Trustmark (TRMK) Valuation Check After a Quiet 13% Year-to-Date Share Price Climb

Trustmark (TRMK) shares have been quietly grinding higher this year, up about 13% year to date. This has investors asking whether this regional bank’s steady fundamentals still justify more upside.

See our latest analysis for Trustmark.

With the share price now around $39.23 and a solid year to date share price return of roughly 13%, Trustmark’s recent pullback looks more like normal volatility than a change in the broader, steadily improving total shareholder return trend.

If this kind of quiet momentum appeals to you, it could be a good moment to explore fast growing stocks with high insider ownership for other under the radar names showing strong ownership conviction.

Yet with solid earnings growth, a history of strong total returns, and shares still trading below analyst targets, investors face a key question: Is Trustmark undervalued today or already pricing in its next leg of growth?

Most Popular Narrative: 10% Undervalued

Compared with the last close at $39.23, the most widely followed narrative points to a fair value near $43.60, implying modest but meaningful upside.

Analysts are assuming Trustmark's revenue will grow by 7.4% annually over the next 3 years. Analysts assume that profit margins will shrink from 28.6% today to 24.6% in 3 years time.

Curious how slower margins can still support an upside case? The narrative leans on steady revenue momentum, disciplined buybacks, and a richer future earnings multiple. Want the full blueprint?

Result: Fair Value of $43.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case could unravel if economic conditions in the Southeast weaken or if Trustmark continues lagging larger peers on digital transformation and scale.

Find out about the key risks to this Trustmark narrative.

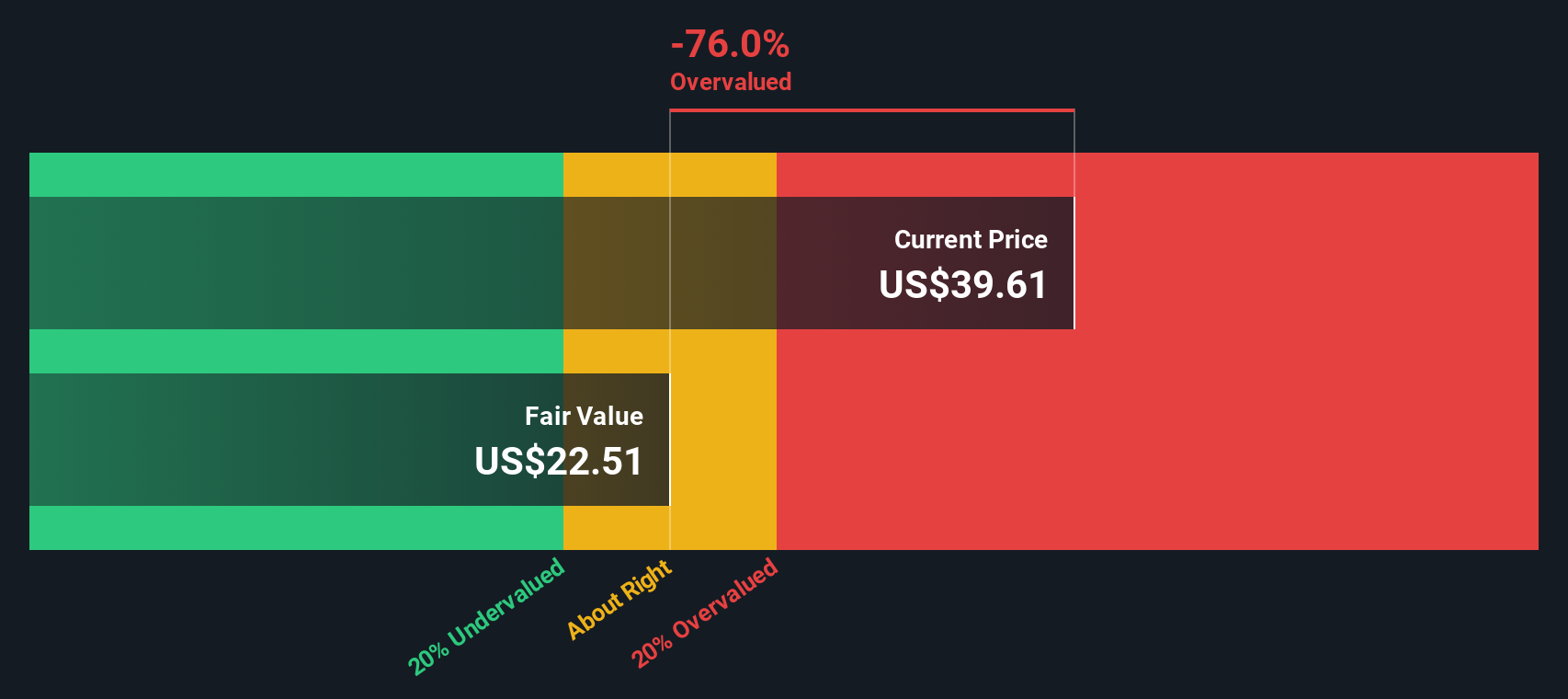

Another View: DCF Signals Overvaluation

While the consensus narrative sees about 10% upside, our DCF model paints a very different picture. From that perspective, Trustmark’s fair value sits nearer $21.99 than $39.23, suggesting the shares could be materially overvalued rather than modestly undervalued. Which story do you consider more convincing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Trustmark for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Trustmark Narrative

If you see the story differently, or just prefer digging into the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Trustmark research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

If Trustmark sparked your interest, do not stop here, the Simply Wall St Screener can quickly surface fresh opportunities that could sharpen your next move.

- Capture potential bargain entries by targeting companies trading below intrinsic value, starting with these 907 undervalued stocks based on cash flows built on robust cash flow assumptions.

- Ride powerful secular trends by zeroing in on innovators at the intersection of medicine and algorithms through these 30 healthcare AI stocks.

- Strengthen your income stream by focusing on reliable payers using these 15 dividend stocks with yields > 3% with yields above 3% and room for sustainable growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com