Does Strong Q3 Beat and Insider Buying Change The Bull Case For Guardian Pharmacy Services (GRDN)?

- Earlier this year, Guardian Pharmacy Services reported robust third-quarter 2025 results that surpassed market expectations, followed by Director Steven D. Cosler purchasing 3,370 shares of Class A common stock.

- This combination of operational outperformance and insider buying signaled strengthened leadership conviction in Guardian Pharmacy Services’ long-term business trajectory.

- Next, we’ll examine how the strong third-quarter earnings performance shapes Guardian Pharmacy Services’ investment narrative for shareholders and prospective investors.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Guardian Pharmacy Services' Investment Narrative?

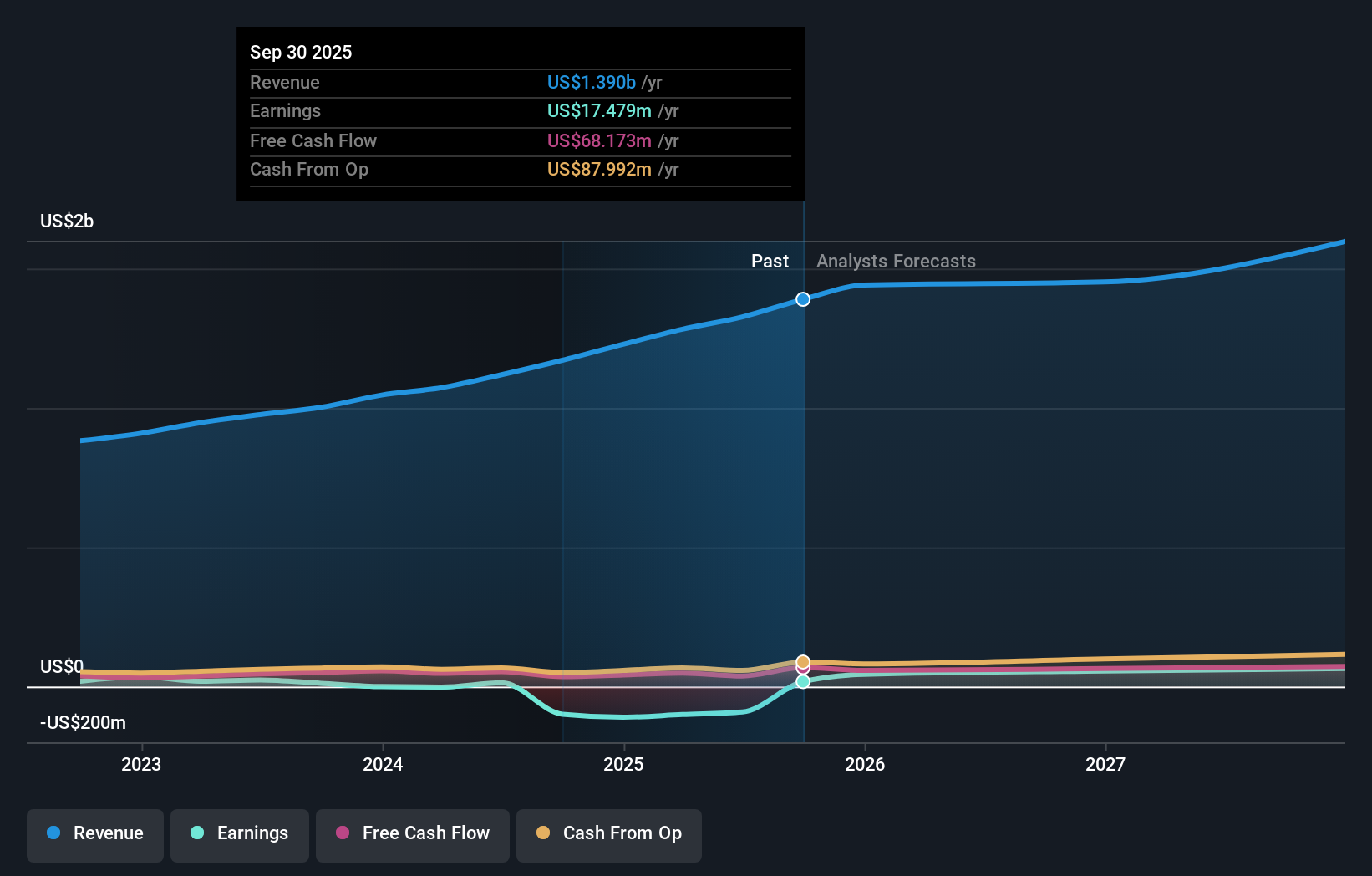

To own Guardian Pharmacy Services, you need to believe that its niche pharmacy model can keep turning steady mid single digit revenue growth into faster earnings expansion, helped by disciplined acquisitions and tight cost control. The latest Q3 beat, higher 2025 revenue guidance of about US$1.43–1.45 billion, and Director Steven D. Cosler’s share purchase all reinforce that story and appear to have added confidence to the near term catalysts rather than changing them. Analyst price target increases following Q3 suggest the market has partially recognised this, although the share price has already run strongly year to date. At the same time, the stock’s very high earnings multiple and reliance on M&A leave little room for execution missteps or regulatory hiccups, which remain the key risks to watch.

Guardian Pharmacy Services' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

The single Simply Wall St Community fair value estimate of about US$29.05 sits close to recent trading levels, offering one anchor point as you weigh the stronger earnings trajectory, rich valuation and M&A execution risks that could sway Guardian Pharmacy Services’ longer term performance.

Explore another fair value estimate on Guardian Pharmacy Services - why the stock might be worth just $29.05!

Build Your Own Guardian Pharmacy Services Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Guardian Pharmacy Services research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Guardian Pharmacy Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Guardian Pharmacy Services' overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com