Carter’s (CRI) Valuation Check as Earnings Improve but Share Price Stays Under Pressure

Carter's (CRI) has quietly drifted lower this year, leaving the stock down sharply even as its latest quarter showed flat revenue but improving earnings. That disconnect is exactly what makes the setup interesting now.

See our latest analysis for Carter's.

At around $31.87, Carter's has seen its share price return fall sharply year to date while still posting a solid 90 day share price return. This suggests sentiment may be stabilizing as investors refocus on earnings resilience rather than extrapolating past weakness.

If Carter's turbulence has you rethinking where growth and conviction might come from next, it could be worth exploring fast growing stocks with high insider ownership as a curated set of stronger momentum ideas.

With earnings inching higher but the share price still languishing near multi year lows, the key question now is whether Carter's is quietly undervalued or if the market is already braced for limited future growth.

Most Popular Narrative Narrative: 8% Overvalued

With Carter's last closing at $31.87 against a narrative fair value of $29.50, the story hinges on how far earnings can stretch from here.

The analysts have a consensus price target of $24.6 for Carter's based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $28.0, and the most bearish reporting a price target of just $22.0.

Curious how a shrinking revenue base, thinner margins, and a richer future earnings multiple still add up to this valuation? The full narrative reveals the exact growth, profitability, and discount-rate assumptions holding this price target together.

Result: Fair Value of $29.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained baby segment momentum and deeper international expansion could lift revenue and margins and force analysts to rethink today’s cautious, overvaluation narrative.

Find out about the key risks to this Carter's narrative.

Another Angle on Valuation

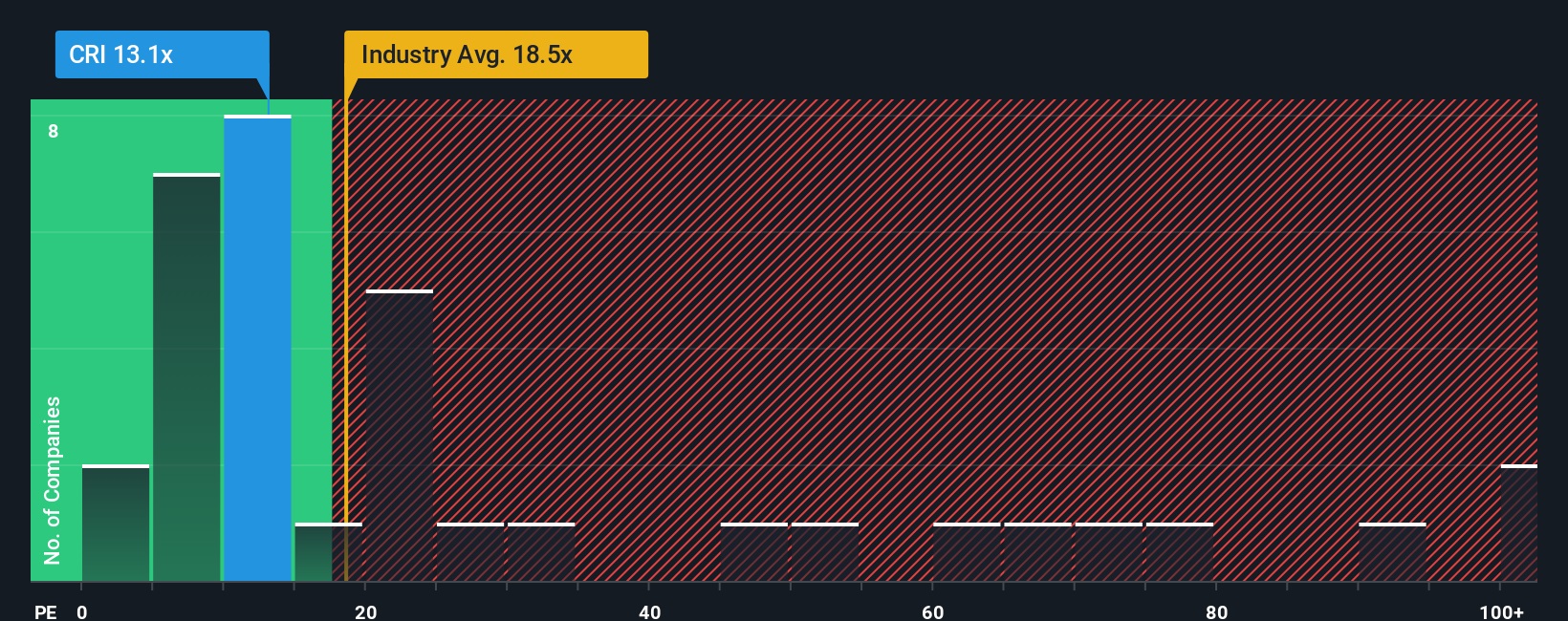

Price targets suggest Carter's is slightly overvalued, but current pricing tells a softer story. At 13.4 times earnings, the stock trades far below the US Luxury industry on 21.5 times and peers on 36.5 times, and even under its 14.3 times fair ratio, hinting at limited downside and potential rerating. Is the market being too pessimistic?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Carter's Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a fresh view in just minutes: Do it your way.

A great starting point for your Carter's research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investing angles?

Before you move on, lock in a few more opportunities by using the Simply Wall St Screener to surface high potential stocks that suit your strategy.

- Capture potential mispricings by targeting companies trading below intrinsic value through these 907 undervalued stocks based on cash flows that spotlight attractive cash flow characteristics.

- Ride powerful structural trends by zeroing in on next generation innovators using these 26 AI penny stocks positioned at the heart of the AI growth story.

- Strengthen portfolio income by focusing on companies with reliable payouts and above market yields via these 15 dividend stocks with yields > 3% tailored for income focused investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com