted screens that surface high potential stocks, rather than waiting for the next idea to find you.

- Capture early-stage potential with these 3574 penny stocks with strong financials that pair low share prices with underlying fundamentals that are stronger than the market expects.

- Capitalize on secular growth by scanning these 26 AI penny stocks positioned to benefit from accelerating demand for intelligent software and automation.

- Identify mispriced opportunities using these 907 undervalued stocks based on cash flows that may offer upside based on discounted cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com