Trainline (LON:TRN shareholders incur further losses as stock declines 12% this week, taking five-year losses to 54%

Statistically speaking, long term investing is a profitable endeavour. But no-one is immune from buying too high. For example the Trainline plc (LON:TRN) share price dropped 54% over five years. That is extremely sub-optimal, to say the least. We also note that the stock has performed poorly over the last year, with the share price down 51%. Shareholders have had an even rougher run lately, with the share price down 22% in the last 90 days.

After losing 12% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, Trainline moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics might give us a better handle on how its value is changing over time.

In contrast to the share price, revenue has actually increased by 28% a year in the five year period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

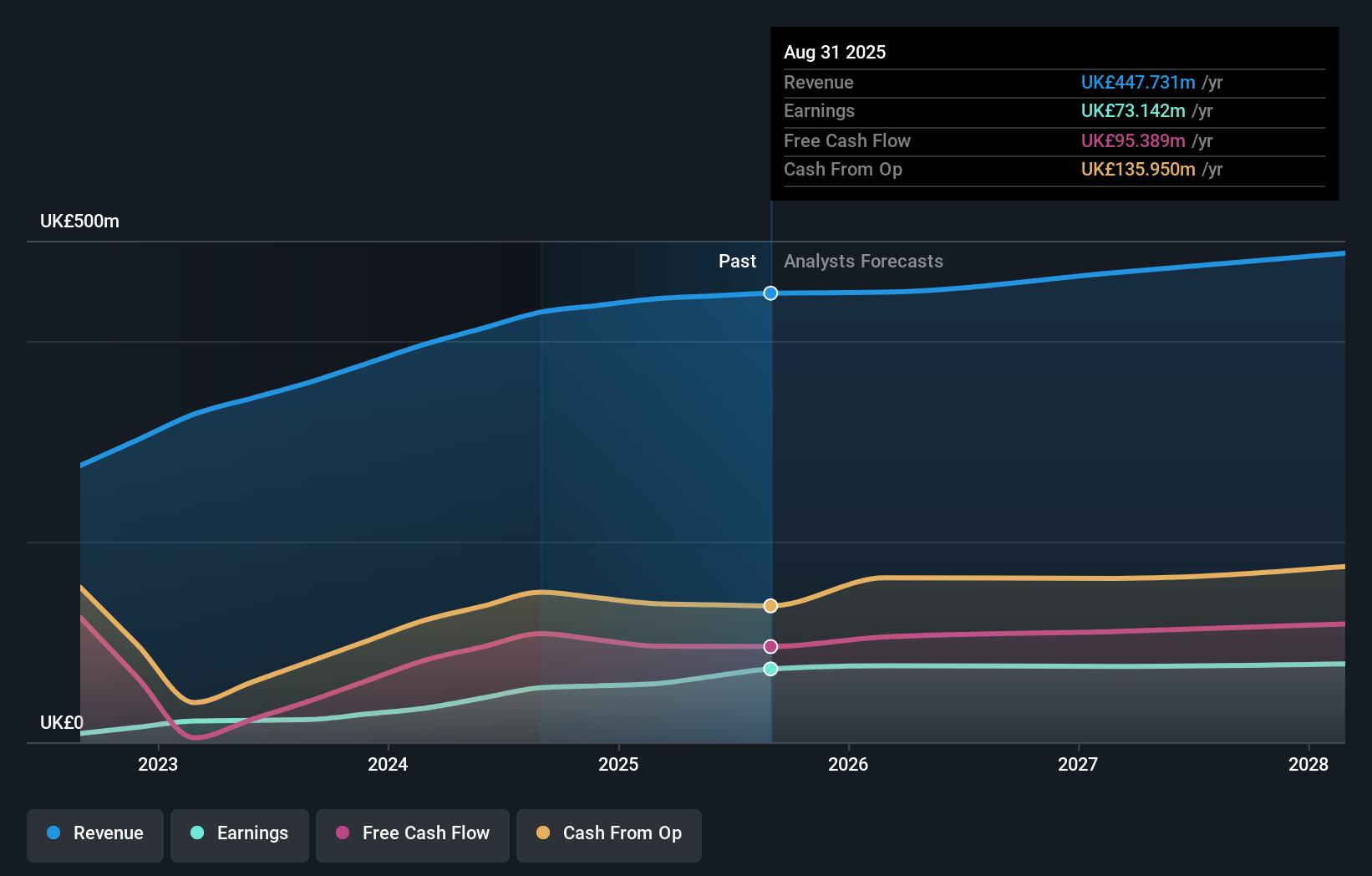

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Trainline is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for Trainline in this interactive graph of future profit estimates.

A Different Perspective

While the broader market gained around 20% in the last year, Trainline shareholders lost 51%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 9% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

Of course Trainline may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.