Earnings Beat And Another Distribution Hike Might Change The Case For Investing In MPLX (MPLX)

- MPLX LP recently reported third-quarter 2025 results that exceeded expectations, powered by higher gathering and processing volumes, stronger transportation rates, and contributions from newly acquired midstream assets, while also announcing a 12.5% increase in its quarterly distribution for a second straight year.

- Despite this past year’s weaker price-only performance, MPLX’s long-run, dividend-fueled total returns and fresh distribution hike highlight how its high payout policy has materially shaped investor outcomes over multi-year periods.

- We’ll now examine how the stronger earnings momentum and sizeable distribution increase influence MPLX’s existing investment narrative and risk-return profile.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

MPLX Investment Narrative Recap

MPLX appeals to investors who believe fee-based midstream cash flows and high distributions can offset commodity and macro volatility over time. The latest earnings beat and 12.5% payout increase support that thesis in the near term, but the most important catalyst remains successful integration and utilization of new Permian-focused assets, while the largest current risk is still heavy capital spending in a sector exposed to long-term energy transition trends.

The 12.5% distribution increase to US$1.0765 per unit, on top of strong Q3 2025 results, is the announcement that most directly ties into MPLX’s income-driven story and recent total return record. It reinforces how capital returns are being shared with unitholders even as the partnership commits billions to acquisitions and organic projects whose eventual cash flow contribution will be critical if energy transition or overbuilding pressures emerge.

Yet even with higher distributions today, MPLX’s sizeable growth CapEx and acquisition spend could become a concern for investors if...

Read the full narrative on MPLX (it's free!)

MPLX's narrative projects $14.0 billion revenue and $5.3 billion earnings by 2028. This requires 6.8% yearly revenue growth and about a $1.0 billion earnings increase from $4.3 billion today.

Uncover how MPLX's forecasts yield a $57.29 fair value, a 3% upside to its current price.

Exploring Other Perspectives

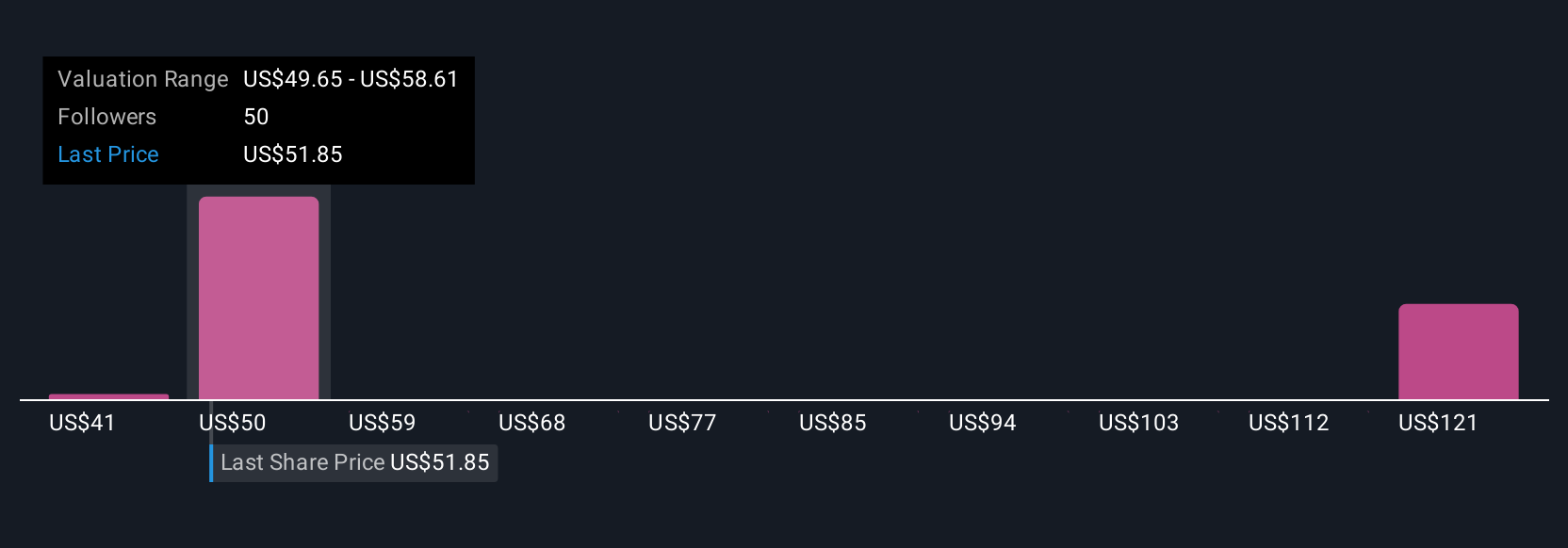

Seven fair value estimates from the Simply Wall St Community span a wide range, from US$41.26 to US$123.85, showing how differently people assess MPLX’s prospects. Many of these investors focus on the same growth-through-acquisitions catalyst discussed above, which could have very different long term outcomes for the partnership’s cash flows and resilience.

Explore 7 other fair value estimates on MPLX - why the stock might be worth over 2x more than the current price!

Build Your Own MPLX Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MPLX research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free MPLX research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MPLX's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com