Weyerhaeuser (WY): Taking Stock of Valuation as Investor Day Targets and Timber Asset Strategy Draw Focus

Weyerhaeuser (WY) is stepping into its upcoming investor day with a lot riding on the message. Management plans to spell out financial targets through 2030, just as housing and lumber weakness weighs on the stock.

See our latest analysis for Weyerhaeuser.

Despite solid annual revenue and net income growth, the share price has struggled, with a year to date share price return of minus 22.5 percent and a one year total shareholder return of minus 28.4 percent, signaling fading momentum even as management leans into long term targets and asset value.

If this kind of cyclical story has you thinking about portfolio balance, it might be worth exploring fast growing stocks with high insider ownership as a way to uncover different styles of opportunity.

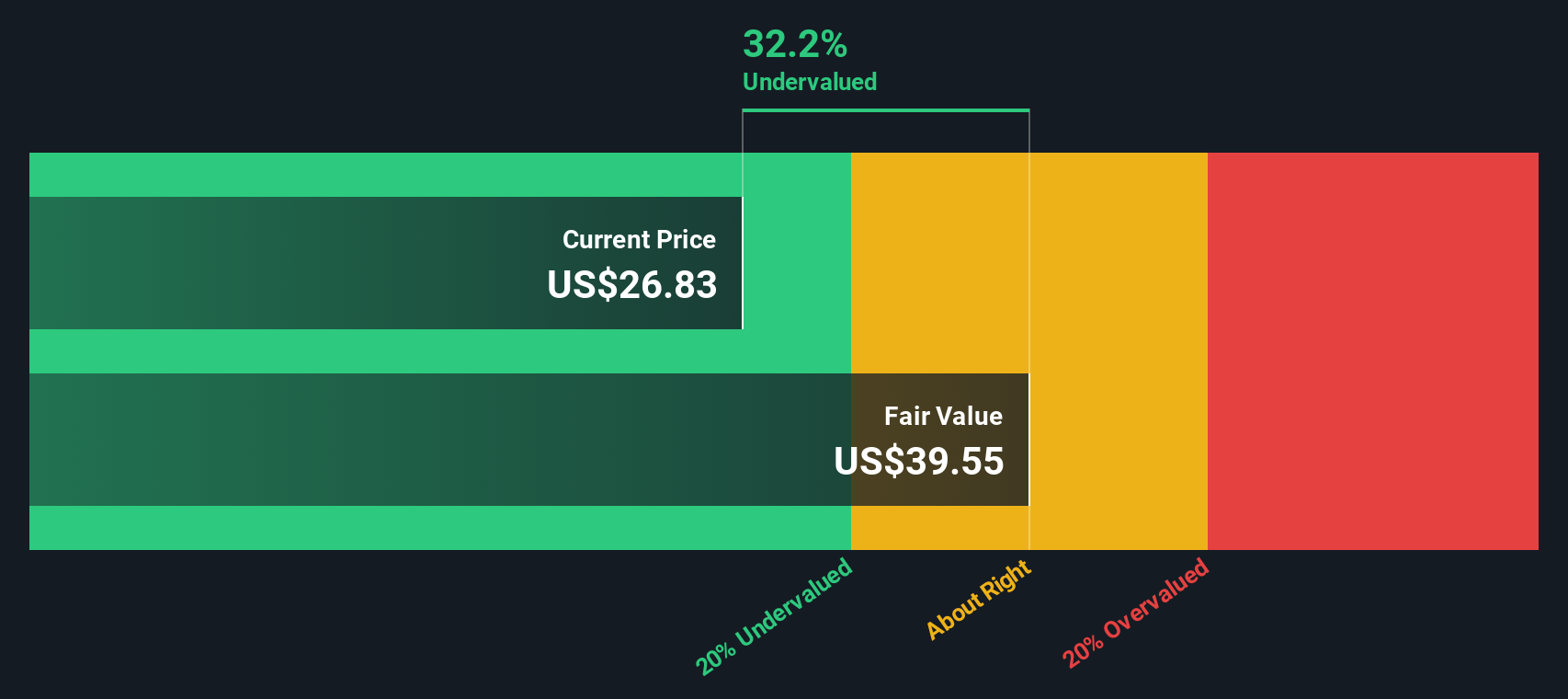

With analyst targets implying almost 40 percent upside and the stock already trading at a sizable intrinsic discount, the key question is whether Weyerhaeuser is genuinely mispriced or whether the market is already factoring in its 2030 growth story.

Most Popular Narrative Narrative: 28.1% Undervalued

Weyerhaeuser's most followed narrative pegs fair value at about 30.18 dollars per share, well above the last close of 21.69 dollars, setting up an optimistic long term case.

The carbon capture and sequestration (CCS) agreement with Occidental Petroleum represents a growth opportunity in Weyerhaeuser's Natural Climate Solutions business, likely boosting future earnings. Ongoing construction of the EWP facility in Arkansas and return to normal operations at the Montana facility will drive increased production, positively impacting revenue and net margins.

Want to see why modest top line growth, sharply higher margins and a richer earnings multiple still add up to upside from here? The full narrative explains how future profitability, capital returns and that higher valuation bar are all meant to fit together, and which assumptions have to go right for this fair value to hold.

Result: Fair Value of $30.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer lumber demand or renewed trade friction, including tariffs and China import bans, could easily derail those margin and valuation assumptions.

Find out about the key risks to this Weyerhaeuser narrative.

Another Lens on Valuation

Our DCF model paints a similar picture, with Weyerhaeuser trading at about 32.8 percent below its estimated fair value of 32.26 dollars per share, suggesting the market is pricing in a lot of bad news. Is this caution justified, or does it overshoot the risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Weyerhaeuser Narrative

If you want to challenge these assumptions or rely on your own due diligence, you can build a custom view in just minutes: Do it your way.

A great starting point for your Weyerhaeuser research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop with one timber stock when you can quickly scan fresh opportunities across sectors using the Simply Wall St Screener, before others catch on.

- Capture potential mispricings early by reviewing these 907 undervalued stocks based on cash flows that may offer stronger upside based on cash flow fundamentals.

- Capitalize on innovation tailwinds by targeting these 26 AI penny stocks that harness artificial intelligence for scalable, long term growth.

- Strengthen your income stream by focusing on these 15 dividend stocks with yields > 3% that combine attractive yields with sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com