Subsea 7 (OB:SUBC): Assessing Valuation After a Strong 1-Year Share Price Rally

Subsea 7 (OB:SUBC) has quietly put together a solid run, with the stock up around 10% over the past month and roughly 25% over the past year, outpacing many energy peers.

See our latest analysis for Subsea 7.

That upward move in the share price, now at NOK 200.6, lines up with a healthy 1 year total shareholder return. This signals that investors are increasingly willing to pay up for Subsea 7s project pipeline.

If Subsea 7s momentum has you looking more broadly across energy exposed names, it could be worth exploring fast growing stocks with high insider ownership as a way to spot other under the radar compounders.

With the shares trading below consensus targets yet boasting robust multi year returns, the key question now is whether Subsea 7 is still trading at a discount or if the market is already pricing in its future growth.

Most Popular Narrative Narrative: 11.8% Undervalued

Compared to Subsea 7s last close at NOK 200.6, the most followed narrative sees a meaningfully higher fair value, hinging on sustained margin gains and long cycle project visibility.

Margin expansion (EBITDA margin above 20%, up 370 bps YoY) has been supported by improved project mix, high vessel utilization, and successful cost optimization, demonstrating Subsea 7's ability to leverage technological advances and operational efficiencies, which should enhance net margins and long-term profitability.

Want to see what kind of revenue trajectory and profit multiple are baked into that view, and how long cycle contracts reshape the earnings curve over time, dive into the full storyline behind this fair value call.

Result: Fair Value of $227.52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps around the Saipem merger or weaker than expected offshore wind demand could quickly undermine the current margin expansion narrative.

Find out about the key risks to this Subsea 7 narrative.

Another Angle on Valuation

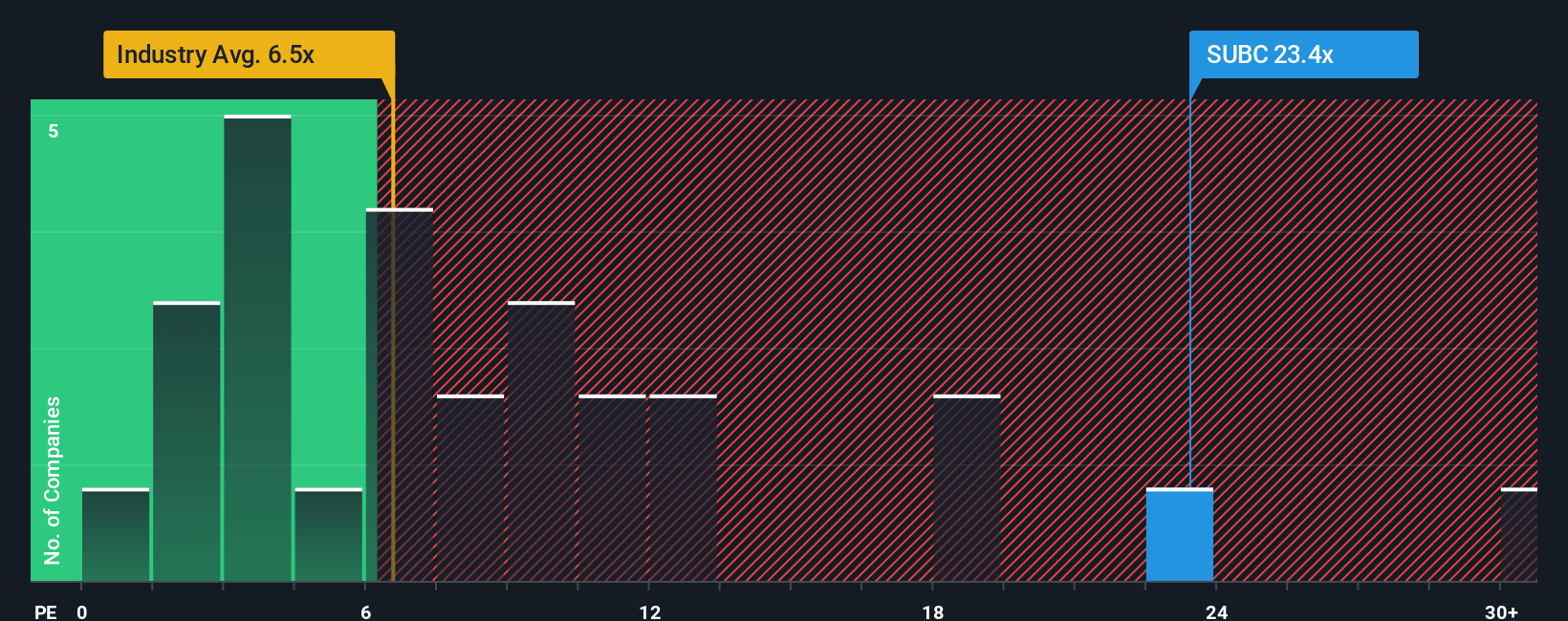

While the popular narrative points to upside, the earnings multiple tells a tougher story. Subsea 7 trades on a 20.4x price to earnings ratio, far richer than the Norwegian Energy Services average of 6.6x, its peer average of 12.7x, and even its own 10.4x fair ratio. If sentiment cools and the market leans back toward that fair ratio, how much downside are you really comfortable with?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Subsea 7 Narrative

If these perspectives do not fully align with your own view, you can dig into the numbers yourself and shape a bespoke storyline in minutes: Do it your way.

A great starting point for your Subsea 7 research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move

Before you move on, put Simply Wall Sts Screener to work for you so you do not miss compelling opportunities beyond Subsea 7.

- Capitalize on resilient income by scanning these 15 dividend stocks with yields > 3% that can support a steadier long term return profile.

- Ride structural tech shifts by targeting these 26 AI penny stocks positioned to benefit from accelerating adoption of artificial intelligence.

- Hunt for mispriced opportunities by zeroing in on these 907 undervalued stocks based on cash flows where market expectations may still be playing catch up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com