Assessing Verisk Analytics (VRSK) Valuation After This Year’s 19% Share Price Pullback

Verisk Analytics (VRSK) has slipped roughly 19% this year even as its core insurance data business continues to grow revenue and earnings at a mid single digit clip, creating an interesting setup for patient investors.

See our latest analysis for Verisk Analytics.

That slide has left Verisk with a roughly 19% year to date share price decline, even though the 3 year total shareholder return is still comfortably positive. This suggests that shorter term momentum is fading while the longer term narrative remains intact.

If Verisk’s recent pullback has you rethinking where to find steadier growth, it might be worth exploring fast growing stocks with high insider ownership as a fresh hunting ground for ideas.

With mid single digit growth, solid profitability, and shares now trading at a mid teens discount to analyst targets, is Verisk starting to look mispriced, or is the market simply baking in every ounce of its future growth?

Most Popular Narrative Narrative: 12% Undervalued

With Verisk closing at $221.24 against a narrative fair value of $251.29, the gap reflects confident expectations for steady compounding rather than explosive growth.

Analysts are assuming Verisk Analytics's revenue will grow by 9.1% annually over the next 3 years.

Analysts assume that profit margins will increase from 30.4% today to 31.5% in 3 years time.

Curious why a mature insurance data business commands a premium style earnings multiple? The narrative leans on rising margins, accelerating top line, and resilient cash generation. Want to see how those ingredients combine into that valuation call?

Result: Fair Value of $251.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, several pressures, from slowing organic growth to higher interest costs on debt, could still derail those upbeat margin and earnings expectations.

Find out about the key risks to this Verisk Analytics narrative.

Another Angle on Valuation

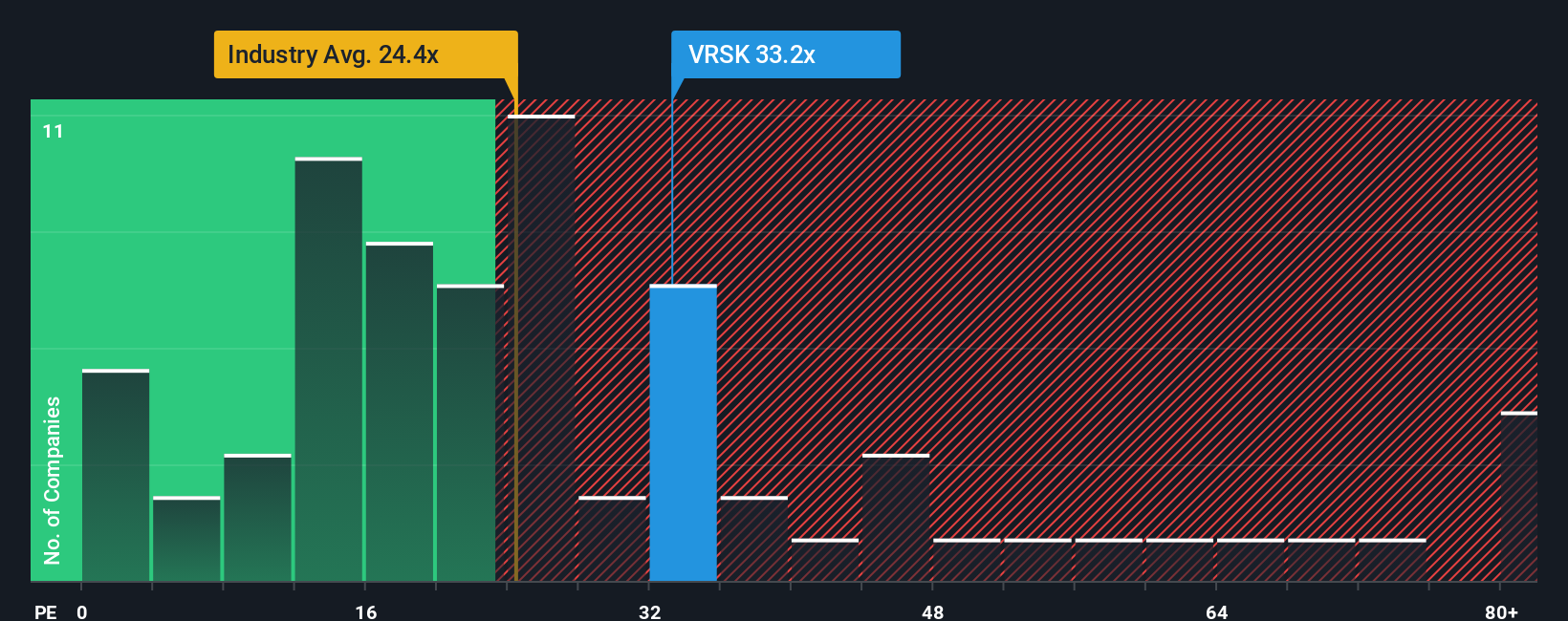

On earnings, Verisk looks less generous. Its current price to earnings ratio is 33.7 times, above the US Professional Services average of 25 times and its 29.2 times fair ratio estimate. That premium narrows the margin of safety, so how much upside is really left?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Verisk Analytics Narrative

If you see the story differently or simply prefer to dig into the numbers yourself, you can build a personalized view in minutes: Do it your way.

A great starting point for your Verisk Analytics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next high conviction idea?

Do not let your research stall here; use the Simply Wall Street Screener to pinpoint fresh opportunities that match your strategy before the market catches on.

- Capture potential high growth stories early by scanning these 3573 penny stocks with strong financials with improving fundamentals and room for market re-rating.

- Position yourself at the frontier of innovation by targeting these 26 AI penny stocks shaping how businesses, consumers, and entire industries use artificial intelligence.

- Strengthen the income side of your portfolio by focusing on these 15 dividend stocks with yields > 3% that balance attractive yields with sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com