MGM Resorts (MGM): Reassessing Valuation After Technical Breakout and Improving Global Entertainment Outlook

MGM Resorts International (MGM) just caught investors attention, jumping about 14% on the XETRA exchange as traders reacted to a clean technical breakout and improving sentiment around global entertainment demand.

See our latest analysis for MGM Resorts International.

Zooming out, that breakout sits on top of a steady grind higher, with a roughly 10% 1 month share price return and a modestly positive year to date move. However, the 1 year total shareholder return is still slightly negative, suggesting momentum is rebuilding as investors warm to MGM’s growth and rebranding efforts.

If MGM’s rebound has you rethinking the sector, it could be a good moment to explore fast growing stocks with high insider ownership for other potential high conviction ideas.

Yet with earnings recovering, analyst targets sitting higher, and the shares still trading at a sizable intrinsic discount, investors now face a key question: Is MGM genuinely undervalued or already pricing in its next leg of growth?

Most Popular Narrative: 15.1% Undervalued

With MGM Resorts International last closing at $36.07 against a narrative fair value of $42.50, the setup suggests upside if the long range plan delivers.

The development and opening of international integrated resorts specifically, the exclusive license in MGM Osaka, anticipated multibillion-dollar revenue potential, and Dubai project should capture rising demand for destination travel among the growing global middle class, unlocking new recurring revenue streams and diversifying consolidated earnings over the long term.

Curious how modest top line growth, climbing margins, and shrinking share count can still justify a richer future earnings multiple than today. See the full blueprint.

Result: Fair Value of $42.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer Las Vegas visitation and heavy spending on long-dated Osaka and Dubai projects could strain cash flows and delay the expected margin uplift.

Find out about the key risks to this MGM Resorts International narrative.

Another Take On Valuation

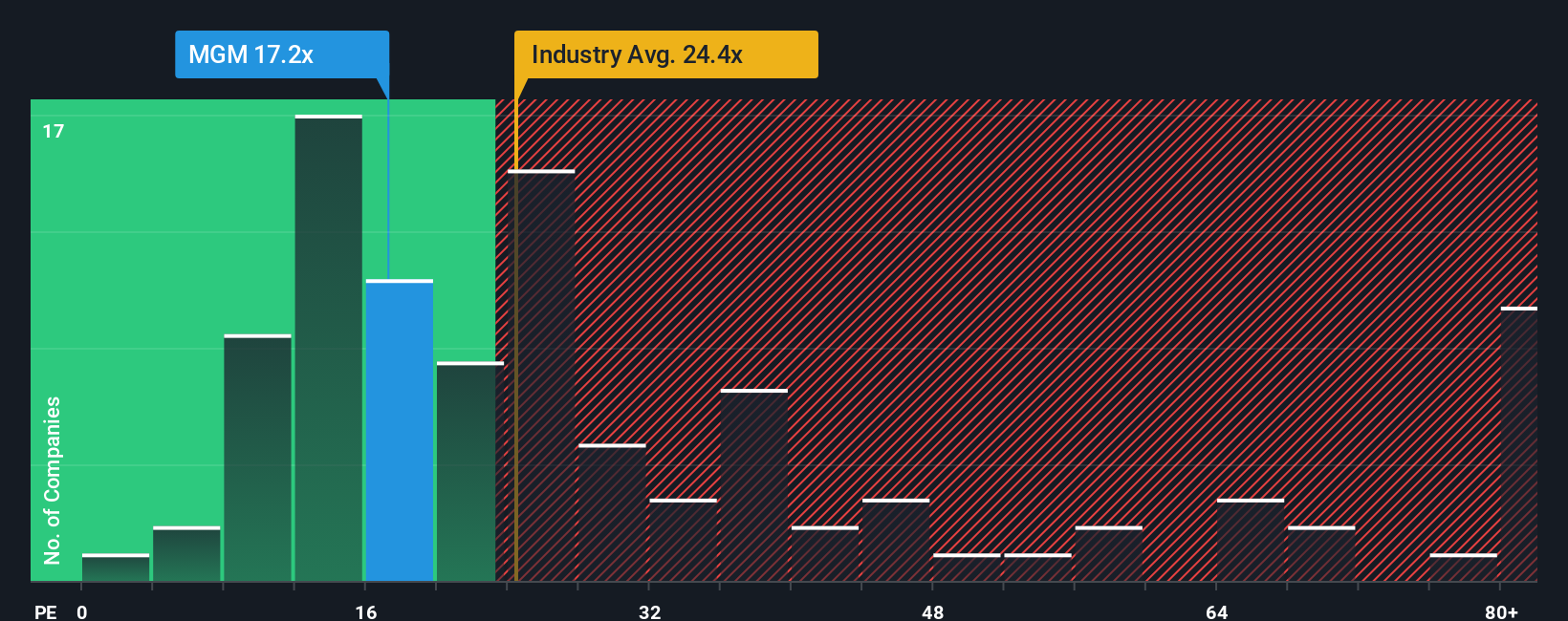

Looking beyond the narrative of fair value, MGM appears expensive on an earnings basis. Its P E ratio is about 146.9 times, compared with a fair ratio of 50.5 times, 23.3 times for the US Hospitality industry, and 16.5 times for peers. Is the market already assuming too much future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MGM Resorts International Narrative

If this framing does not match your view or you would rather dig into the numbers yourself, you can build a custom thesis in minutes: Do it your way.

A great starting point for your MGM Resorts International research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before MGM moves again, lock in your next opportunity with focused stock ideas on Simply Wall St that match your strategy and risk appetite.

- Capture potential multi baggers early by scanning these 3574 penny stocks with strong financials that already show solid financial strength instead of speculative hype.

- Position yourself at the forefront of intelligent automation by targeting these 26 AI penny stocks shaping the next wave of data driven innovation.

- Secure more value for every dollar you invest by filtering for these 15 dividend stocks with yields > 3% that can keep paying you through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com