Early Phase 2 RALLY-MF Data For DISC-0974 Might Change The Case For Investing In Disc Medicine (IRON)

- Disc Medicine recently reported positive initial data from its Phase 2 RALLY-MF trial of DISC-0974 in anemia of myelofibrosis at the ASH Annual Meeting, showing large reductions in hepcidin, higher iron levels, and clinically meaningful improvements in hemoglobin and transfusion needs across multiple patient groups.

- The early results also showed that DISC-0974 was generally well-tolerated and produced hematologic responses even in patients on concurrent JAK inhibitor therapy, hinting at potential use across varied treatment regimens.

- We’ll now examine how this early Phase 2 efficacy across both transfusion-dependent and non–transfusion-dependent patients may influence Disc Medicine’s investment narrative.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

What Is Disc Medicine's Investment Narrative?

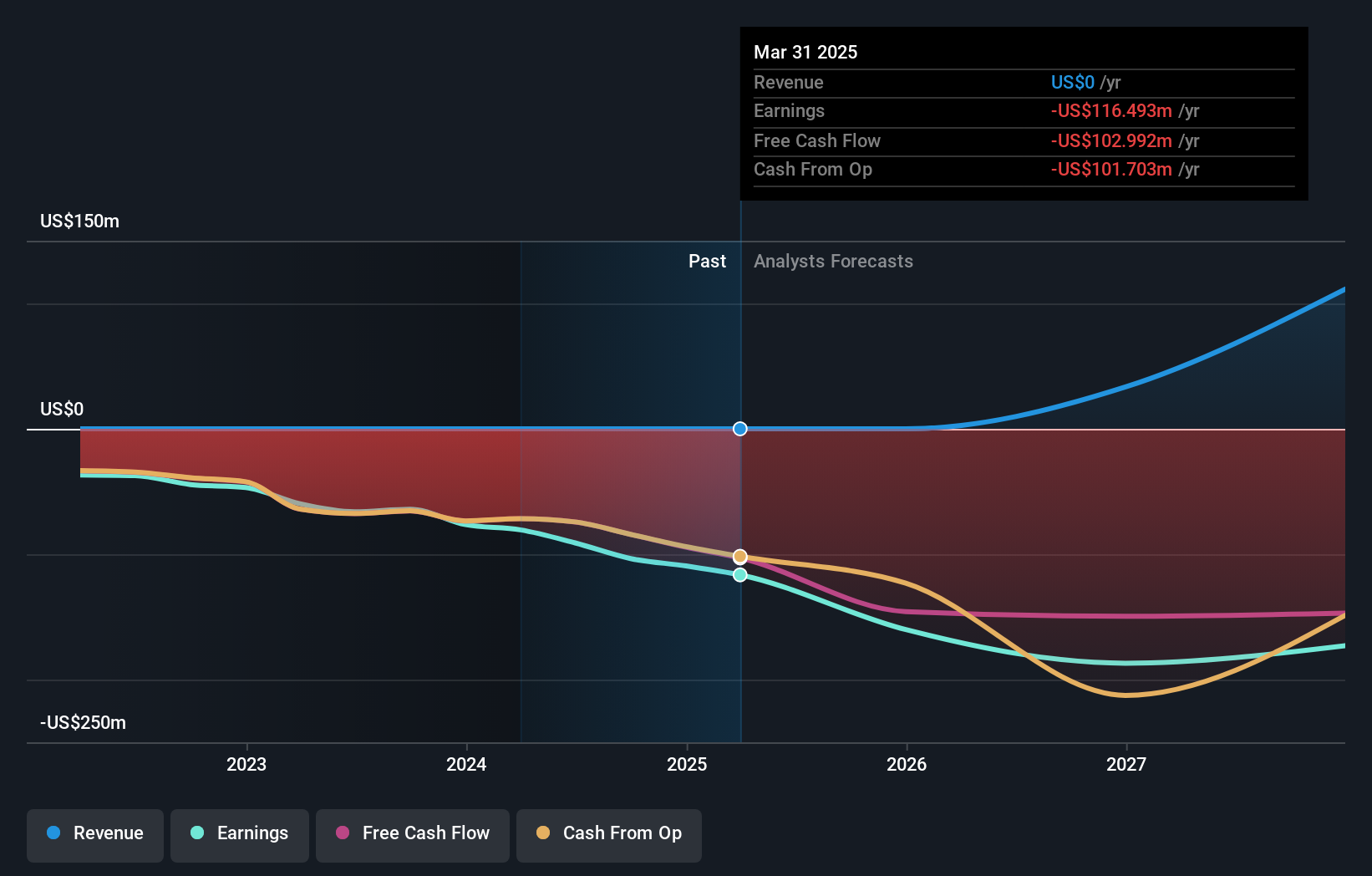

To own Disc Medicine, you really need to believe its hepcidin-focused platform can turn strong early signals into durable, approvable drugs across rare hematologic conditions, while the company manages years of losses and funding needs. The new RALLY-MF Phase 2 data on DISC-0974 reinforces that core story by adding a second clinical shot on goal alongside bitopertin, showing anemia benefits in both transfusion-dependent and non–transfusion-dependent myelofibrosis patients and in those on JAK inhibitors. In the near term, the biggest catalysts still center on bitopertin’s NDA review in EPP and any regulatory feedback around the accelerated pathway, but DISC-0974 now feels more central to the equity story than it did before. The key risks remain the same: clinical or regulatory setbacks, future dilution and the possibility that today’s optimism proves ahead of the fundamentals.

However, one key financing-related risk could catch some shareholders off guard. Disc Medicine's share price has been on the slide but might be up to 10% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore 2 other fair value estimates on Disc Medicine - why the stock might be worth as much as 27% more than the current price!

Build Your Own Disc Medicine Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Disc Medicine research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Disc Medicine research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Disc Medicine's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com