Is Rising Online Car-Buying Demand And Slower Dealer Growth Altering The Investment Case For CarGurus (CARG)?

- Earlier this week, CarGurus released its 2025 U.S. Consumer Insights Report, showing that 83% of shoppers now want to complete more of the car-buying process online while still valuing in-person inspection and dealer support.

- Alongside this, the company reported strong gains in average revenue per user and free cash flow margins, even as growth in paying dealers slowed, highlighting both improved monetization and emerging questions around future dealer demand.

- With consumer openness to AI tools rising and CarGurus boosting monetization despite slower dealer additions, we’ll explore how this reshapes its investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

CarGurus Investment Narrative Recap

To own CarGurus, you need to believe it can turn its marketplace scale, brand trust, and data into steadily higher monetization, even as competition and dealer budgets tighten. The latest consumer report reinforces the near term catalyst around digital retail and AI tools, while the key risk remains whether slower dealer additions signal softer underlying demand. On balance, this news supports the core thesis rather than changing it.

The most relevant update alongside this report is CarGurus’ strong growth in average revenue per user and free cash flow margins. Together with rising consumer openness to AI, this points to deeper monetization of existing dealer relationships as a crucial driver, while the moderation in new paying dealers sits uncomfortably next to growing pressure from OEM and retailer platforms.

Yet even as monetization improves, investors should be aware that slower paying dealer growth could...

Read the full narrative on CarGurus (it's free!)

CarGurus' narrative projects $1.1 billion revenue and $316.9 million earnings by 2028. This requires 5.7% yearly revenue growth and roughly a $187.1 million earnings increase from $129.8 million today.

Uncover how CarGurus' forecasts yield a $40.29 fair value, a 12% upside to its current price.

Exploring Other Perspectives

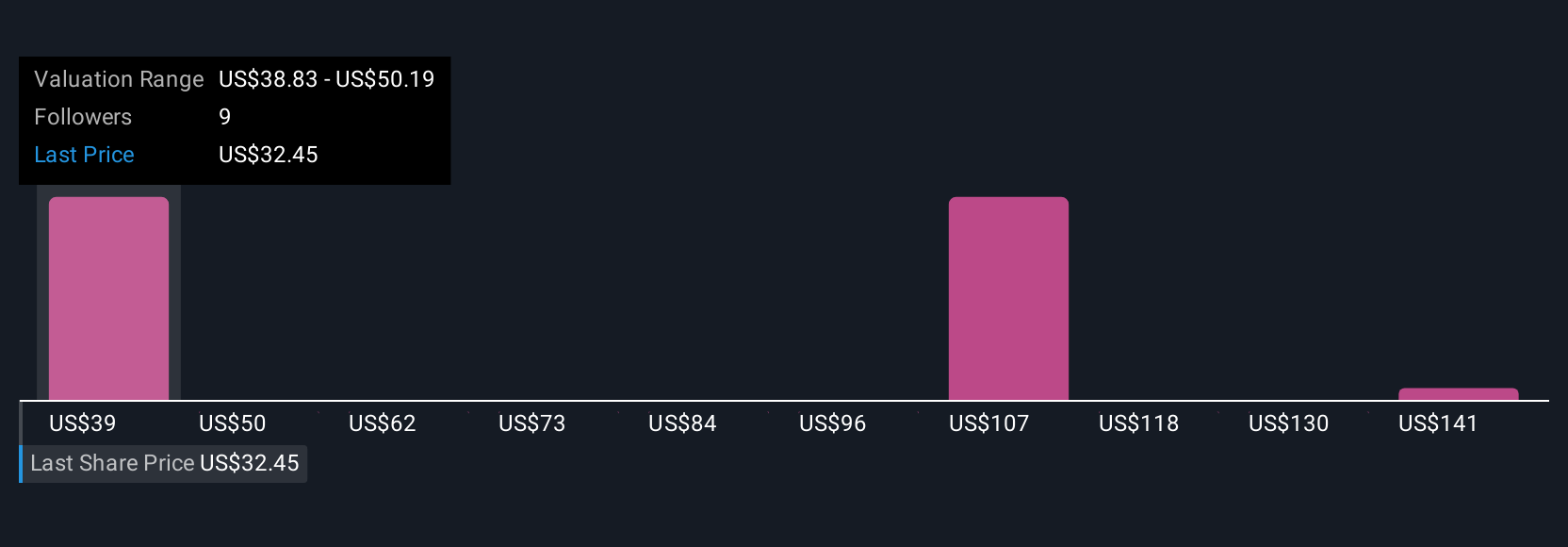

Six fair value estimates from the Simply Wall St Community span roughly US$40 to US$152 per share, underlining how far apart individual views can be. When you weigh that against the reliance on AI powered tools and higher ARPU from a relatively flat dealer base, it becomes even more important to explore several competing opinions on how sustainable CarGurus’ current momentum really is.

Explore 6 other fair value estimates on CarGurus - why the stock might be worth over 4x more than the current price!

Build Your Own CarGurus Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CarGurus research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free CarGurus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CarGurus' overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com