Taking a Fresh Look at KONE (HLSE:KNEBV)’s Valuation After Its Recent Share Price Climb

Recent Performance Overview

KONE Oyj (HLSE:KNEBV) has quietly put together a steady run, with the stock up about 2% over the past month and roughly 6% in the past 3 months, outpacing many industrial peers.

See our latest analysis for KONE Oyj.

At a latest share price of $59.62, KONE Oyj has built solid momentum, with a strong year to date share price return and an equally healthy multi year total shareholder return pointing to gradually improving sentiment on its long term prospects.

If KONE’s steady climb has you rethinking your watchlist, it could be worth discovering other auto manufacturers that are showing interesting trends of their own.

With shares already above the average analyst target yet still trading at a slight intrinsic discount, is KONE now a premium priced compounder, or does today’s valuation still leave room for upside as growth compounds?

Most Popular Narrative Narrative: 4.9% Overvalued

With KONE Oyj last closing at €59.62 against a narrative fair value of about €56.81, the story leans toward a mildly stretched valuation built on improving profitability.

Improved expectations for long term profitability, driven by service mix, modernization demand, and cost discipline, are viewed as key drivers of potential upside to earnings over time. Structural exposure to urbanization and replacement cycles in core markets is cited as a supportive growth pillar, underpinning confidence that mid cycle valuations can be sustained.

Curious how steady mid single digit growth, rising margins, and a richer future earnings multiple all fit together into that price tag? The narrative’s math may surprise you.

Result: Fair Value of €56.81 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could quickly unravel if China’s construction slowdown deepens or if KONE’s heavy digital and R&D spend fails to translate into higher-margin growth.

Find out about the key risks to this KONE Oyj narrative.

Another Angle on Valuation

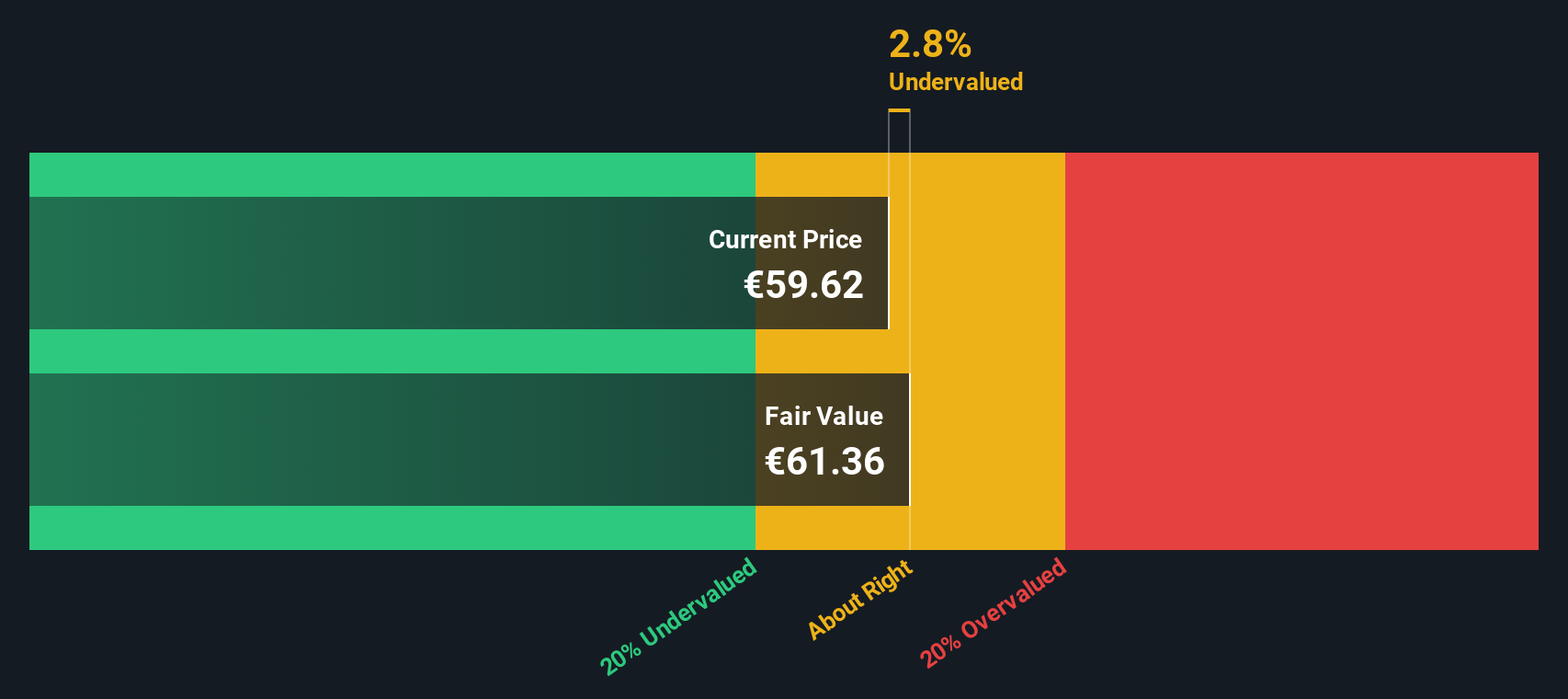

Our SWS DCF model paints a more forgiving picture, suggesting KONE is about 2.8% undervalued at roughly €61.35. That is a sharp contrast to the narrative calling the shares nearly 5% overvalued, leaving investors to decide which story feels more believable.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out KONE Oyj for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own KONE Oyj Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your KONE Oyj research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next standout opportunity?

Before the market prices in the next wave of winners, put Simply Wall Street’s Screener to work and uncover focused ideas that match your strategy today.

- Capture potential mispricings by targeting quality companies trading at attractive valuations through these 907 undervalued stocks based on cash flows that may not stay cheap for long.

- Tap into powerful trends in automation and data revolution by zeroing in on these 26 AI penny stocks positioned to benefit from accelerating AI adoption.

- Boost your income game by scanning for reliable payers with these 15 dividend stocks with yields > 3% that can strengthen returns even when markets move sideways.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com