Market Still Lacking Some Conviction On Aktor Societe Anonyme Holding Company Technical and Energy Projects (ATH:AKTR)

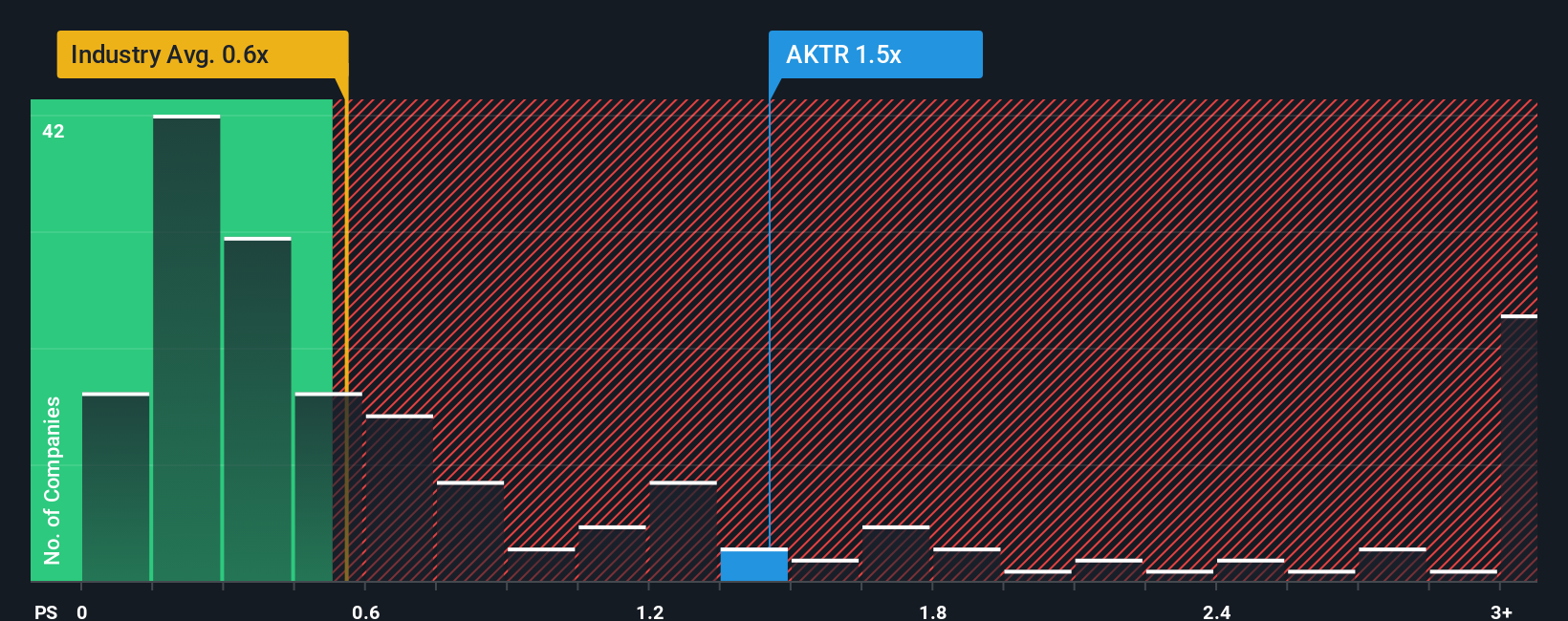

With a median price-to-sales (or "P/S") ratio of close to 1.5x in the Construction industry in Greece, you could be forgiven for feeling indifferent about Aktor Societe Anonyme Holding Company Technical and Energy Projects' (ATH:AKTR) P/S ratio, which comes in at about the same. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Aktor Societe Anonyme Holding Company Technical and Energy Projects

How Has Aktor Societe Anonyme Holding Company Technical and Energy Projects Performed Recently?

Aktor Societe Anonyme Holding Company Technical and Energy Projects certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. Those who are bullish on Aktor Societe Anonyme Holding Company Technical and Energy Projects will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Aktor Societe Anonyme Holding Company Technical and Energy Projects will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Aktor Societe Anonyme Holding Company Technical and Energy Projects' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 69% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

When compared to the industry's one-year growth forecast of 5.2%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we find it interesting that Aktor Societe Anonyme Holding Company Technical and Energy Projects is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Aktor Societe Anonyme Holding Company Technical and Energy Projects' P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

To our surprise, Aktor Societe Anonyme Holding Company Technical and Energy Projects revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

You should always think about risks. Case in point, we've spotted 1 warning sign for Aktor Societe Anonyme Holding Company Technical and Energy Projects you should be aware of.

If you're unsure about the strength of Aktor Societe Anonyme Holding Company Technical and Energy Projects' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.