Upgraded AI Infrastructure Outlook Could Be A Game Changer For nVent Electric (NVT)

- In recent months, nVent Electric raised its full-year 2025 outlook, now guiding to 31–33% revenue growth and adjusted EPS of US$3.31–US$3.33, following stronger-than-expected third-quarter results driven by data center and power utility demand.

- The company’s expansion in liquid cooling capacity and its addition to NVIDIA’s partner network in the past year highlight its deepening role in AI-focused electrical infrastructure solutions.

- We’ll now examine how nVent’s upgraded guidance and AI-focused liquid cooling expansion may influence its broader investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

nVent Electric Investment Narrative Recap

To own nVent Electric, you need to believe that AI and power grid investment can support sustained demand for its electrical and cooling solutions. The upgraded 2025 revenue and EPS guidance strengthens the near term growth catalyst from AI data center and utility spending, but it also heightens exposure to any slowdown in AI capital expenditure, which remains the most immediate risk.

Among recent company actions, nVent’s expansion of liquid cooling capacity and its entry into NVIDIA’s partner network are most relevant here, as they directly tie the stronger guidance to concrete participation in AI infrastructure build outs. These moves support the growth story around high density computing, while at the same time increasing reliance on a concentrated set of fast growing, but potentially cyclical, end markets.

But investors should also be aware that if AI data center spending cools more quickly than expected, ...

Read the full narrative on nVent Electric (it's free!)

nVent Electric's narrative projects $4.5 billion revenue and $651.5 million earnings by 2028.

Uncover how nVent Electric's forecasts yield a $121.54 fair value, a 13% upside to its current price.

Exploring Other Perspectives

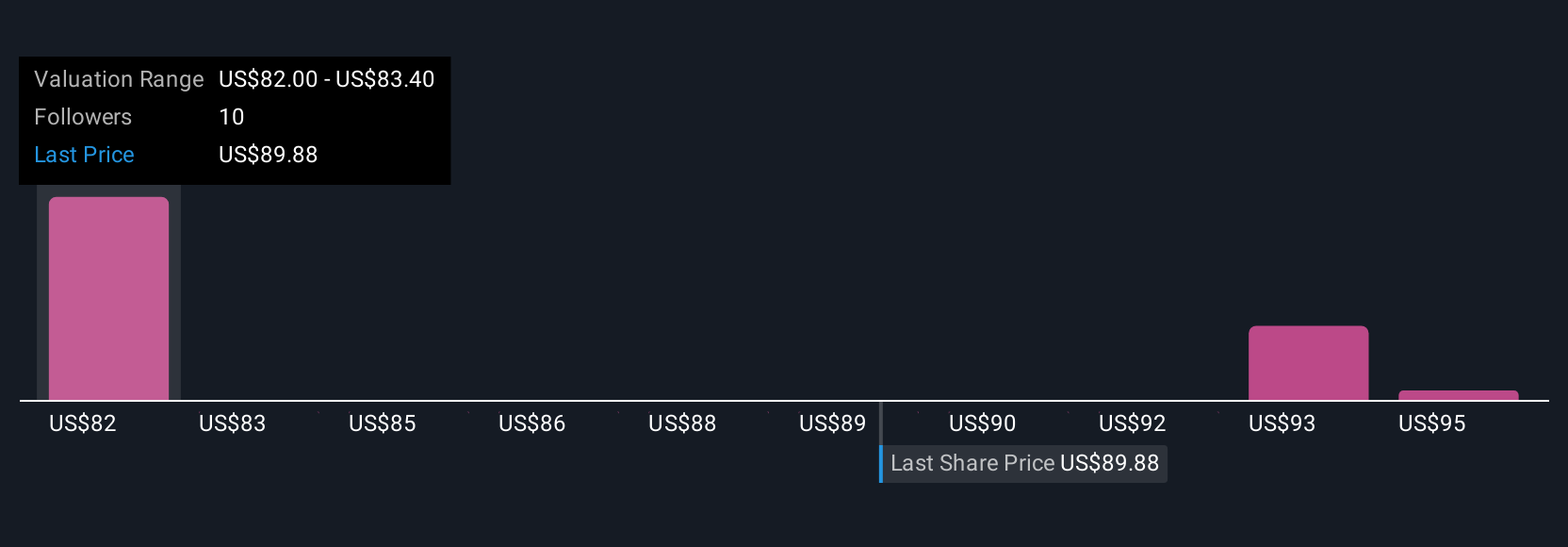

Five fair value estimates from the Simply Wall St Community span roughly US$73 to US$122 per share, with opinions clustered across that wide band. When you set those varied views against nVent’s heavy reliance on AI driven data center demand, it underlines why many readers may want to compare multiple risk and growth assumptions before forming a view.

Explore 5 other fair value estimates on nVent Electric - why the stock might be worth 32% less than the current price!

Build Your Own nVent Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your nVent Electric research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free nVent Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate nVent Electric's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com