Should NextDecade’s Planned Sixth Rio Grande LNG Train Expansion Require Action From NEXT Investors?

- In November 2025, NextDecade Corporation initiated the pre-filing process with the Federal Energy Regulatory Commission for a proposed sixth liquefaction train and additional marine berth at its Rio Grande LNG facility, with a full application expected in 2026.

- This early regulatory step signals that NextDecade is actively planning to expand export capacity at one of its key LNG projects, potentially reshaping its long-term infrastructure profile.

- Next, we’ll examine how this planned sixth liquefaction train at Rio Grande LNG could influence NextDecade’s investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is NextDecade's Investment Narrative?

To own NextDecade, you have to believe the Rio Grande LNG buildout will eventually translate a project-heavy story with zero revenue and deep losses into a durable cash-generating platform. In the near term, the real swing factors still sit with financing and final investment decisions on Trains 4 and 5, supported by long dated SPAs with Aramco, JERA, EQT and ConocoPhillips, rather than Train 6. The new FERC pre-filing for a sixth train and extra berth reinforces management’s ambition and adds long term optionality, but it does not meaningfully change today’s key catalysts or the fact that the balance sheet is stretched with high cost, restrictive debt and less than a year of cash runway. Combined with rich book valuation and recent share price volatility, execution risk remains front and center.

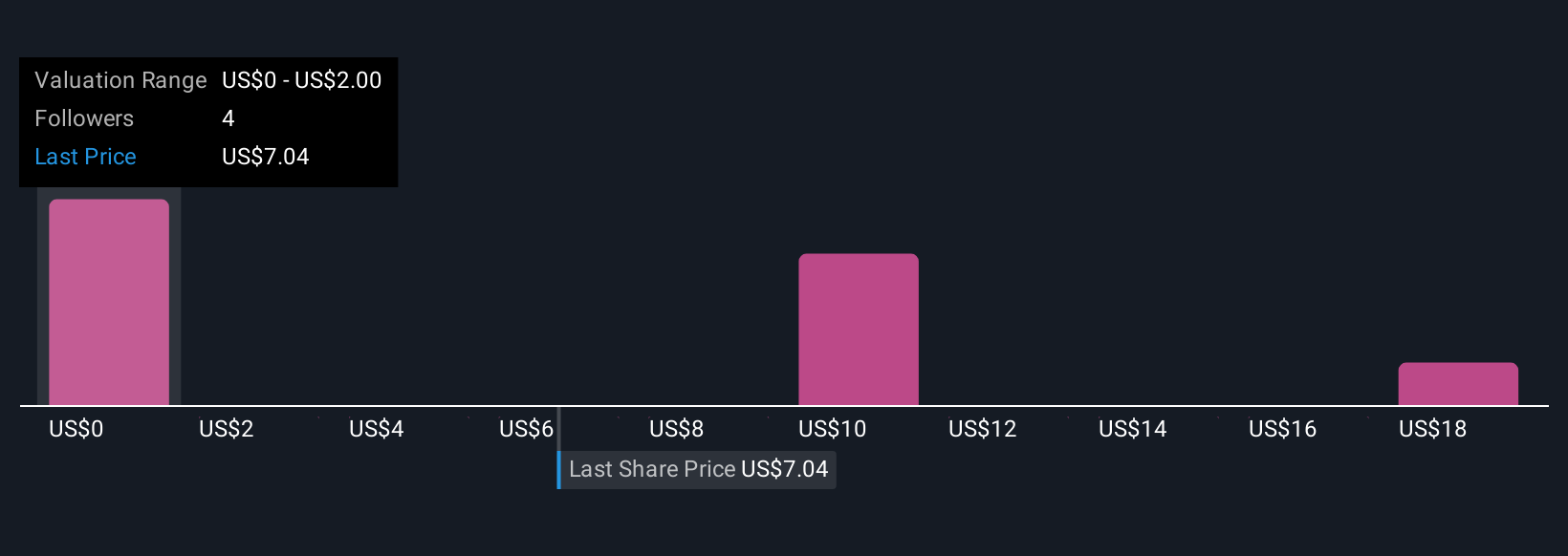

However, one emerging risk around dilution and high coupon debt is easy to overlook until you quantify it. NextDecade's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 4 other fair value estimates on NextDecade - why the stock might be worth less than half the current price!

Build Your Own NextDecade Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NextDecade research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free NextDecade research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NextDecade's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com