Market Participants Recognise Digital Bros S.p.A.'s (BIT:DIB) Revenues Pushing Shares 26% Higher

Digital Bros S.p.A. (BIT:DIB) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 43% in the last year.

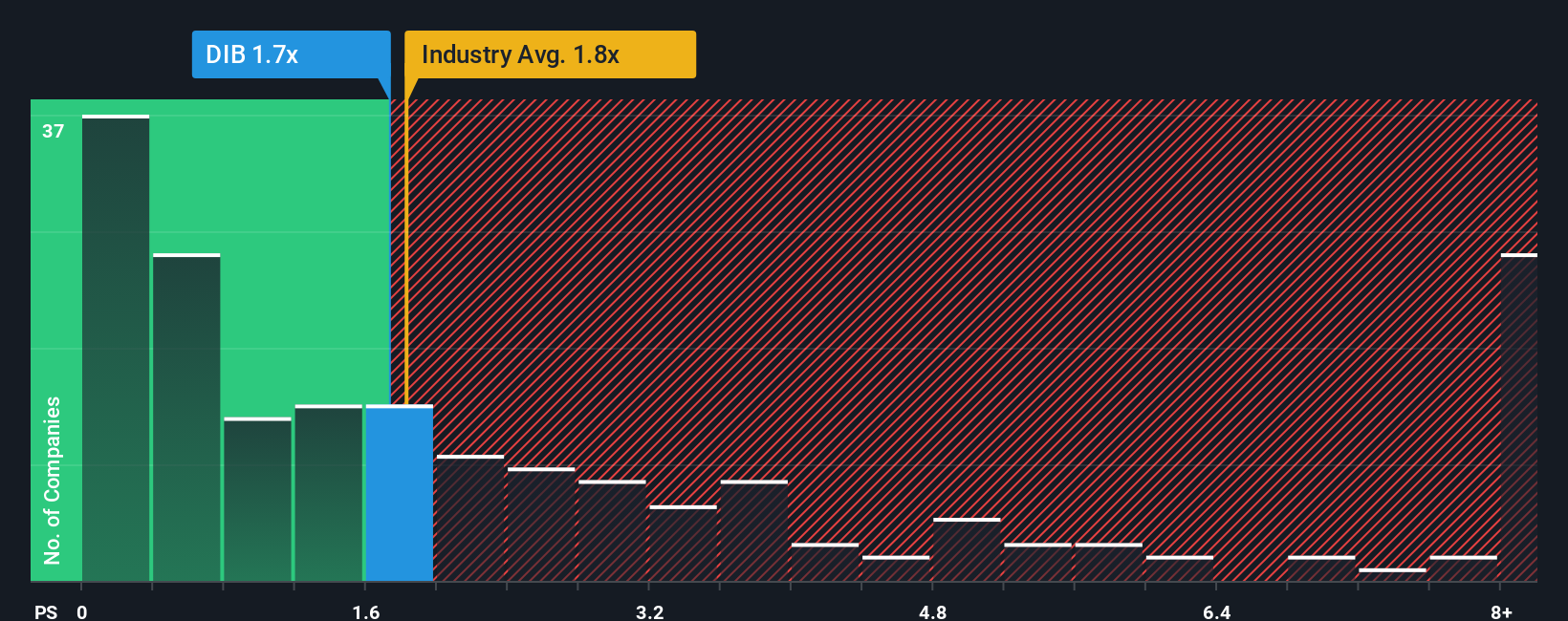

After such a large jump in price, given close to half the companies operating in Italy's Entertainment industry have price-to-sales ratios (or "P/S") below 0.5x, you may consider Digital Bros as a stock to potentially avoid with its 1.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Digital Bros

What Does Digital Bros' P/S Mean For Shareholders?

There hasn't been much to differentiate Digital Bros' and the industry's retreating revenue lately. One possibility is that the P/S ratio is high because investors think the company can turn things around and break free from the broader downward trend in revenue. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Digital Bros will help you uncover what's on the horizon.How Is Digital Bros' Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Digital Bros' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.4%. As a result, revenue from three years ago have also fallen 9.3% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 19% as estimated by the dual analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 15%, which is noticeably less attractive.

With this in mind, it's not hard to understand why Digital Bros' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Digital Bros' P/S?

The large bounce in Digital Bros' shares has lifted the company's P/S handsomely. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Digital Bros shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 1 warning sign for Digital Bros you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.