Will Denali Therapeutics' (DNLI) US$275 Million Tividenofusp Royalty Deal Change Its Investment Narrative?

- In recent days, Denali Therapeutics and Royalty Pharma announced a US$275 million synthetic royalty funding deal tied to potential future net sales of Denali’s investigational Hunter syndrome therapy, tividenofusp alfa, with US$200 million payable at closing and another US$75 million contingent on European approval by the end of 2029.

- The agreement, which depends on FDA accelerated approval by April 2026, gives Denali substantial non-dilutive capital while signaling external confidence in tividenofusp alfa and the company’s broader rare-disease pipeline.

- We’ll now examine how this sizeable non-dilutive royalty financing could reshape Denali’s investment narrative and long-term pipeline funding outlook.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

What Is Denali Therapeutics' Investment Narrative?

For Denali to make sense as a holding, you really have to buy into its core idea: a focused rare‑disease platform, led by tividenofusp alfa, that could eventually turn a zero‑revenue, loss‑making biotech into a commercial company. The US$275 million synthetic royalty deal with Royalty Pharma matters here. It does not change the central near‑term catalyst, which is the FDA’s accelerated approval decision on tividenofusp alfa now targeted for April 2026, but it does ease one of the biggest pressure points: how to fund the pipeline without constant equity raises. At the same time, it introduces a new trade‑off, since success in Hunter syndrome would now come with a 9.25% royalty obligation and heightens company dependence on a single regulatory outcome amid leadership transition and ongoing clinical holds elsewhere.

However, one specific Hunter‑syndrome risk could catch some shareholders off‑guard if they miss it. Our valuation report unveils the possibility Denali Therapeutics' shares may be trading at a premium.Exploring Other Perspectives

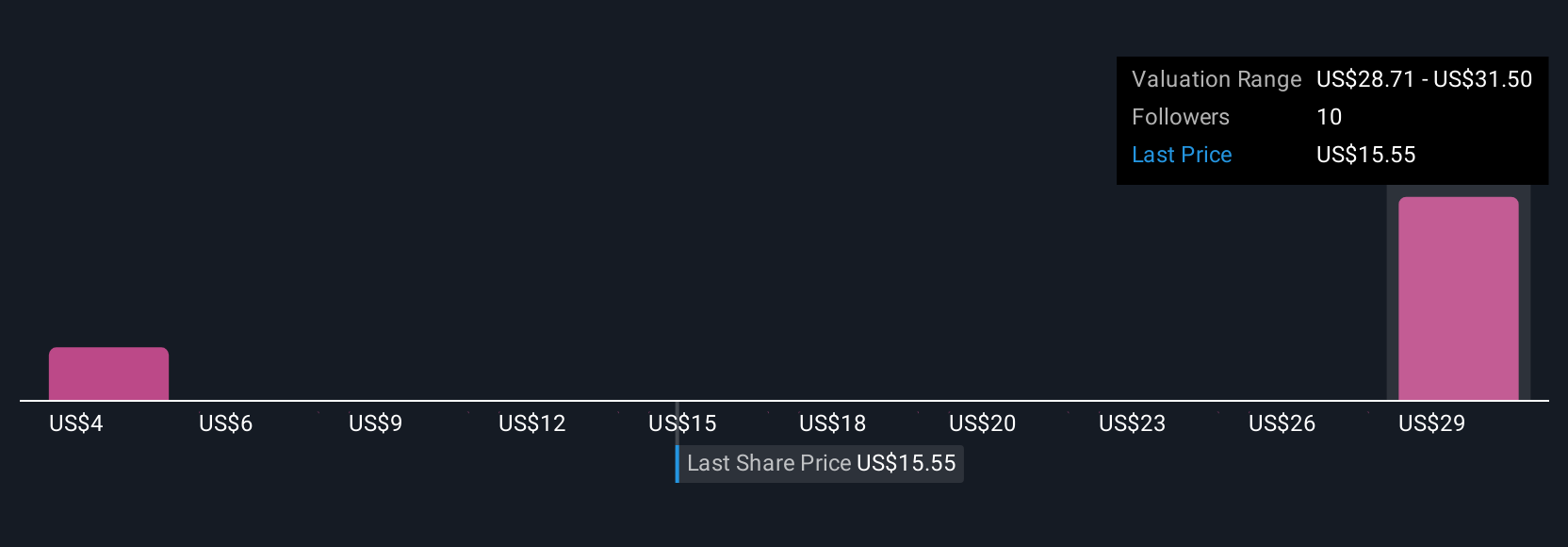

Two fair value estimates from the Simply Wall St Community span roughly US$3 to US$32 per share, reflecting very different expectations around Denali’s future. Set that against the current focus on a single FDA decision and the new royalty overhang, and it becomes clear why you may want to weigh several perspectives before deciding how Denali might fit into your portfolio.

Explore 2 other fair value estimates on Denali Therapeutics - why the stock might be worth as much as 62% more than the current price!

Build Your Own Denali Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Denali Therapeutics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Denali Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Denali Therapeutics' overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com