Is Triumph Financial’s (TFIN) New Institutional Holder Quietly Reframing Its Freight-Focused Investment Story?

- Triumph Financial, Inc. previously declared a quarterly cash dividend of US$17.81 per share on its 7.125% Series C Fixed-Rate Non-Cumulative Perpetual Preferred Stock (NYSE: TFIN-PR), with holders of depositary shares receiving US$0.44525 per share, paid on December 30, 2025 to shareholders of record on December 15, 2025.

- A separate regulatory filing showing that institutional investor Creative Planning initiated a new position in Triumph Financial added an institutional endorsement that attracted fresh attention to the company’s outlook beyond its routine preferred dividend payment.

- Against this backdrop of new institutional ownership, we’ll assess how Creative Planning’s entry may influence Triumph Financial’s existing freight-focused investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Triumph Financial Investment Narrative Recap

To own Triumph Financial, you need to believe its freight centric banking, payments, and intelligence platform can translate into improving profitability despite recent margin pressure and freight cycle risk. The latest preferred dividend declaration looks routine and, by itself, does not change the main near term catalyst, which remains execution in scaling TriumphPay and intelligence services, or the key risk of earnings vulnerability if freight volumes and carrier health weaken further. Creative Planning’s new stake may help sentiment, but it does not materially alter those fundamentals.

The repeated quarterly dividend on the 7.125% Series C preferred stock, including the US$17.81 per share (US$0.44525 per depositary share) payment declared for December 30, 2025, reinforces Triumph’s pattern of servicing its preferred capital stack even while common equity earnings remain modest. For investors watching catalysts around freight focused growth initiatives, this consistency offers context on the company’s funding costs and flexibility as it invests in TriumphPay and intelligence products during a still volatile operating backdrop.

But against that stability, Triumph’s concentrated exposure to small and mid sized freight carriers means investors should be aware of...

Read the full narrative on Triumph Financial (it's free!)

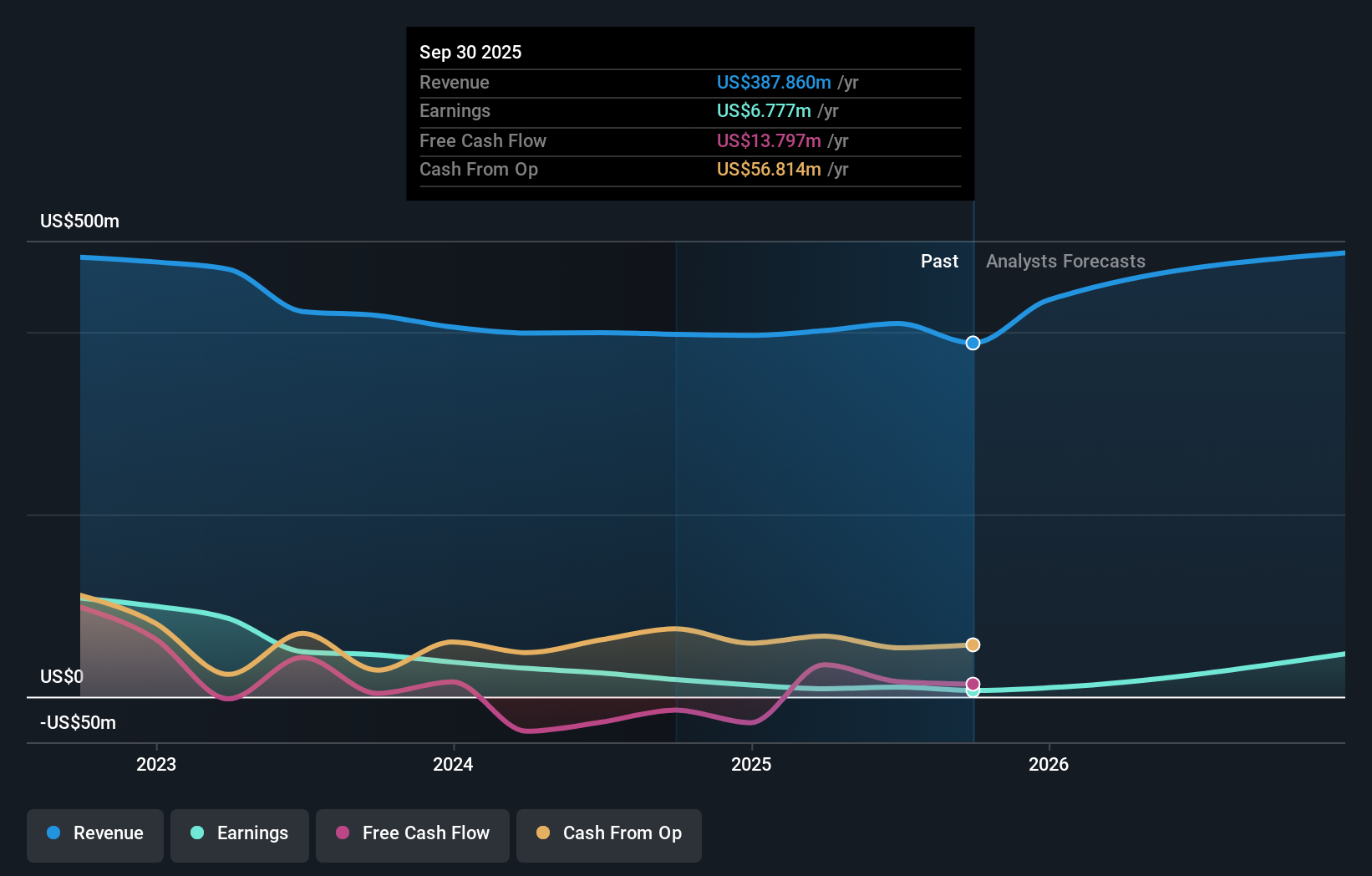

Triumph Financial's narrative projects $602.4 million revenue and $131.3 million earnings by 2028.

Uncover how Triumph Financial's forecasts yield a $60.50 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community members currently see Triumph Financial’s fair value anywhere from about US$11.83 to US$60.50 across 2 separate views, underscoring how far opinions can stretch. When you set that against the freight cycle exposure and earnings sensitivity described above, it becomes clear why many readers choose to compare several independent perspectives before forming their own view on the company’s prospects.

Explore 2 other fair value estimates on Triumph Financial - why the stock might be worth as much as $60.50!

Build Your Own Triumph Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Triumph Financial research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Triumph Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Triumph Financial's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com