Reassessing Schneider National (SNDR) Valuation After Its Recent Double-Digit Share Price Rebound

Schneider National (SNDR) has quietly pulled off a double digit bounce over the past month, outpacing broader transport peers even as its year to date and 1 year returns remain negative.

See our latest analysis for Schneider National.

That recent bounce has lifted Schneider National’s latest share price to $25.95, but while short term share price momentum is clearly improving, the 1 year total shareholder return of minus 16.31 percent still lags its solid 3 year and 5 year total shareholder returns.

If Schneider’s move has you rethinking where momentum and management conviction overlap, it might be worth scanning fast growing stocks with high insider ownership for other ideas with similar long term potential.

With profits growing faster than revenues and the share price still nursing double digit losses over the past year, is Schneider National trading at a discount to its improving fundamentals, or has the market already priced in the next leg of growth?

Most Popular Narrative: 2.1% Overvalued

Compared with Schneider National’s last close at $25.95, the most widely followed narrative pegs fair value slightly lower, hinting at modest downside if its long range forecasts fail to materialize.

Analysts are assuming Schneider National's revenue will grow by 6.2% annually over the next 3 years.

Analysts assume that profit margins will increase from 2.3% today to 5.2% in 3 years time.

Curious why a company with only moderate top line growth expectations might still earn a punchy future earnings multiple, and how margin rebuilding reshapes that valuation story? The full narrative walks through the step by step earnings bridge, the assumed profitability reset and the future multiple needed to justify today’s price, but keeps one crucial tension between growth and valuation front and center.

Result: Fair Value of $25.42 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent freight overcapacity and rising regulatory and equipment costs could pressure margins and undermine the margin recovery and earnings ramp that are already reflected in today’s valuation.

Find out about the key risks to this Schneider National narrative.

Another Lens on Value

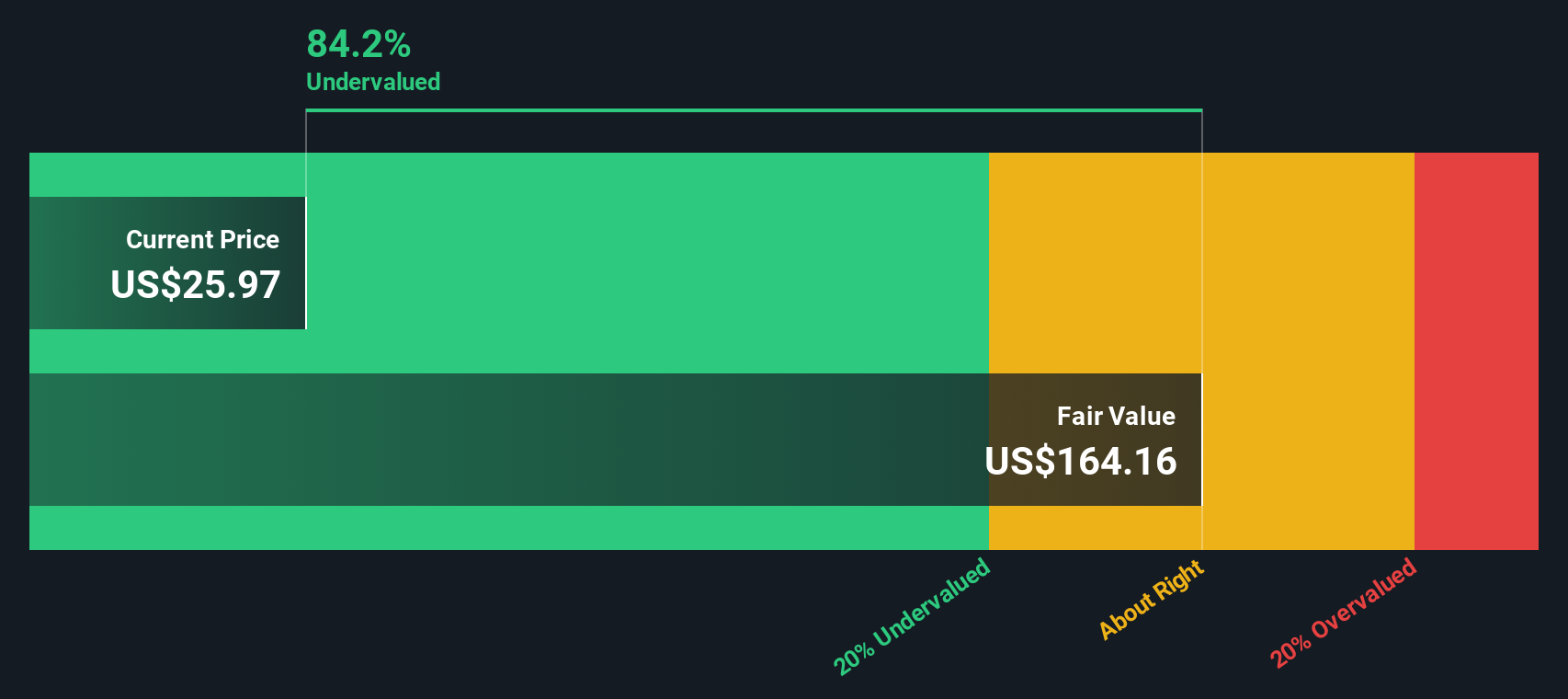

While the narrative driven fair value of $25.42 suggests Schneider National is modestly overvalued, our DCF model sees things very differently. Based on those cash flow assumptions, the shares appear deeply undervalued, trading at about 84 percent below a fair value estimate of roughly $164.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Schneider National for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Schneider National Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Schneider National.

Looking for more investment ideas?

Do not stop at Schneider when you could be building a stronger, more resilient portfolio. Use the Simply Wall St Screener to explore potential opportunities.

- Capture early stage upside by reviewing these 3573 penny stocks with strong financials that already show robust financial foundations instead of fragile balance sheets.

- Position yourself for potential productivity trends by scanning these 30 healthcare AI stocks that are reshaping diagnostics, treatments, and care delivery with real world adoption.

- Seek potential income streams by focusing on these 15 dividend stocks with yields > 3% that combine dividend payments with balance sheets designed to support ongoing distributions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com