What Royalty Pharma (RPRX)'s Denali Rare-Disease Royalty Deal and Cash Surge Means For Shareholders

- Royalty Pharma recently agreed to provide US$275 million in synthetic royalty funding to Denali Therapeutics tied to future net sales of tividenofusp alfa for Hunter syndrome, including a US$200 million upfront payment and a contingent US$75 million upon potential European approval by the end of 2029.

- This funding, combined with Royalty Pharma’s latest quarter showing growing portfolio receipts and higher full-year guidance, highlights how the company is using its cash flow strength to secure exposure to emerging rare disease therapies while supporting partners’ development and launch efforts.

- We will now examine how Royalty Pharma’s Denali partnership and stronger recent cash generation may influence its longer-term investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Royalty Pharma Investment Narrative Recap

To own Royalty Pharma, you need to believe in its model of turning steady royalty cash flows into a growing, diversified stream of drug-linked payments, especially in complex areas like rare diseases. The Denali deal modestly reinforces that story by adding exposure to a potential Hunter syndrome therapy, but the most important near term catalysts and main risks still sit with how existing large royalties perform and how the Vertex Alyftrek dispute is ultimately resolved, so the immediate impact looks limited.

Among recent developments, the company’s raised full year portfolio receipt guidance to US$3.2 billion to US$3.25 billion and continued execution on its US$3.0 billion buyback program matter most in framing the Denali funding. Stronger cash generation and ongoing capital returns give Royalty Pharma more room to fund new royalty agreements like tividenofusp alfa while still managing balance sheet risk and shareholder payouts, which ties directly into how resilient its cash flow base proves if older assets slow.

Yet, despite these positives, investors should still be aware of how a prolonged or unfavorable outcome in the Vertex Alyftrek royalty dispute could...

Read the full narrative on Royalty Pharma (it's free!)

Royalty Pharma’s narrative projects $4.0 billion revenue and $922.7 million earnings by 2028. This implies 20.0% yearly revenue growth and an earnings decrease of about $77 million from $1.0 billion today.

Uncover how Royalty Pharma's forecasts yield a $45.98 fair value, a 16% upside to its current price.

Exploring Other Perspectives

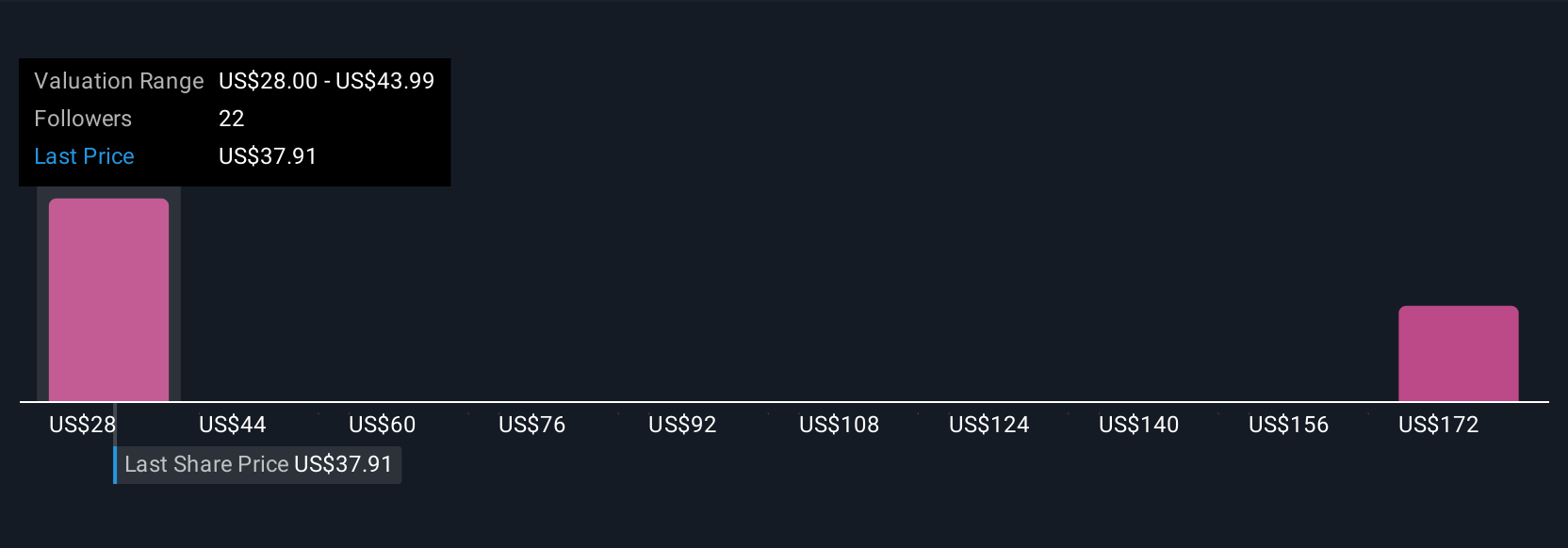

Simply Wall St Community members have five fair value estimates for Royalty Pharma, ranging from about US$39 to US$172, showing very different views on upside potential. When you contrast that with the ongoing Alyftrek royalty dispute risk, it underlines why many investors prefer to weigh several perspectives before deciding how resilient the current cash flow story really is.

Explore 5 other fair value estimates on Royalty Pharma - why the stock might be worth just $39.10!

Build Your Own Royalty Pharma Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Royalty Pharma research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Royalty Pharma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Royalty Pharma's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com