Should Possible Sale of Salt Lake City Facility and EBITDA Lift Require Action From Albany International (AIN) Investors?

- Albany International Corp. recently declared a quarterly dividend of US$0.28 per share and earlier announced it is reviewing options, including a possible sale, for its Amelia Earhart Drive structures assembly facility in Salt Lake City, which has drawn interest from more than ten private equity investors.

- The potential divestiture of this facility could lift the Albany Engineered Composites segment’s Adjusted EBITDA margin into the mid to high teens, reshaping the company’s earnings mix and financial profile.

- We’ll now examine how the potential sale of the Amelia Earhart Drive facility could influence Albany International’s existing investment narrative.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Albany International Investment Narrative Recap

To own Albany International, you need to be comfortable with a mixed business where a mature Machine Clothing segment helps fund a more volatile aerospace composites arm. The potential sale of the Amelia Earhart Drive facility is a meaningful short term catalyst because it could lift AEC margins, but it also underlines execution and contract risk in a segment that has already weighed on recent profitability.

The latest dividend increase to US$0.28 per share shows the board is still returning cash to shareholders even as the company reviews options for the structures assembly facility. For investors, that combination of portfolio reshaping and ongoing capital returns sits alongside the key question of how much concentration risk in AEC programs they are willing to accept.

But behind the prospect of higher AEC margins, investors should be aware of the concentration risk around a handful of major aerospace programs...

Read the full narrative on Albany International (it's free!)

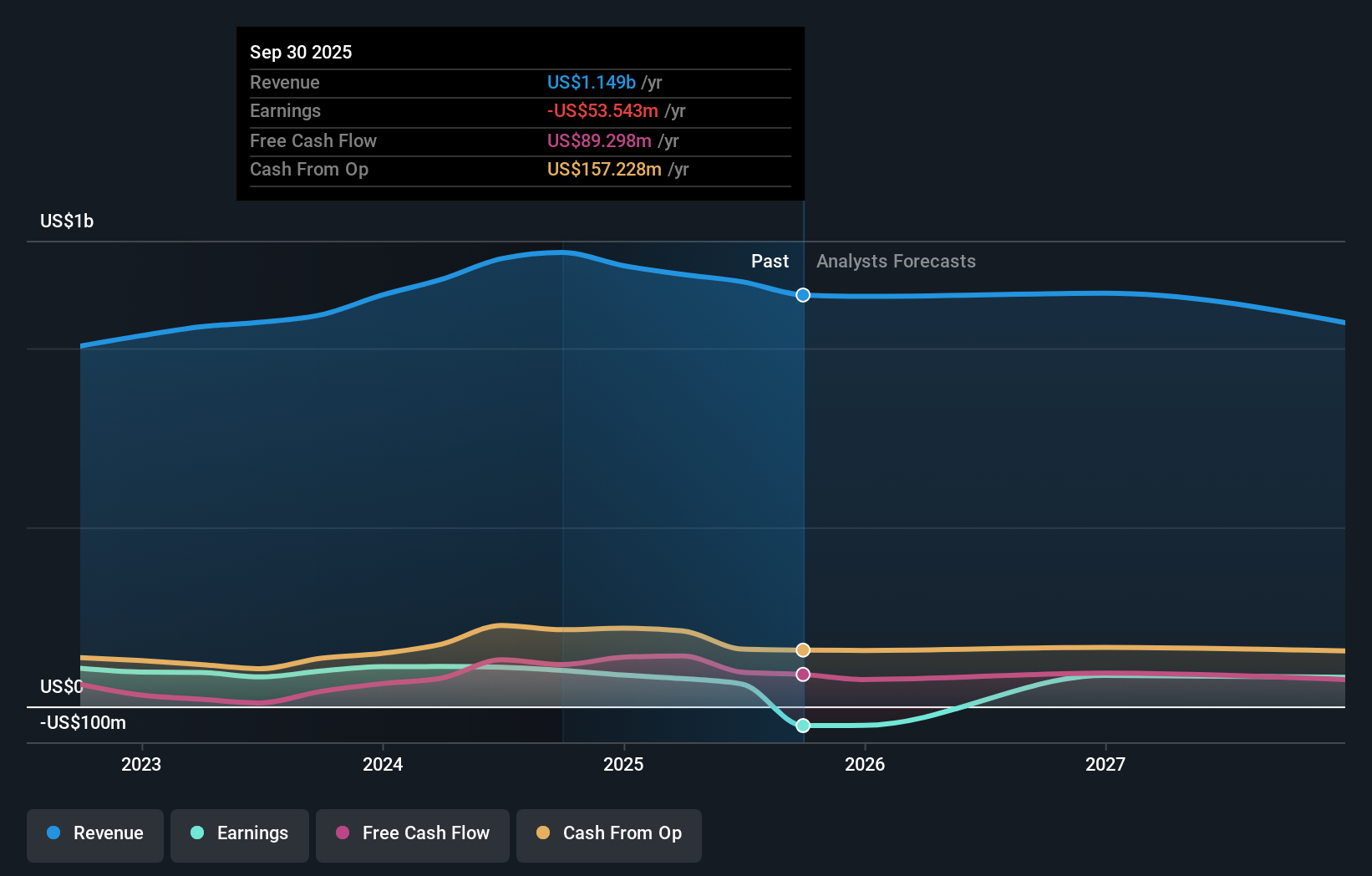

Albany International's narrative projects $1.3 billion revenue and $181.1 million earnings by 2028. This implies earnings rising by about $181.1 million from today's level.

Uncover how Albany International's forecasts yield a $53.50 fair value, a 8% upside to its current price.

Exploring Other Perspectives

The one Simply Wall St Community fair value input of US$53.50 highlights how even a single private estimate can differ from current pricing. You should weigh that against the risk that Albany’s heavy dependence on a few aerospace and defense programs could still drive meaningful earnings volatility.

Explore another fair value estimate on Albany International - why the stock might be worth as much as 8% more than the current price!

Build Your Own Albany International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Albany International research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Albany International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Albany International's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com