How Investors May Respond To Gaming and Leisure Properties (GLPI) Dividend Hike And US$1.5 Billion Project Push

- Gaming and Leisure Properties, Inc. recently declared a fourth-quarter 2025 cash dividend of US$0.78 per share, payable on December 19 to shareholders of record as of December 5, while also updating investors on progress across roughly US$1.50 billion of gaming real estate projects with multiple operating partners.

- These updates, alongside better-than-expected third-quarter earnings and higher full-year 2025 guidance, underline how active capital deployment into projects like Bally’s developments, PENN’s M Resort expansion, and new tribal ventures is increasingly shaping GLPI’s income profile and growth outlook.

- With GLPI raising its full-year guidance while pushing forward US$1.50 billion of development commitments, we’ll explore how this activity reshapes its investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Gaming and Leisure Properties Investment Narrative Recap

To own Gaming and Leisure Properties, you have to believe in the resilience of brick-and-mortar casino real estate and GLPI’s ability to keep collecting contractual rent even as the sector faces structural and macro pressures. The latest dividend declaration and project milestones do not materially change the near term picture, where the key catalyst is execution on US$1.50 billion of development commitments and the biggest risk remains tenant and project exposure to weaker counterparties like Bally’s.

The most relevant recent announcement here is GLPI’s update on five projects tied to roughly US$1.50 billion in capital commitments alongside its guidance raise. As properties like Bally’s Baton Rouge and PENN’s M Resort expansion open and begin contributing rent, these build outs sit at the heart of the current catalyst path, but also concentrate risk where counterpart credit quality or construction outcomes matter most for how this investment story evolves.

Yet behind GLPI’s expanding project pipeline, investors should be aware of how much of that capital is tied to Bally’s and...

Read the full narrative on Gaming and Leisure Properties (it's free!)

Gaming and Leisure Properties’ narrative projects $2.0 billion revenue and $1.1 billion earnings by 2028. This requires 9.0% yearly revenue growth and about a $382 million earnings increase from $717.9 million today.

Uncover how Gaming and Leisure Properties' forecasts yield a $54.07 fair value, a 29% upside to its current price.

Exploring Other Perspectives

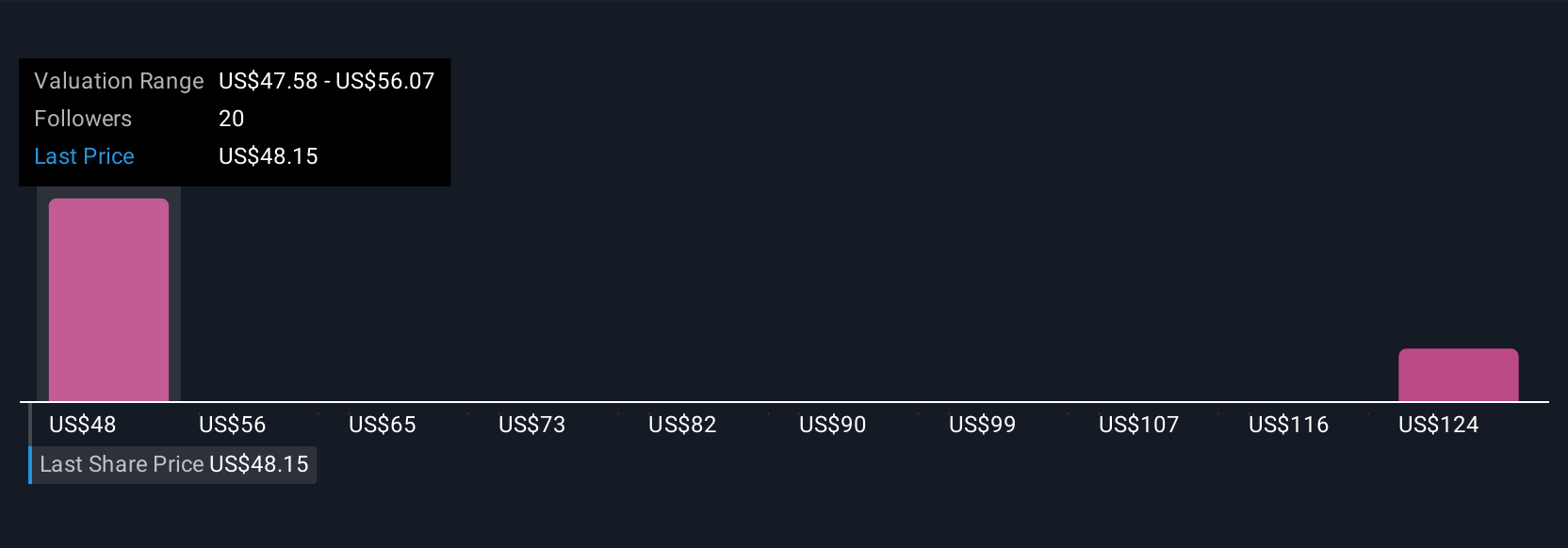

Three members of the Simply Wall St Community currently see GLPI’s fair value between US$47.58 and about US$101.59, reflecting wide divergence in expectations. Against that backdrop, GLPI’s heavy commitments to development projects with Bally’s and other partners put real weight on successful execution and tenant health, which could meaningfully influence how those valuations ultimately play out.

Explore 3 other fair value estimates on Gaming and Leisure Properties - why the stock might be worth just $47.58!

Build Your Own Gaming and Leisure Properties Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gaming and Leisure Properties research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Gaming and Leisure Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gaming and Leisure Properties' overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com