Should HubSpot’s AI-Driven Q3 Earnings Beat Reshape the Long-Term Outlook for HubSpot (HUBS) Investors?

- In late November 2025, HubSpot reported strong third-quarter results, with revenue and profit exceeding expectations, customer numbers rising by 17% year over year, and management reiterating confidence in its AI-first CRM transformation.

- The company’s Breeze AI platform, pricing changes such as Core Seats, and accelerating multi-hub adoption are reshaping how customers use and pay for HubSpot’s integrated CRM suite.

- We’ll now examine how HubSpot’s Q3 earnings beat and accelerating AI-driven CRM strategy may influence its longer-term investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

HubSpot Investment Narrative Recap

To own HubSpot, you need to believe its shift to an AI-first, multi-hub CRM platform can keep driving strong customer adoption and monetization, despite rich valuation and intensifying competition. The Q3 beat and confident outlook reinforce AI as the key near term catalyst, while the 24% share price pullback and reliance on new AI monetization models highlight execution risk more than any change in fundamental demand.

Among recent developments, HubSpot’s decision to deploy a US$500 million buyback, repurchasing about 1.9% of shares so far, stands out alongside its solid Q3 performance. For investors weighing the AI-driven growth story against elevated expectations, this capital return signals conviction in the business while the real test remains how quickly Breeze-powered CRM and multi-hub adoption can translate into durable profitability.

Yet beneath the strong AI and CRM growth story, investors should be aware that HubSpot’s early stage AI monetization model...

Read the full narrative on HubSpot (it's free!)

HubSpot’s narrative projects $4.6 billion revenue and $388.4 million earnings by 2028. This requires 17.1% yearly revenue growth and about a $400 million earnings increase from -$11.9 million today.

Uncover how HubSpot's forecasts yield a $585.47 fair value, a 54% upside to its current price.

Exploring Other Perspectives

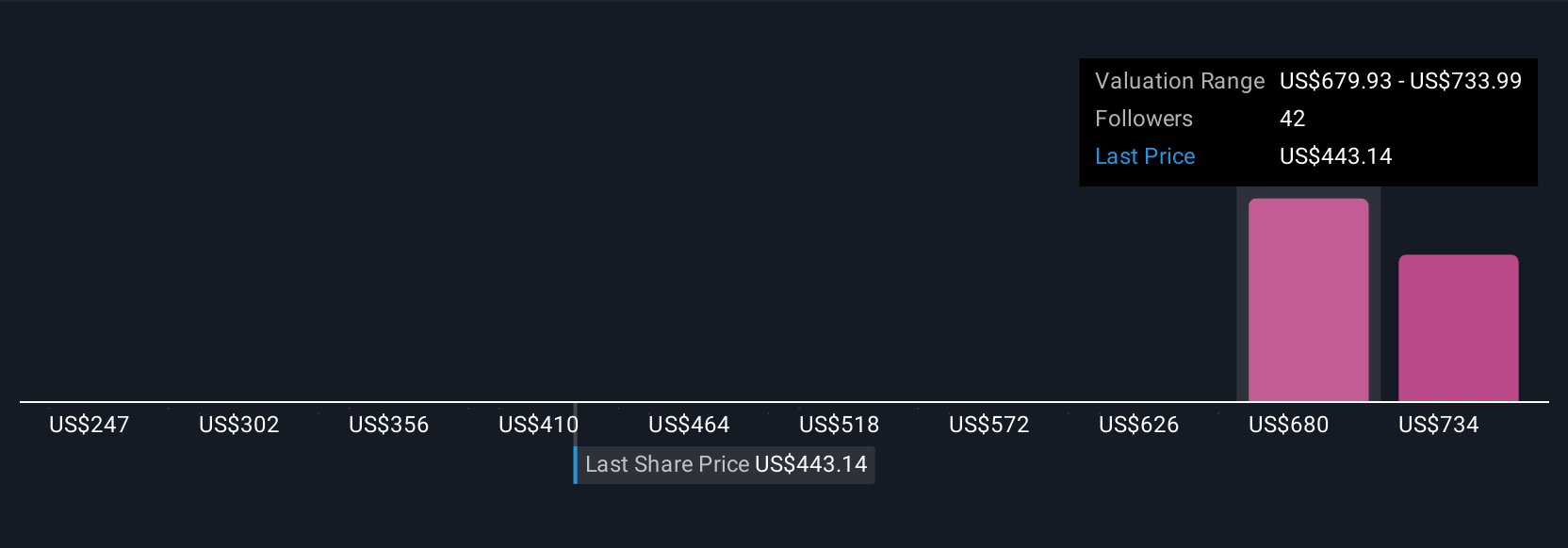

Eight fair value estimates from the Simply Wall St Community span roughly US$205 to US$585 per share, showing how far apart individual views on HubSpot can be. When you set that wide range against the company’s accelerating AI-first CRM strategy and recent Q3 outperformance, it underlines why checking several perspectives before deciding how this growth story fits your portfolio can be so important.

Explore 8 other fair value estimates on HubSpot - why the stock might be worth 46% less than the current price!

Build Your Own HubSpot Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HubSpot research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free HubSpot research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HubSpot's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com