Taking a Fresh Look at Sumitomo Pharma (TSE:4506)’s Valuation After Its Strong 1-Year Share Price Surge

Sumitomo Pharma (TSE:4506) has quietly turned into a momentum story, with the share price climbing roughly 36% over the past 3 months and tripling over the past year, far outpacing its earnings growth.

See our latest analysis for Sumitomo Pharma.

That surge sits against a powerful backdrop, with a 90 day share price return of 36.14% and a 1 year total shareholder return of 326.00%. This signals strong, still building momentum as investors reassess Sumitomo Pharma’s risk reward profile.

Given how quickly sentiment can turn in healthcare, this is also a good moment to explore other potential opportunities across healthcare stocks.

With earnings under pressure, a sharp rerating, and the share price now sitting above analyst targets, the key question is whether Sumitomo Pharma still trades at a discount to its intrinsic value or whether markets have already priced in future growth.

Price-to-Earnings of 6.3x: Is it justified?

On a price-to-earnings ratio of 6.3x at the last close of ¥2441, Sumitomo Pharma screens as notably undervalued versus both peers and the wider Japanese pharmaceuticals sector.

The price-to-earnings ratio compares what investors pay for each unit of current earnings, a core yardstick for mature, cash generative drug makers like Sumitomo Pharma. At 6.3x earnings, the market is assigning a far lower multiple than comparable companies, despite the business having recently returned to profitability and delivering a 58.3% return on equity.

Relative pricing reinforces that disconnect, with Sumitomo Pharma trading at a steep discount to the Pharmaceuticals industry average of 15.3x and the peer group average of 24.8x. Compared with an estimated fair price-to-earnings ratio of 18.9x, the current multiple implies investors may be pricing in a much weaker earnings outlook than our fair ratio suggests the market could ultimately move toward.

Explore the SWS fair ratio for Sumitomo Pharma

Result: Price-to-Earnings of 6.3x (UNDERVALUED)

However, momentum could reverse quickly if earnings continue to contract or if sentiment toward Japan’s smaller pharma names cools after such a steep rerating.

Find out about the key risks to this Sumitomo Pharma narrative.

Another View on Value

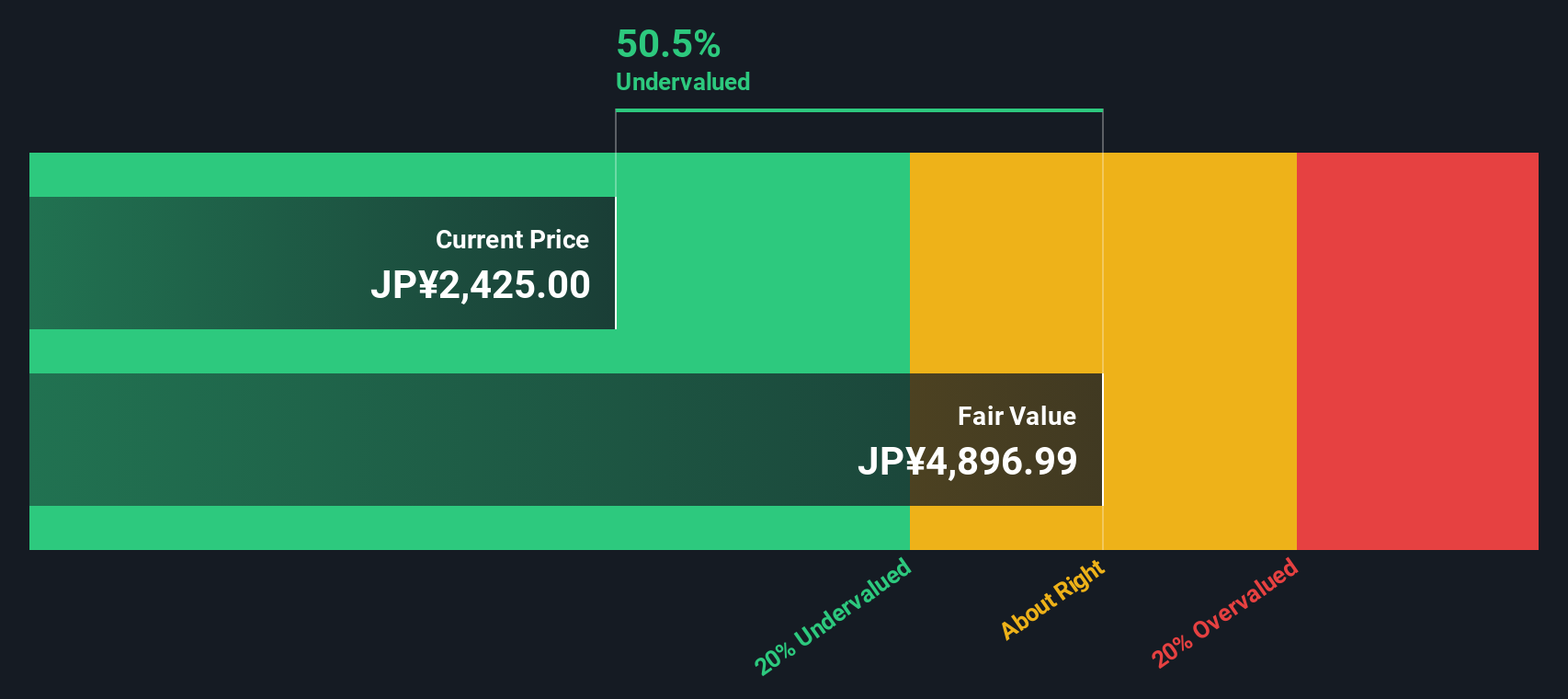

Our DCF model paints an even starker picture, suggesting Sumitomo Pharma’s fair value is around ¥4,897 versus the current ¥2,441 share price, implying it trades roughly 50% below intrinsic value. If both earnings multiples and cash flows point to value, what could still derail the story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sumitomo Pharma for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sumitomo Pharma Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalised view in just minutes using Do it your way.

A great starting point for your Sumitomo Pharma research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before momentum shifts again, you can use Simply Wall Street’s powerful screener to look for fresh opportunities and position your portfolio for the next move.

- Target potential mispriced winners by scanning these 907 undervalued stocks based on cash flows, which is built to highlight companies whose cash flows may justify far higher valuations.

- Explore income-focused ideas by reviewing these 15 dividend stocks with yields > 3% and concentrating on businesses delivering reliable, above-average yields.

- Tap into structural technology shifts through these 26 AI penny stocks and review companies using artificial intelligence in ways that may reshape entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com