Toda (TSE:1860) Valuation Check After Strong 12‑Month Share Price Rally

Toda (TSE:1860) has quietly outperformed the broader Japanese construction sector over the past year, with shares up roughly 33% over 12 months and about 26% year to date, inviting a closer look.

See our latest analysis for Toda.

That upward move has come in bursts rather than a straight line, with a strong 30 day share price return and an impressive multi year total shareholder return. Together, these suggest momentum is still building as investors re rate Toda's prospects.

If Toda's run has you thinking about what else could surprise to the upside, this is a good moment to explore fast growing stocks with high insider ownership for other potential growth stories.

Given the strong multiyear rally alongside only modest revenue growth and falling net income, investors now face a key question: Is Toda still trading below its true worth, or is the market already pricing in its next chapter?

Price-to-Earnings of 11.7x: Is it justified?

On a trailing price-to-earnings ratio of 11.7 times at a last close of ¥1,197, Toda trades at a discount to both peers and the broader Japanese market, which suggests the market is not fully pricing in its current earnings power.

The price-to-earnings multiple compares the company’s share price with its earnings per share. It is a straightforward way to gauge how much investors are willing to pay for each yen of profit. For a mature construction and civil engineering group like Toda, this is a key yardstick because earnings tend to be cyclical yet relatively predictable across cycles.

In Toda’s case, the 11.7 times multiple sits below the Japanese market average of 14 times. This indicates that investors are paying less for its earnings than for the typical listed company. At the same time, our fair price-to-earnings estimate also sits at 11.7 times. This indicates the current valuation is closely aligned with the level the market could gravitate toward if sentiment and fundamentals stay consistent.

Against the construction industry’s average multiple of 12.2 times and a peer average of 16.1 times, Toda’s lower ratio stands out as clearly cheaper. This reinforces the view that its earnings are being valued conservatively despite strong recent profit growth.

Explore the SWS fair ratio for Toda

Result: Price-to-Earnings of 11.7x (ABOUT RIGHT)

However, slowing earnings, combined with a share price above analyst targets, could trigger a reassessment if margins or order momentum weaken from here.

Find out about the key risks to this Toda narrative.

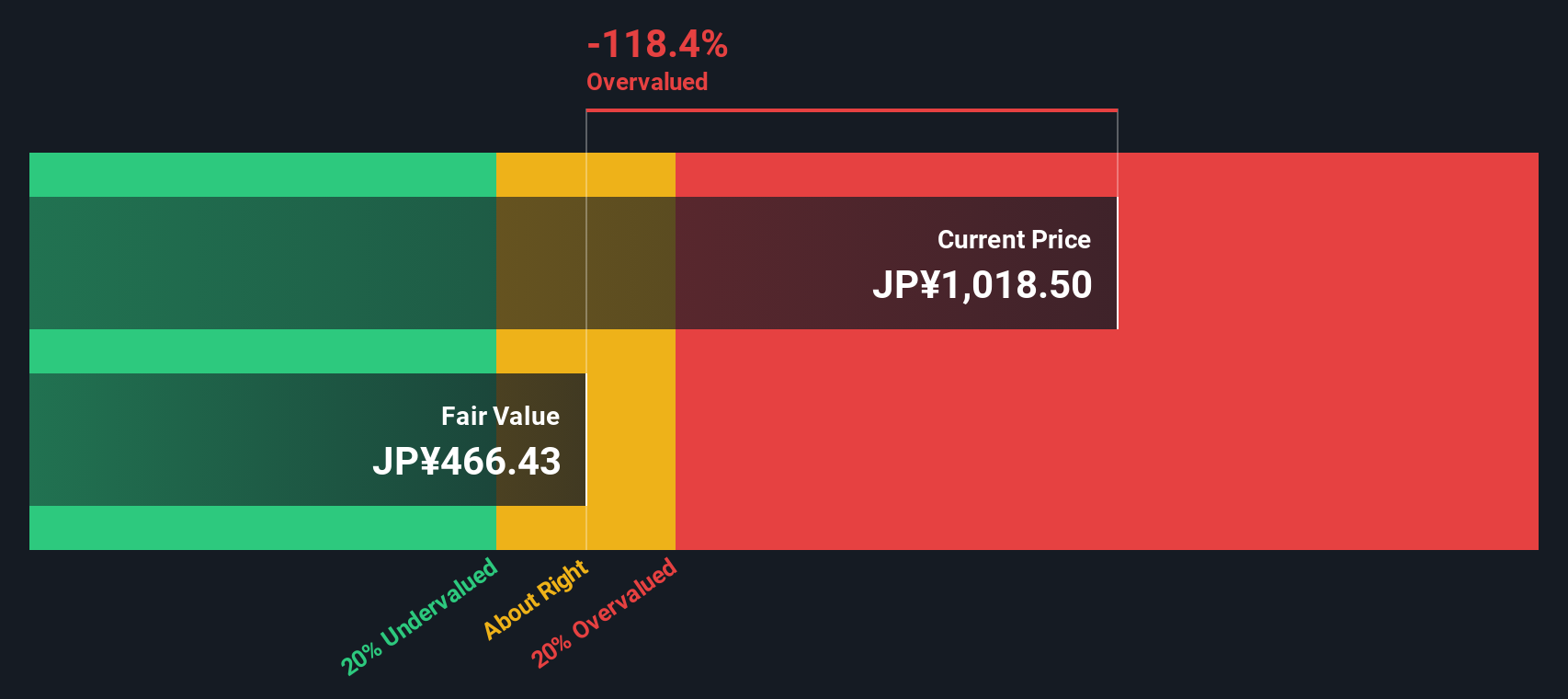

Another View: DCF Flags Overvaluation Risk

While the 11.7 times earnings multiple looks fair, our DCF model paints a tougher picture, with Toda trading around ¥1,197 versus an estimated fair value of about ¥696. This implies material overvaluation and raises the question: is the market betting on a stronger long term story than the cash flows support?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Toda for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Toda Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in minutes with Do it your way.

A great starting point for your Toda research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Do not stop at Toda when you can quickly surface fresh, data backed opportunities tailored to your strategy using Simply Wall Street’s powerful stock screener tools today.

- Capture mispriced opportunities by hunting through these 907 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has overlooked.

- Boost your income potential by targeting these 15 dividend stocks with yields > 3% offering attractive yields without sacrificing financial quality.

- Position yourself at the frontier of fintech innovation with these 81 cryptocurrency and blockchain stocks that are building real world solutions on blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com