DigitalBridge (DBRG) Valuation Check After Sharp Short-Term Share Price Rebound

DigitalBridge Group (DBRG) has quietly put together an impressive run lately, with the stock up about 45% over the past week and roughly 34% over the past month, easily outpacing the broader market.

See our latest analysis for DigitalBridge Group.

That surge in the 1 week and 1 month share price returns sits on top of a solid 90 day share price return of 23.86%. At the same time, the 1 year total shareholder return of 10.39% and 3 year total shareholder return of 13.05% suggest momentum is building but still has work to do to repair a weaker 5 year total shareholder return of minus 24.92%, especially now that the share price is at $14.12.

If this kind of rebound has you thinking about what else could rerate, it might be worth exploring fast growing stocks with high insider ownership as your next hunting ground.

Yet with revenue and earnings growing quickly, a modest value score, and the stock still trading below analyst targets, investors now face a key question: is this a genuine buying opportunity, or is the market already pricing in the next leg of growth?

Most Popular Narrative: 18.3% Undervalued

With the narrative fair value sitting at approximately $17.28 against the last close of $14.12, the story leans toward meaningful upside if its growth path plays out.

The explosion in AI workloads and hyperscale/cloud CapEx is driving unprecedented demand for data centers and power, fueling a substantial multi-year leasing and development pipeline for DigitalBridge; this supports long-term revenue, FEEUM, and EBITDA growth as the company monetizes these trends through new asset deployment and leasing.

Curious how a capital intensive infrastructure manager gets a premium style valuation tag? Put simply, the narrative is banking on rapid revenue growth, margin expansion, and a surprisingly robust earnings multiple several years out. Want to see exactly how those moving parts stack up to justify that fair value?

Result: Fair Value of $17.28 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could unravel if rising funding costs or intensified competition squeeze returns, delay projects, and weaken the expected earnings ramp.

Find out about the key risks to this DigitalBridge Group narrative.

Another View: Rich on Earnings

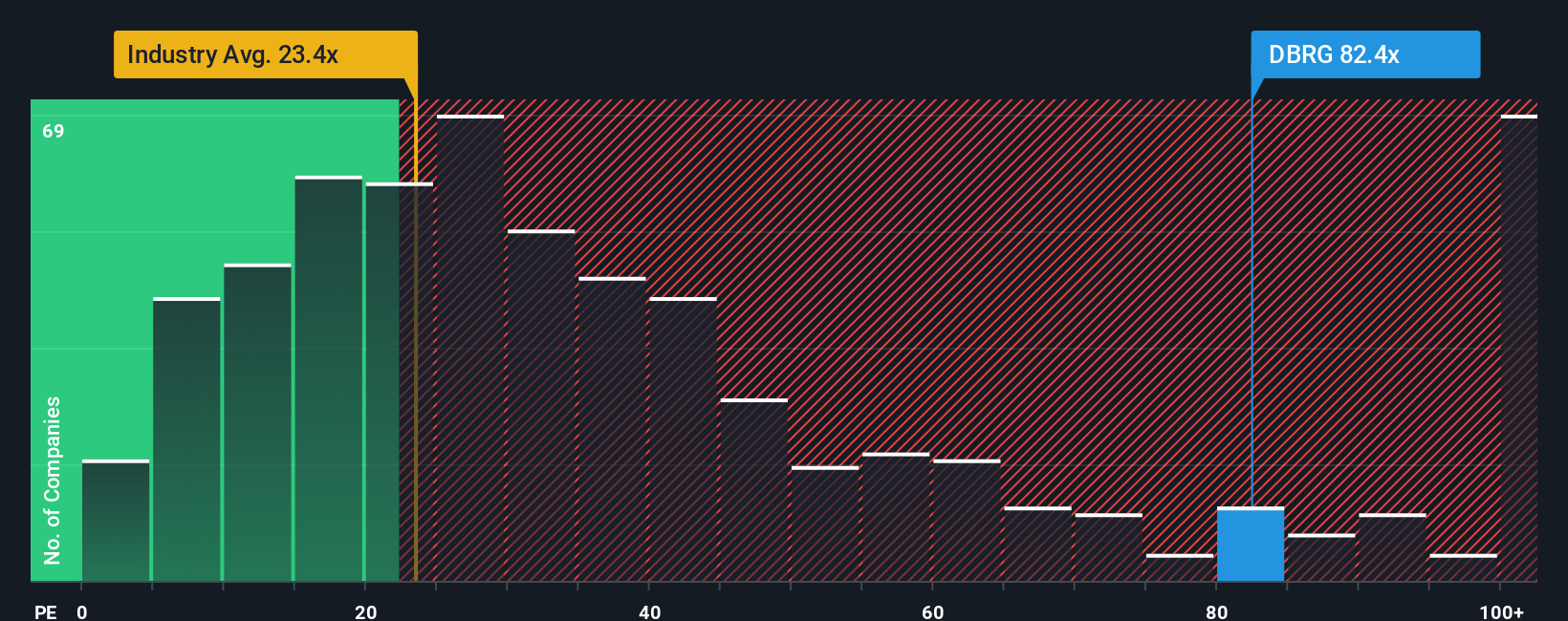

Step away from the growth story and the current price to earnings ratio tells a very different tale. At about 126.5 times earnings versus 24.2 times for the US Capital Markets industry and a fair ratio of 30.8 times, DBRG screens as expensive, leaving little room for execution missteps.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DigitalBridge Group Narrative

If you see the numbers differently or would rather trust your own work, you can build a custom view in just a few minutes, starting with Do it your way.

A great starting point for your DigitalBridge Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you move on, lock in your edge by using the Simply Wall St Screener to uncover fresh ideas that could strengthen and diversify your portfolio.

- Target dependable income by reviewing companies in these 15 dividend stocks with yields > 3% that may help anchor your portfolio with consistent cash returns.

- Capitalize on powerful growth themes by scanning these 26 AI penny stocks for businesses riding the surge in artificial intelligence adoption.

- Position yourself ahead of the market by checking these 907 undervalued stocks based on cash flows for opportunities that cash flow models suggest the crowd is underpricing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com