How IFF’s New Robotic Fragrance System Could Reshape Its Innovation Edge for Investors (IFF)

- International Flavors & Fragrances Inc. recently implemented the Colibri robotic dosing system at its Chin Bee, Singapore facility, enabling on‑demand fragrance sample production in minutes and increasing capacity to 200 batches in an eight‑hour shift.

- This automation push in Greater Asia, alongside existing Colibri deployments in Europe, materially tightens IFF’s innovation cycle from concept to customer trial.

- Now, we’ll examine how this new automation-driven speed in fragrance development could influence the company’s broader investment narrative.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

International Flavors & Fragrances Investment Narrative Recap

To own International Flavors & Fragrances, you need to believe its investment in innovation and automation can ultimately translate into more resilient growth and better margins across Scent, Taste and Ingredients. The new Colibri system in Singapore improves speed and capacity in fragrance sampling, but it does not materially change the near term picture where softness in key markets and pressure in commoditized fragrance ingredients remain the most immediate risks to watch.

The recent Q3 2025 update is the most relevant backdrop for this automation news, as IFF reaffirmed its 2025 sales and adjusted EBITDA guidance despite year on year net sales pressure. Faster fragrance development in Greater Asia may help the Scent segment support that guidance over time, but it sits alongside a company that is still working through weak Health and legacy ingredients performance and a year to date net loss.

Yet even with faster robots in Singapore, investors should also be aware that...

Read the full narrative on International Flavors & Fragrances (it's free!)

International Flavors & Fragrances’ narrative projects $11.4 billion revenue and $784.4 million earnings by 2028.

Uncover how International Flavors & Fragrances' forecasts yield a $82.08 fair value, a 22% upside to its current price.

Exploring Other Perspectives

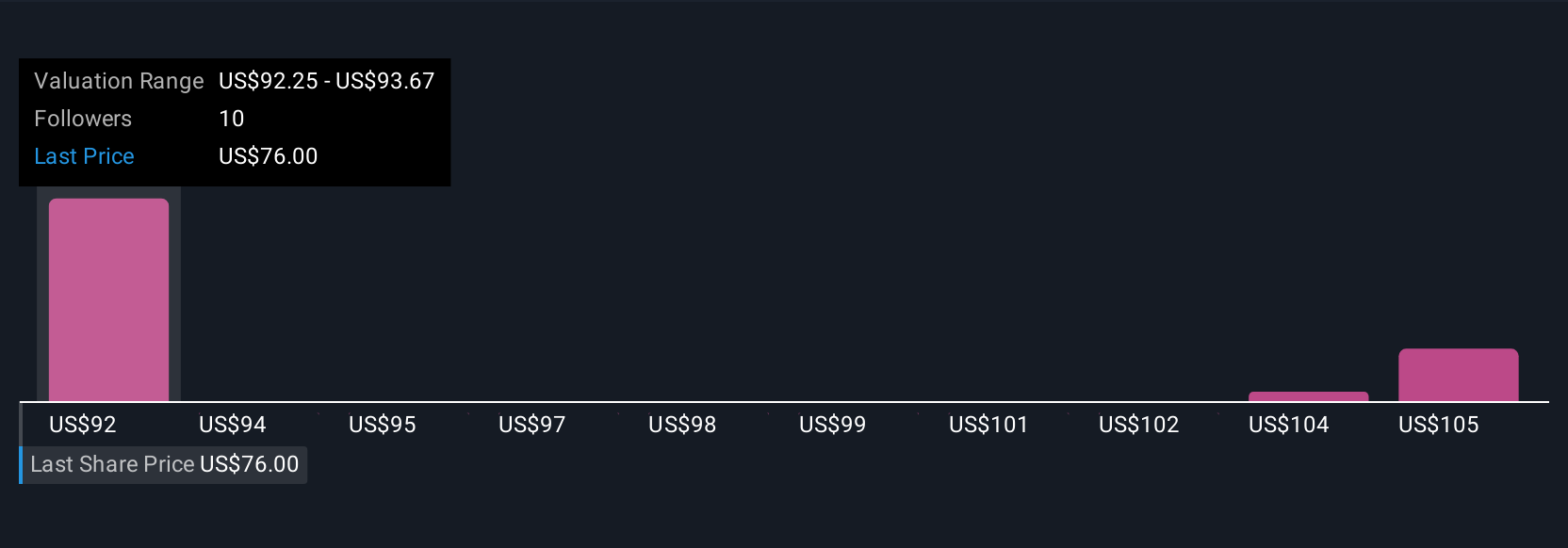

Four Simply Wall St Community fair value estimates cluster between US$82.08 and US$108.03 per share, underlining how far opinions can spread. Against this, ongoing softness in North America, China and commoditized fragrance ingredients could continue to weigh on margins and make it important to compare several viewpoints before forming a view on IFF’s prospects.

Explore 4 other fair value estimates on International Flavors & Fragrances - why the stock might be worth as much as 61% more than the current price!

Build Your Own International Flavors & Fragrances Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your International Flavors & Fragrances research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free International Flavors & Fragrances research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate International Flavors & Fragrances' overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com