Will Major PE Share Sales After Strong Quarter Change Sotera Health's (SHC) Narrative

- Affiliates of Warburg Pincus and GTCR recently completed a large secondary offering of Sotera Health shares, selling tens of millions of shares for more than US$250,000,000 in aggregate, with Sotera Health itself receiving no proceeds but bearing offering-related costs.

- This transfer of ownership from long‑time private equity backers to public investors comes just after Sotera Health reported stronger‑than‑expected quarterly results and maintained support from covering analysts, sharpening attention on how its shareholder base is evolving.

- With this sizable secondary sale by legacy shareholders now complete, we’ll examine how it reframes Sotera Health’s investment narrative and future expectations.

Find companies with promising cash flow potential yet trading below their fair value.

Sotera Health Investment Narrative Recap

To own Sotera Health, you need to believe its sterilization and lab testing businesses can grow through tighter regulation and evolving customer needs, while managing litigation, capital intensity and competition. The recent secondary share sale by Warburg Pincus and GTCR looks more like a change in who owns the stock than a change in what drives it, so it does not materially alter the near term growth catalysts or the key regulatory and legal risks.

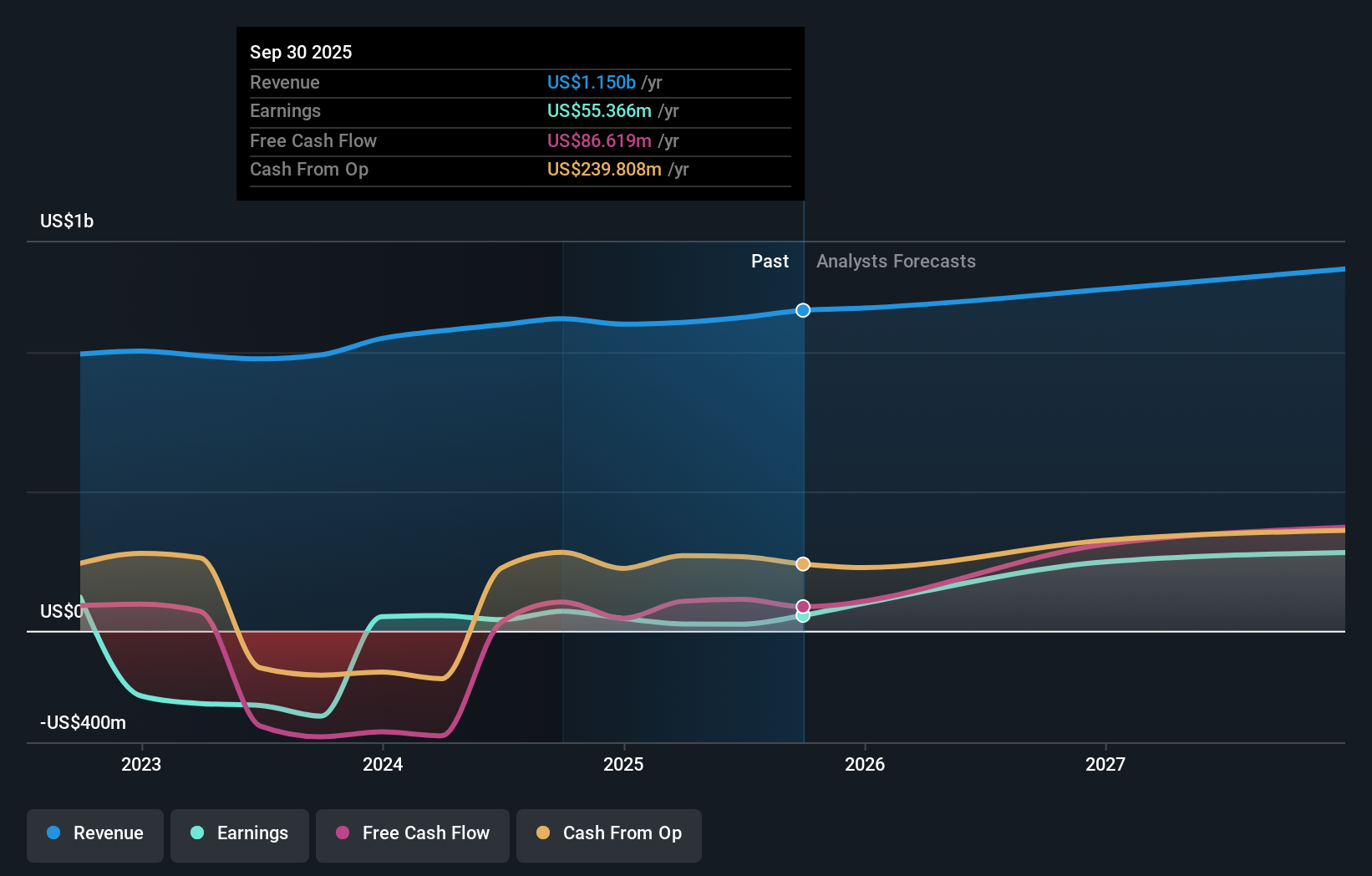

The most relevant recent announcement here is Sotera’s stronger than expected Q3 2025 results and reaffirmed full year revenue growth guidance of 4.5% to 6.0%. That performance backdrop helps explain why demand for the offering was sufficient to absorb 30,000,000 shares, and it keeps the focus on whether volumes, capacity projects and regulatory developments can support the earnings improvement that many investors are counting on.

Yet while the earnings trend looks encouraging, the real risk investors need to understand is how future ethylene oxide rules could...

Read the full narrative on Sotera Health (it's free!)

Sotera Health's narrative projects $1.3 billion revenue and $314.2 million earnings by 2028.

Uncover how Sotera Health's forecasts yield a $18.93 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Two Sotera fair value estimates from the Simply Wall St Community span roughly US$18.93 to US$33.59, underscoring how far apart individual views can be. Set against that, the ongoing ethylene oxide regulatory and litigation overhang may weigh heavily on how different investors interpret the same operating results and balance sheet.

Explore 2 other fair value estimates on Sotera Health - why the stock might be worth just $18.93!

Build Your Own Sotera Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sotera Health research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sotera Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sotera Health's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com