Is CTOS’s Earnings Beat And Higher Guidance Altering The Investment Case For Custom Truck One Source (CTOS)?

- In its latest quarterly update, Custom Truck One Source reported US$482.1 million in revenue, a 7.8% year-on-year increase that came in slightly below analyst forecasts, while delivering an earnings per share beat and an impressive outperformance on adjusted operating income.

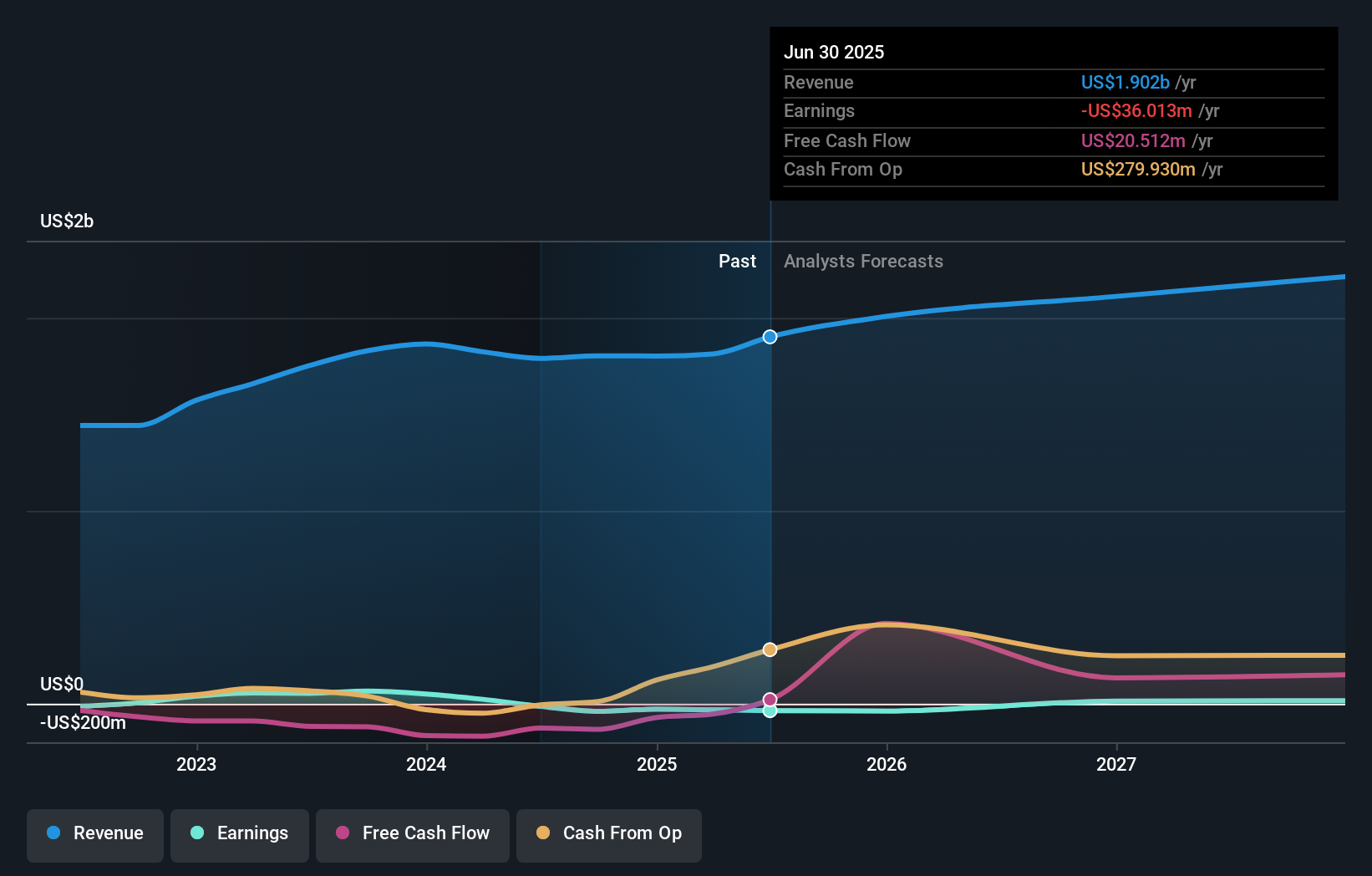

- Despite recent pressure on profitability and free cash flow, the company also raised its full-year guidance more than peers, signaling management’s confidence in operational improvements and demand trends.

- We’ll now examine how Custom Truck One Source’s earnings beat and strengthened full-year guidance reshape the company’s existing investment narrative and risk profile.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Custom Truck One Source Investment Narrative Recap

To own Custom Truck One Source, you need to believe that long term demand for grid, telecom and infrastructure equipment will support steady rental and sales growth, eventually translating into consistent profitability and lower leverage. The latest quarter’s revenue miss but earnings beat and raised full year outlook modestly supports that thesis near term, while the biggest immediate risk remains that high debt and capital spending could become more painful if growth slows.

The reaffirmed 2025 revenue guidance range of US$1,970 million to US$2,060 million is the most relevant update here, because it ties directly to the demand outlook that underpins both the rental growth catalyst and management’s plan to bring net leverage down over time.

Yet investors should be aware that elevated net leverage above 4x means any setback in growth or margins could quickly affect...

Read the full narrative on Custom Truck One Source (it's free!)

Custom Truck One Source's narrative projects $2.3 billion revenue and $28.6 million earnings by 2028. This requires 6.6% yearly revenue growth and a $64.6 million earnings increase from $-36.0 million today.

Uncover how Custom Truck One Source's forecasts yield a $7.67 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span roughly US$5.50 to US$7.67 per share, underscoring how differently individual investors view CTOS. Against that backdrop, the company’s raised full year guidance and recent earnings beat could influence how you weigh its infrastructure demand catalyst against the ongoing pressure from high leverage and thin free cash flow.

Explore 2 other fair value estimates on Custom Truck One Source - why the stock might be worth 10% less than the current price!

Build Your Own Custom Truck One Source Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Custom Truck One Source research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Custom Truck One Source research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Custom Truck One Source's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com