Evaluating JFrog (FROG) After Fresh Wall Street Optimism on Its AI Software Development Potential

A fresh vote of confidence from a major Wall Street firm just pushed JFrog (FROG) into the spotlight again, as investors reacted to upbeat commentary around its role in powering AI driven software development.

See our latest analysis for JFrog.

That bullish call has landed at a time when momentum is already strong, with a roughly 28 percent 3 month share price return and a year to date gain above 110 percent. The 1 year total shareholder return of about 107 percent suggests investors are increasingly pricing in JFrog's AI driven growth story despite recent insider 10b5 1 selling plans.

If JFrog's surge has you thinking more broadly about where software and AI could go next, it might be worth scanning other high growth tech names through high growth tech and AI stocks.

Yet with shares now hovering close to Wall Street targets after a triple digit year, is JFrog still trading below its true AI potential, or are markets already pricing in every ounce of future growth?

Most Popular Narrative: 6.4% Undervalued

With JFrog last closing at $64.77 against a narrative fair value of $69.22, the story leans modestly optimistic on where upside still sits.

Deepening partnerships and integrations with hyperscale cloud providers (AWS, Azure, Google Cloud) and leading developer platforms (for example, Hugging Face and GitHub) are increasing JFrog's relevance in the software development ecosystem, driving co sell opportunities, improved customer acquisition, and lower churn, which in turn support sustainable top line growth and enhanced operating leverage.

Want to see what justifies paying a premium today for profits that may only arrive years from now? Discover the growth, margins, and future multiple this narrative is banking on.

Result: Fair Value of $69.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained outperformance is not guaranteed, with longer enterprise deal cycles and intensifying security competition both capable of derailing today’s bullish expectations.

Find out about the key risks to this JFrog narrative.

Another View: Rich Multiples Signal Less Cushion

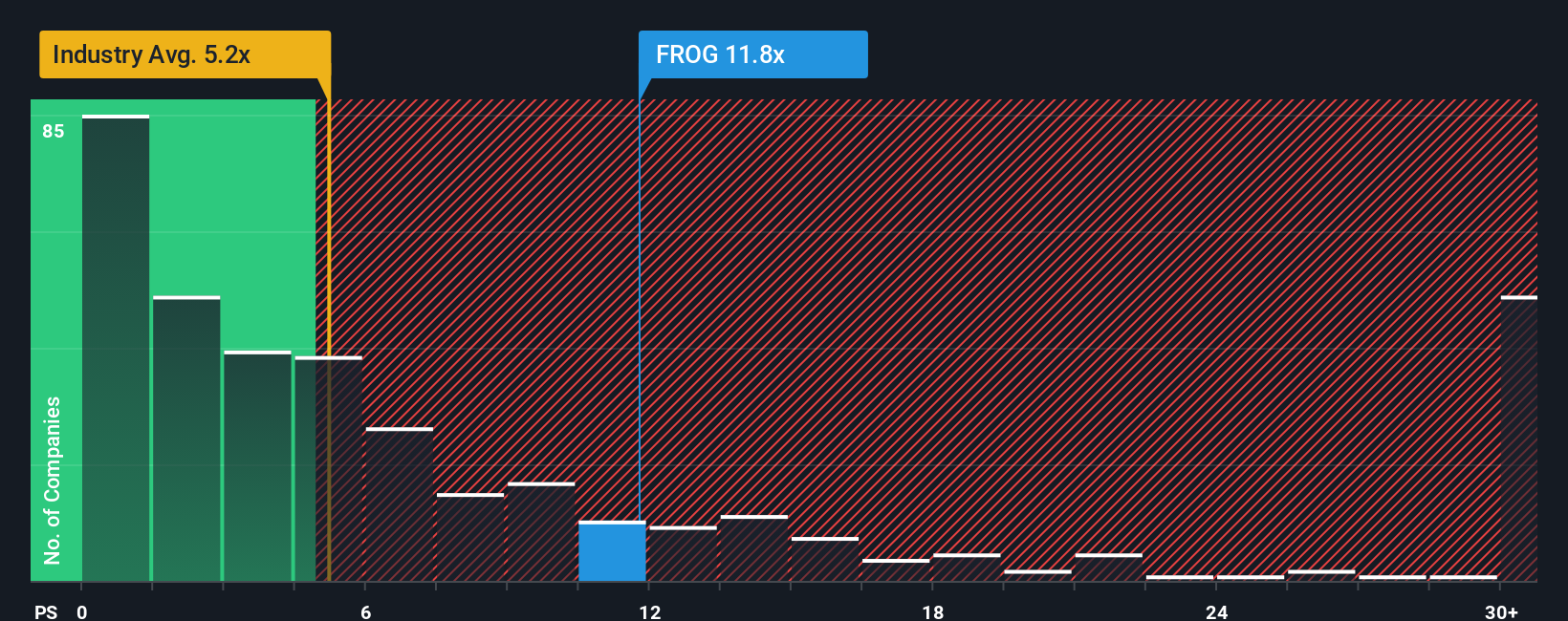

While the narrative fair value suggests modest upside, our valuation checks using the price to sales ratio paint a tougher picture. At roughly 15.2 times sales versus an industry 4.9 times and a fair ratio of 7.1 times, JFrog looks aggressively priced, leaving less room for execution missteps.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own JFrog Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in under three minutes: Do it your way.

A great starting point for your JFrog research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by using the Simply Wall Street Screener to uncover fresh stocks that fit your strategy and time horizon.

- Capture potential multi baggers early by scanning these 3573 penny stocks with strong financials that pair tiny market caps with balance sheets and earnings profiles that can support serious upside.

- Position yourself at the heart of the AI surge by targeting these 26 AI penny stocks that already show strong growth momentum and real world adoption.

- Strengthen your income stream and reduce guesswork by focusing on these 15 dividend stocks with yields > 3% with payouts that aim to stay ahead of inflation while rewarding patient shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com