Assessing ABB (SWX:ABBN) Valuation After Its Latest Share Buyback Move

ABB (SWX:ABBN) just bought back nearly 300,000 shares as part of its ongoing 2025 repurchase program, a steady signal that management prefers returning cash to investors instead of chasing every acquisition opportunity.

See our latest analysis for ABB.

That steady buying has come alongside firm price momentum, with the share price at CHF 58.68 and a robust year to date share price return of 19.37 percent. The five year total shareholder return of 191.81 percent shows that ABB’s long term story has already rewarded patient investors even as management sidestepped the MacLean Power bid.

If ABB’s disciplined capital moves have you thinking about what else could surprise on the upside, it might be worth scouting fast growing stocks with high insider ownership as your next set of ideas.

Yet with ABB now trading slightly above analyst targets and its valuation rich versus historic norms, investors face a key question: Is there still upside left in the stock, or is future growth already priced in?

Most Popular Narrative: 4% Overvalued

With ABB’s narrative fair value sitting just below the CHF 58.68 last close, the story hinges on whether its execution can sustain premium pricing power.

The analysts have a consensus price target of CHF51.106 for ABB based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF65.13, and the most bearish reporting a price target of just CHF36.98.

Want to see what justifies paying up for ABB today? The narrative leans on durable growth, rising margins and a richer future earnings multiple. Curious which assumptions really carry that valuation?

Result: Fair Value of $56.44 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, weaker demand in key industrial end markets and intensifying robotics competition, especially in China, could quickly undermine the optimistic earnings trajectory.

Find out about the key risks to this ABB narrative.

Another Angle on Valuation

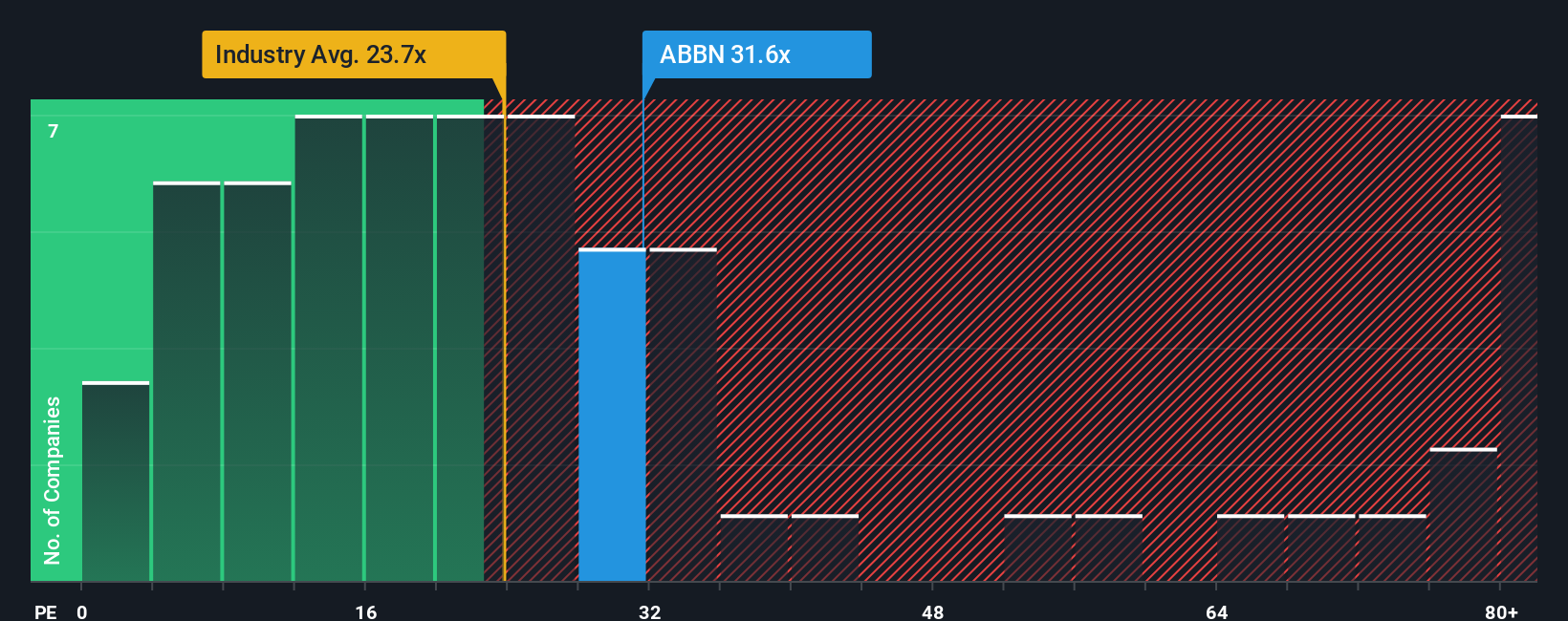

On earnings, ABB trades at 29.8 times, richer than both the European electrical industry at 22.7 times and peers at 28.4 times, yet still below a 36.5 times fair ratio. That mix of premium pricing and theoretical upside leaves a dilemma: are you being paid enough for the risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ABB Narrative

If this narrative does not align with your view, or you prefer digging into the numbers yourself, you can build a custom version in minutes: Do it your way.

A great starting point for your ABB research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next edge by using our screener to pinpoint stocks that match your strategy instead of chasing ideas later.

- Capture potential bargains early by targeting companies that look mispriced on future cash flows through these 907 undervalued stocks based on cash flows, before the broader market catches on.

- Position yourself for the next wave of innovation by focusing on cutting edge names reshaping automation and analytics with these 26 AI penny stocks.

- Strengthen your portfolio’s income engine by zeroing in on reliable payers via these 15 dividend stocks with yields > 3% so you are not relying solely on capital gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com