Is TTM Technologies (TTMI) Still Undervalued After Its 200% Year-To-Date Share Price Surge?

TTM Technologies (TTMI) has quietly turned into a strong performer, with the stock up about 11% over the past month and roughly 57% in the past 3 months, drawing fresh attention from growth focused investors.

See our latest analysis for TTM Technologies.

That surge in momentum has not come out of nowhere, with a powerful year to date share price return of around 200% and a five year total shareholder return above 450% suggesting investors are rapidly re rating TTM’s growth and risk profile.

If this kind of sustained run has you wondering what else might be breaking out, it is a good time to explore other high growth tech and AI names through high growth tech and AI stocks.

With shares now hovering just below analyst targets after a 200 percent year to date surge, investors face a pivotal question: is TTM Technologies still undervalued, or is the market already pricing in its future growth?

Most Popular Narrative Narrative: 3% Undervalued

With TTM Technologies last closing at $73.74 against a narrative fair value of $76.00, the story points to modest upside still on the table.

Large scale data center buildouts announced by tech giants (e.g., Google, CoreWeave, Meta) and TTM's new Wisconsin facility position the company to capture outsized demand for advanced PCBs and interconnects required for AI and cloud infrastructure. This directly supports revenue growth and long term customer relationships. Sustained increases in U.S. and NATO defense spending plans, alongside TTM's deep strategic alignment and $1.46 billion A&D backlog, provide long term visibility and stability for high margin revenue streams. This improves predictability of forward earnings and supports ongoing margin expansion.

Want to see what kind of revenue build, margin lift, and future earnings multiple are backing that price tag? The narrative links them in surprising ways.

Result: Fair Value of $76 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks around new facilities and high operating costs, as well as heavy reliance on a handful of major customers, could quickly challenge this upbeat outlook.

Find out about the key risks to this TTM Technologies narrative.

Another View on Value

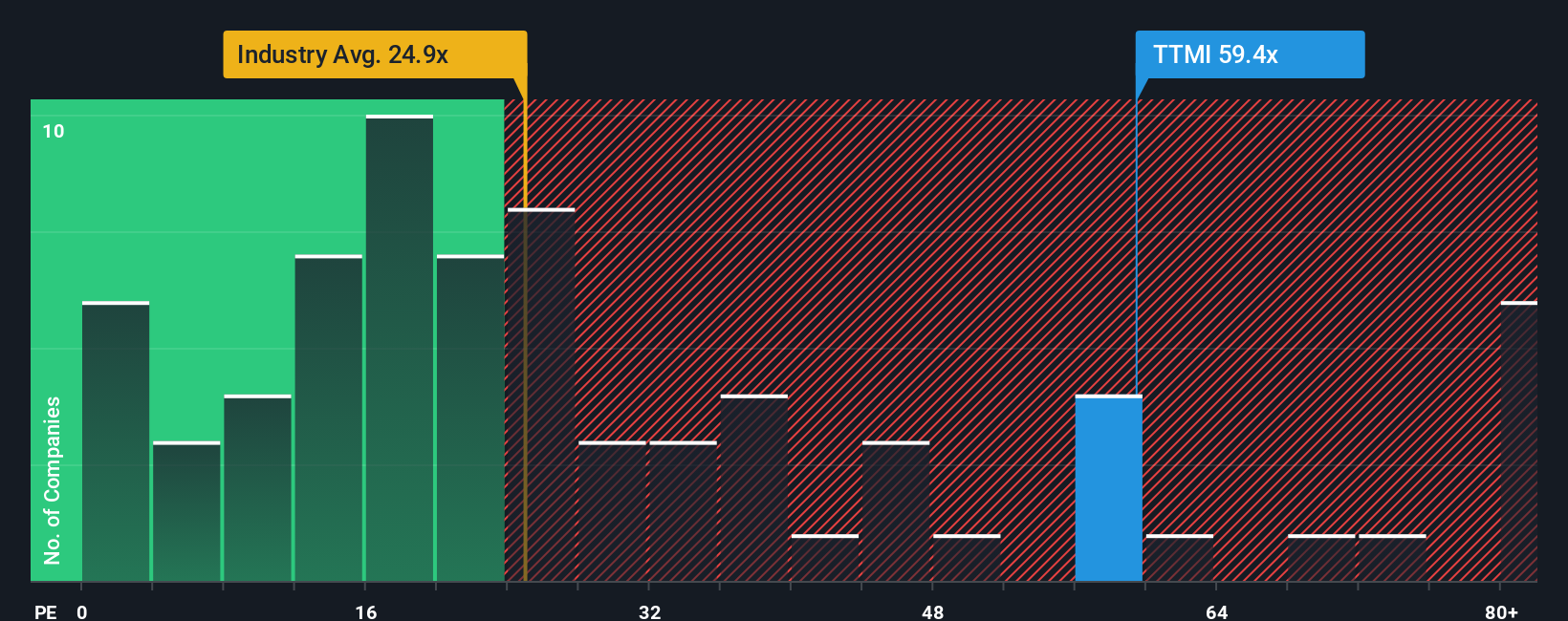

Looked at through its earnings multiple, TTM Technologies appears stretched. The shares trade on a price to earnings ratio of 57.8 times, versus an industry average of 24.6 times and a fair ratio of 33.9 times, suggesting valuation risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TTM Technologies Narrative

If you see the story differently, or simply prefer digging into the numbers yourself, you can build a custom narrative in minutes: Do it your way.

A great starting point for your TTM Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking For More High Conviction Ideas?

Before momentum shifts again, take a moment to scan other stock ideas on Simply Wall Street's screener so fresh opportunities do not slip past you.

- Capitalize on mispriced quality by targeting companies that look cheap on future cash flows through these 907 undervalued stocks based on cash flows and position yourself early in potential reratings.

- Ride powerful secular trends in automation and machine learning by focusing on these 26 AI penny stocks that could compound growth as AI adoption accelerates worldwide.

- Boost your income stream by zeroing in on these 15 dividend stocks with yields > 3% that can enhance returns while potentially cushioning your portfolio in choppy markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com