Should Willis Towers Watson’s New Radar Fusion Underwriting Platform (WTW) Require Action From Investors?

- Earlier this week, Willis Towers Watson launched Radar Fusion, a cloud-native commercial underwriting platform for the U.S. market that automates simple risks, consolidates internal and external data, and gives underwriters real-time analytics and pricing insights, with plans to expand to additional regions.

- The product is positioned as an integrated extension of WTW’s Radar analytics suite, aiming to boost underwriting productivity and profitability by automating routine tasks while keeping complex risk decisions in the hands of expert underwriters.

- Next, we’ll examine how Radar Fusion’s real-time analytics and workflow automation could influence Willis Towers Watson’s existing investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Willis Towers Watson Investment Narrative Recap

To own Willis Towers Watson, you generally need to believe in its ability to turn data, analytics and consulting depth into durable, fee-based growth despite intense competition and technology-driven change. Radar Fusion fits that thesis by reinforcing WTW’s push into AI-enabled insurance workflows, but it does not materially alter the near term picture where the key catalyst remains broader adoption of its digital platforms, and a central risk is service commoditization as automation tools spread across the industry.

Among recent announcements, the reaffirmed quarterly cash dividend of US$0.92 per share stands out alongside Radar Fusion, as it underscores WTW’s current capital return approach while it invests in analytics-led products. For shareholders, that mix of ongoing dividends and product investment sits against the backdrop of earnings expected to decline over the next three years, even as management leans on automation and analytics to support margins and differentiate from peers.

Yet investors should be aware that rising AI adoption across insurance could compress fees faster than WTW’s own tools can offset...

Read the full narrative on Willis Towers Watson (it's free!)

Willis Towers Watson's narrative projects $10.9 billion revenue and $2.5 billion earnings by 2028. This requires 3.7% yearly revenue growth and an earnings increase of about $2.4 billion from $137.0 million today.

Uncover how Willis Towers Watson's forecasts yield a $371.61 fair value, a 16% upside to its current price.

Exploring Other Perspectives

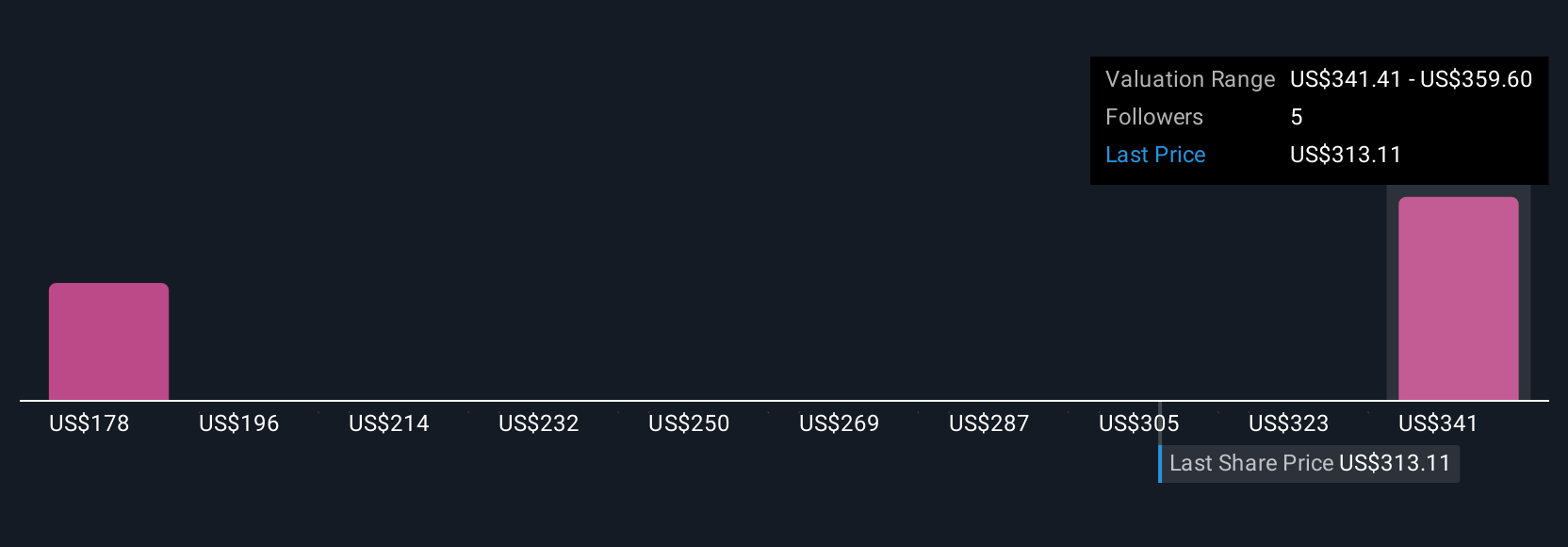

Two fair value estimates from the Simply Wall St Community cluster between US$371.61 and US$392.33, highlighting how differently individual investors can view the same business. You may want to weigh those views against the risk that accelerating AI and digital automation could commoditize WTW’s core services and affect its ability to sustain margins over time.

Explore 2 other fair value estimates on Willis Towers Watson - why the stock might be worth just $371.61!

Build Your Own Willis Towers Watson Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Willis Towers Watson research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Willis Towers Watson research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Willis Towers Watson's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com