How Investors Are Reacting To TELUS (TSX:T) Capital Structure Overhaul And Pause In Dividend Growth

- TELUS recently completed multi-currency debt financing, issuing US$1.50 billion and C$800.00 million of fixed-to-fixed rate junior subordinated notes due 2056, alongside a tender offer of up to C$500.00 million to repurchase several longer-dated bonds and plans to redeem its C$600.00 million 3.75% Notes due March 2026.

- By pausing dividend growth while extending low-reset hybrid debt and retiring older issues, TELUS is reshaping its capital structure to prioritize free cash flow and leverage reduction over incremental payout increases.

- Next, we’ll look at how this pause in dividend growth and large hybrid issuance could influence TELUS’s long-term investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

TELUS Investment Narrative Recap

To own TELUS, you need to believe its core connectivity and growing digital services can support a high dividend while it brings leverage under control. The latest C$2.8 billion hybrid debt issuance and bond buybacks directly affect that balance sheet story, but do not change the near term operational catalyst, which remains execution on broadband and TELUS Health growth. The biggest current risk is still that high debt and interest costs constrain flexibility if competitive or regulatory pressures intensify.

The most relevant recent announcement, in my view, is TELUS pausing its long running dividend growth plan while targeting C$2.4 billion of free cash flow in 2026 and outlining a path to lower its net debt to EBITDA ratio. That decision sits alongside the new long dated hybrid funding and tender offers, and together they frame how TELUS is trying to align its payout, refinancing activity and capital intensity with its goal of improving free cash flow and balance sheet resilience over time.

But investors also need to be aware that TELUS’s elevated debt load and ongoing capex needs could still...

Read the full narrative on TELUS (it's free!)

TELUS’ narrative projects CA$22.7 billion revenue and CA$1.5 billion earnings by 2028.

Uncover how TELUS' forecasts yield a CA$23.06 fair value, a 23% upside to its current price.

Exploring Other Perspectives

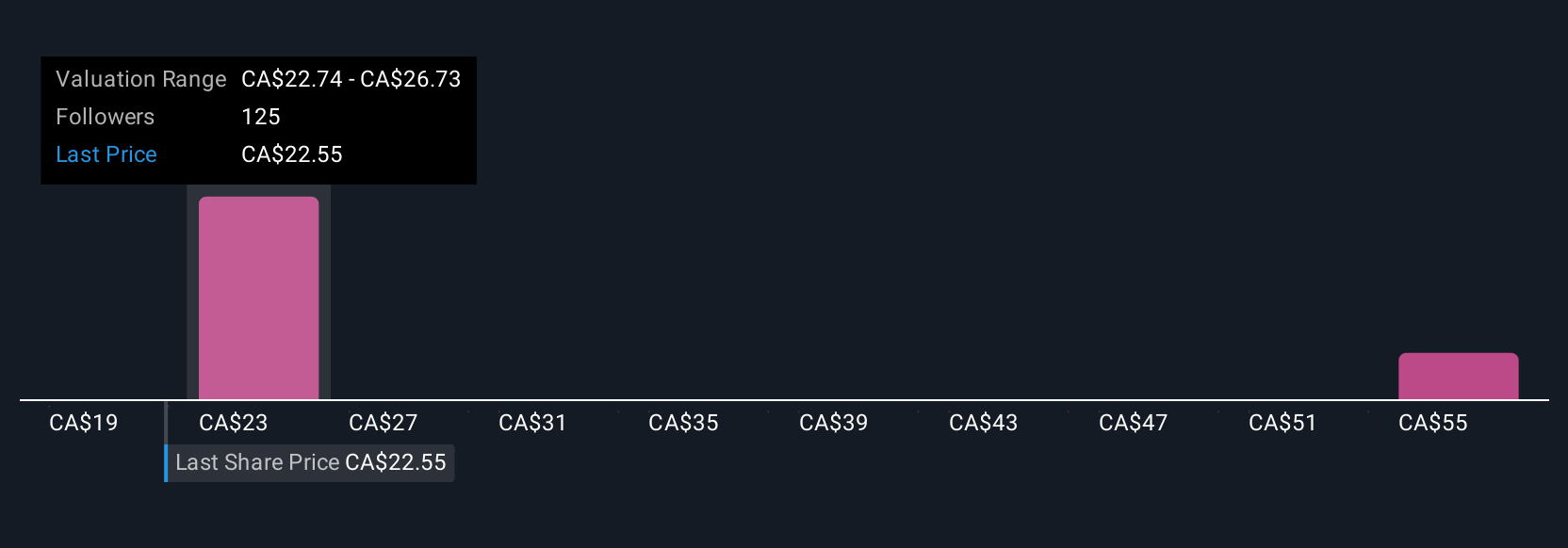

Six members of the Simply Wall St Community see TELUS’s fair value between C$20 and about C$47, reflecting very different expectations for the business. When you weigh those viewpoints against the company’s high capital intensity and leverage risk, it highlights why understanding your own comfort with balance sheet and refinancing exposure really matters for this stock.

Explore 6 other fair value estimates on TELUS - why the stock might be worth over 2x more than the current price!

Build Your Own TELUS Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TELUS research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free TELUS research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TELUS' overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com